As the dust has now settled after last week’s interest rate hike by the Reserve Bank, economists have been reassessing just how many more hikes are to come in this interest rate cycle.

Three of the big four banks have revised their forecasts, after the lower than expected 0.25 per cent RBA October rate hike.

ANZ now predicts the cash rate will peak at 3.60 per cent in May next year, instead of 3.35 per cent by the end of this year. ANZ noted the RBA’s decision to reduce the pace of the hikes increases the risk that more hikes will be needed in total.

While Westpac still believes the cash rate will hit 3.60 per cent, it has pushed back the peak until March next year.

NAB has kept its 3.1 per cent peak but has pushed it back from November to February 2023.

CBA’s cash rate outlook remains unchanged, forecasting the peak at 2.85 per cent next month.

Big four bank cash rate forecasts

CBA: +0.25 per cent in Nov, peaking at 2.85 per cent. Two 0.25 per cent cuts in Aug and Nov 2023.

Westpac: +0.25 per cent in Nov, peaking at 3.60 per cent in March 2023. Four 0.25 per cent cuts in 2024.

NAB: +0.25 per cent in Nov, peaking at 3.10 per cent in Feb 2023.

ANZ: +0.25 per cent in Nov, peaking at 3.60 per cent in May 2023. Two 0.25 per cent cuts in 2024.

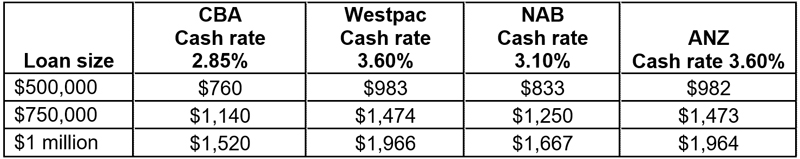

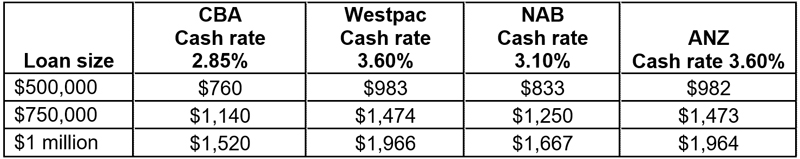

Analysis from RateCity.com.au shows the average borrower’s monthly repayments could rise in total by between $760 – $983, based on the big four banks’ cash rate forecasts.

Total increase to repayments 1 May 2022 to peak on big four bank 2023 forecasts

Source: RateCity.com.au. Calculations are estimates and repayments are for an owner-occupier paying principal and interest over 25 years. Starting rate is the RBA existing variable customer rate of 2.86% in April 2022 and big four bank cash rate forecasts are applied.

Don’t forget, rising interest rates means your borrowing capacity falls

As interest rates rise, people applying for a loan are seeing the maximum amount they can borrow from the bank fall because they are paying more in interest.

Banks stress test potential borrowers to see if they can afford their mortgage repayments on an interest rate that’s 3 per cent above their current rate. As interest rates get higher, this test gets harder to pass.

If Westpac’s forecast for the cash rate is realised, and it hits 3.60 per cent next year, the average family could see their home buying loan budget shrink, in total, by more than $250,000.

RateCity research has found a family with two kids, on a combined annual income of $150,000 before tax, could borrow $995,800 six months ago.

Once the October rate hike kicks in, they can borrow an estimated $800,300, which is $195,500 less.

However, by April next year, if the cash rate rises to 3.60 per cent, as forecast by Westpac, this family would be able to borrow an estimated $728,100, which is $267,700 less than they could have before the hikes began.

These calculations are estimates and assume one parent works full-time and the other part-time at half the wage. Calculations include an annual pay rise at the start of the financial year. The exact amount someone can borrow depends on their personal situation and/or their lender.

Steps you can take to help pay the mortgage

Make budget cuts

Look at your bank account and see where you’re spending the most money to see if you can make cutbacks. Remember, it’s a fallacy that you need to live a life of deprivation in order to save money.

Refinance your mortgage

It’s the biggest monthly expense for many families, so get yourself on a better deal. Switching to a lower rate could save you hundreds of dollars each month.

The days where being a long-term bank customer afforded you savings are well and truly gone. In fact, these days the opposite is generally true.

The simple fact of the matter is that you often need to leave your existing home loan provider to get a competitive deal.

Review your other bills

Put your other bills under the microscope to see where you can save, such as your energy, phone and internet packages. Negotiate a better deal with each of your suppliers to bring your costs down. There are some great tips to hone your negotiation skills here. It’s also helpful to revisit the way you manage your bills as you can save money by paying early, paying online or paying annually rather than monthly.

Push for a pay rise: If you haven’t had a decent wage increase recently, now is the time to ask your boss for a pay rise. It can be a scary proposition, but remember, if you don’t ask, you won’t get. Book an appointment with your boss, know your value in the marketplace plus the value you bring to the business, and make sure you agree ‘next steps’ with your boss before you end the meeting.

Ask for help early: Before you miss a mortgage repayment, call your bank to see what options you have. You can also call a financial counsellor for advice – the National Debt Helpline is 1800 007 007. You’ll find more strategies for tackling mortgage stress here.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.