Existing bank home loan customers are being financially screwed like never before. But it’s up to you to fight with your bank.

For example, if someone took out one of the big four banks’ lowest variable rates this time just last year they would now be on a rate that is, on average, 0.44 per cent higher than what is on offer to new customers of the very same bank… that’s almost two standard RBA hikes more.

On a $500,000, 25-year loan today this difference could equate to an estimated $2,210 extra in interest over the next year.

Existing customer vs new customer variable rates (post-Dec hike)

Assumes borrower took out the bank’s lowest rate loan in Dec 2021 and has not negotiated since.

Source: RateCity.com.au. Rates are for owner-occupiers paying principal and interest on the big four banks’ lowest variable rates. New customer rate includes Westpac’s introductory rate and CBA’s package loan rate. Rates are effective 16 Dec and 20 Dec for Westpac.

Now go and fight for your rights as a loyal customer!

And while you’re at it… fight for a good savings rate

While the banks were quick to pass on the rate rise to borrowers, when it comes to passing on the rise to savers… hmm, not so fast. And the rates between savings accounts, even within the same bank, can vary significantly. So know what’s out there and shop around.

All adults: Highest ongoing savings rates

RateCity.com.au analysis shows five banks currently offer savings accounts to all adults with an ongoing rate of more than 4 per cent… ING, MOVE Bank, Virgin Money, People’s Choice and ubank.

- 4.6 per cent: Virgin Money Boost Saver, effective 9 December on balances up to $250,000. Conditions: Savers must deposit $2,000 a month into a linked transaction account, make 5 or more transactions on the linked account and provide 32 days’ notice to access funds.

- 4.55 per cent: ING Savings Maximiser, effective 13 December on balances up to $100,000. Conditions: Savers must deposit $1,000 a month into a linked transaction account, make 5 or more transactions on the linked account and grow their savings balance each month.

Young adults: Highest ongoing savings rates

- 4.75 per cent: BOQ Future Saver, effective 9 December on balances up to $50,000. Conditions: Savers must deposit $2,000 a month into a linked transaction account, make 5 or more transactions on the linked account. Bonus criteria waived for people under 18.

- 4.35 per cent: Westpac Spend&Save, effective 16 December on balances up to $30,000. Conditions: Savers must grow their savings balance each month and make 5 or more purchases on their linked transaction account.

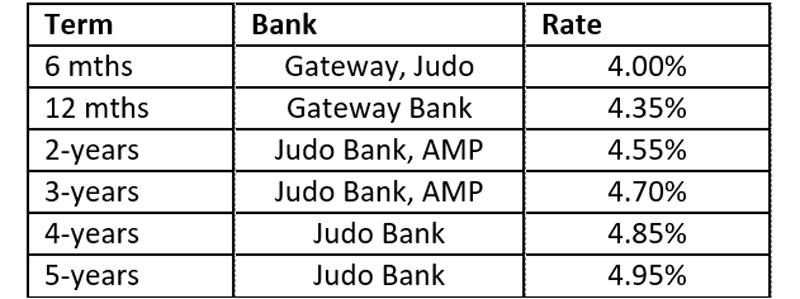

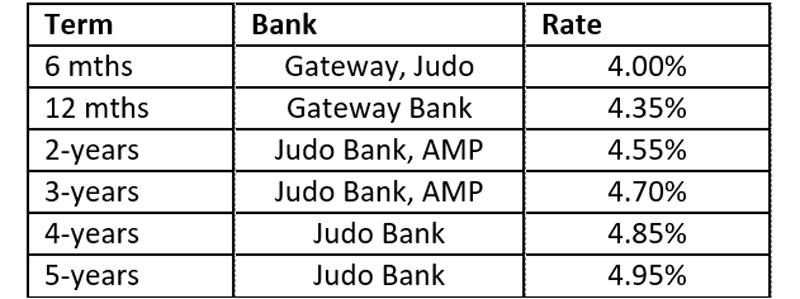

Highest term deposit rates on RateCity.com.au

Term deposit rates continue to climb on the back of the rising cash rate and the forecasts for next year.

The highest term deposit rate is now 4.95 per cent from Judo Bank, however, savers have to be willing to lock up their cash for five years.

Source: RateCity.com.au. AMP rate is for deposits over $25K.

Source: RateCity.com.au. Rates are the maximum ongoing rate offered.

Big four banks’ savings rates

Source: RateCity.com.au. Note: Rates are for existing customers and do not include introductory rates. Terms and conditions apply for some maximum rates. CBA and Westpac increases effective 16 December. ANZ and NAB yet to announce any Dec savings rate increases.

Highest ongoing savings rates – then and now

Source: RateCity.com.au. Monthly conditions apply for max rates. Virgin and BOQ rates effective 9 Dec, Westpac 16 Dec.

Household savings are still in pretty good shape to fight rate rises

Australia’s household saving ratio decreased to 6.9 per cent in the September quarter from 8.3 per cent in the June quarter… back to late 2019 pre-pandemic levels.

Remember the saving rate may have fallen but it’s still positive, so at this stage savings are not being drawn down!!!

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.