When it comes to money, this week was ruled by Central Banks and interest rates. The Reserve Bank (RBA) on Tuesday and the US Federal Reserve (the Fed) yesterday morning. Big decisions… big reactions.

So first our Reserve Bank’s decision to lift official interest rates by another 0.25 per cent to 2.85 per cent. That’s a nine-year high. But there is a view that we’ll get another 0.25 per cent rise at the next RBA meeting on the first Tuesday in December, then the RBA will pause for a couple of months to see the full effects of how all this year’s rate rises flow through to consumer spending and the property market.

The final paragraph of the statement accompanying the rate decision sums it up nicely:

The Board has increased interest rates materially since May. This has been necessary to establish a more sustainable balance of demand and supply in the Australian economy to help return inflation to target. The Board expects to increase interest rates further over the period ahead. It is closely monitoring the global economy, household spending and wage and price-setting behaviour. The size and timing of future interest rate increases will continue to be determined by the incoming data and the Board’s assessment of the outlook for inflation and the labour market.

Did the RBA move quickly enough?

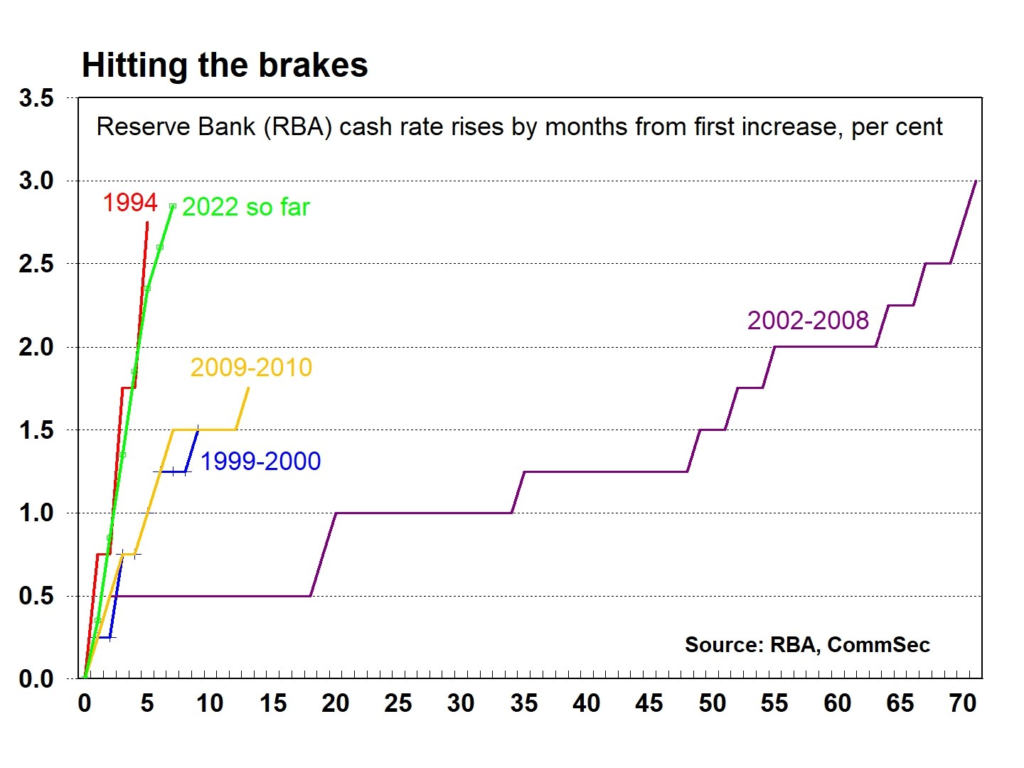

Many of the market commentators criticised the RBA for being too slow to lift official interest rates to fight inflation (I agree) and for not moving quickly enough once they did decide to hike. I’m not so sure the second criticism stacks up.

As this graph shows, the current tightening cycle is one of the quickest in recent history when compared with the previous four tightening cycles. Rates are rising at a pace not seen for a generation.

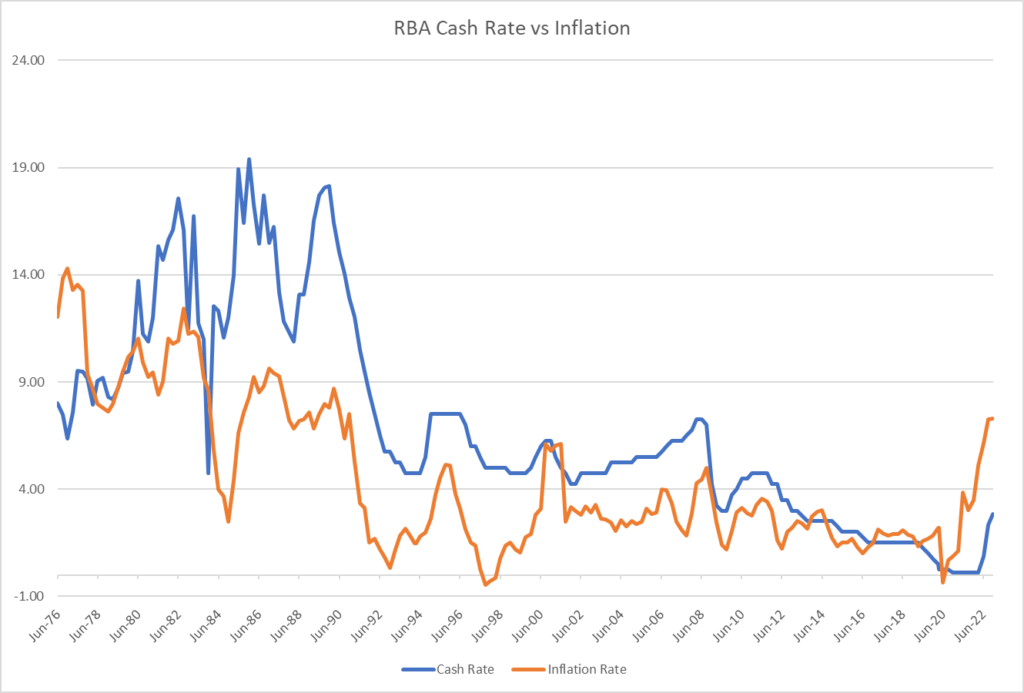

But with inflation so high, we have negative “real” interest rates at the moment, which is what economists and the RBA are worried about. Basically you have to go back to the OPEC Oil Crisis of the mid-1970s to see such a big negative gap between rates and inflation.

The aim is to get that orange line below the blue again.

The US Federal Reserve is more aggressive and talking tough

While Australia increased official rates 0.25 per cent, the US Federal Reserve upped their rates by another blockbuster 0.75 per cent to a range of 3.75-4 per cent – much higher than we are at.

There had been a growing view in the US that the Fed would start to slow down the rate rises and, as a result, the US sharemarket had a cracking October… up 16 per cent, which was the best October gain since the 1990s. This was due to investors anticipating an end to the rising rate cycle, inflation getting under control and a recession avoided.

Those views were slapped down by Fed chairman Jerome Powell at a press conference after the rate decision.

He said that “ongoing increases” will still be needed to bring interest rates to a level that are “sufficiently restrictive to return inflation to 2 per cent over time.” But also noted that policymakers are considering the “cumulative” impact of its hikes so far.

In his press conference Fed chair Powell said, “The ultimate level of interest rates will be higher than previously expected.” But he added it would be appropriate to slow the pace of increases “at some point“ and “that time is coming and may come as soon as the next meeting or the one after that.”

Unlike Australia, American households are not in a strong position

One of the scary parts of the US rate rises is that, unlike Australia, American households are not in a strong position to cope with it. The average Aussie household has been sitting on record levels of wealth. Obviously, those levels have come down from falling property values, negative superannuation returns and digging into savings, but those levels of wealth are still pretty healthy.

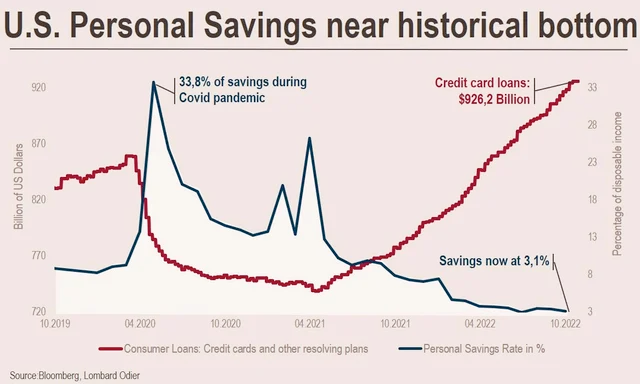

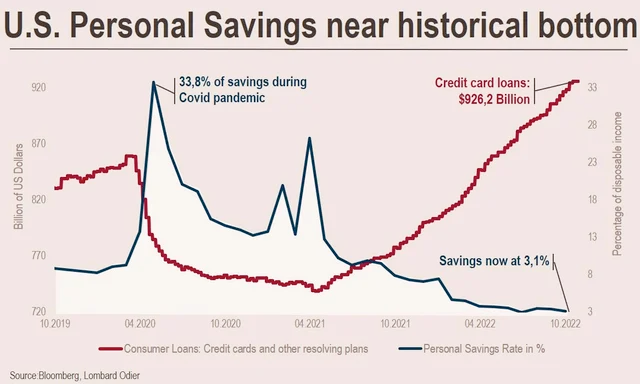

By comparison, look at this chart showing how credit card loans in the US are at record highs and savings levels have dwindled to almost nothing. These rising rates are going to devastate US household finances and is one of the reasons so many economists expect an American economic recession next year.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending