Australia’s first national network of buyer’s agents BuyersBuyers, says that a renewed focus on property through the pandemic has helped to drive a record increase in Australian household wealth.

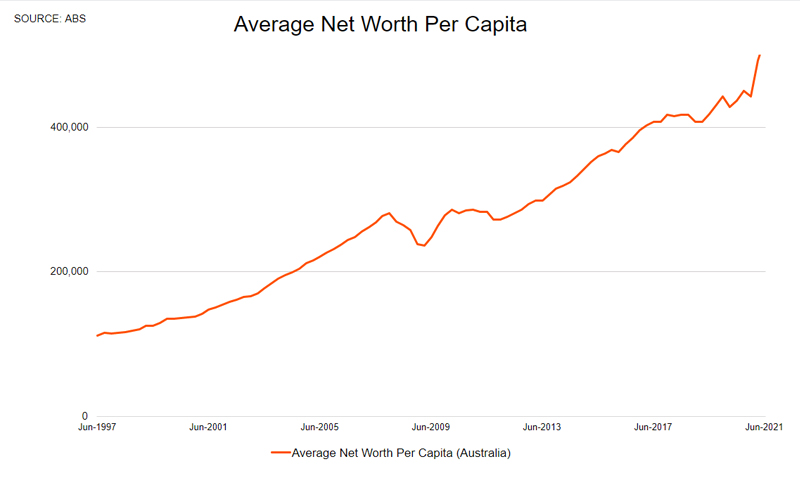

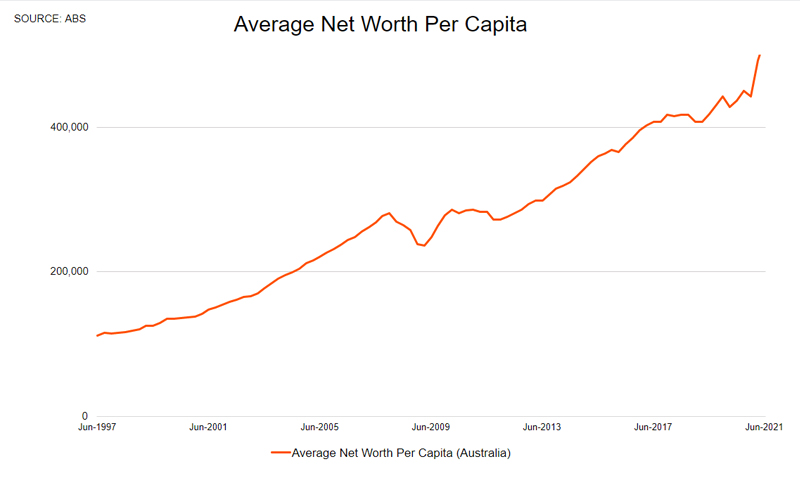

“The latest Australian Bureau of Statistics figures showed total net wealth increasing by $735 billion or 6 per cent to a record high of $13.4 trillion in the June quarter, which averages out to around $522,000 per capita,” says Pete Wargent, co-founder of BuyersBuyers.

“That’s a dramatic 20 per cent increase from a year earlier, driven by property prices and a stock market rebound.”

Source: Buyersbuyers.com.au / ABS data

A record increase in Australian household wealth

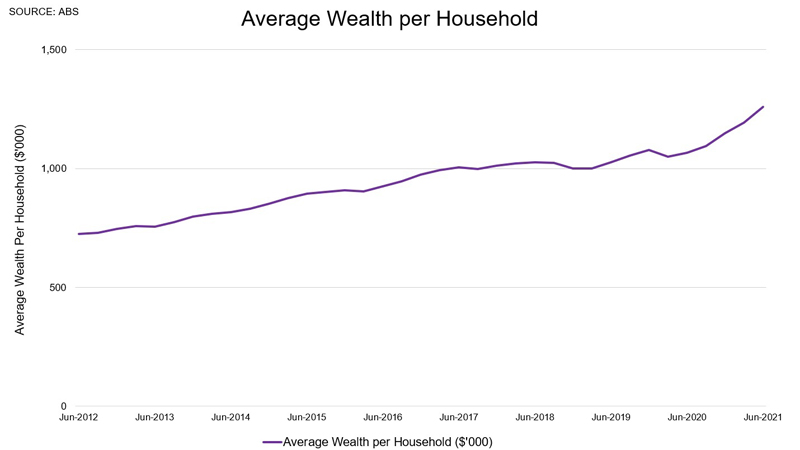

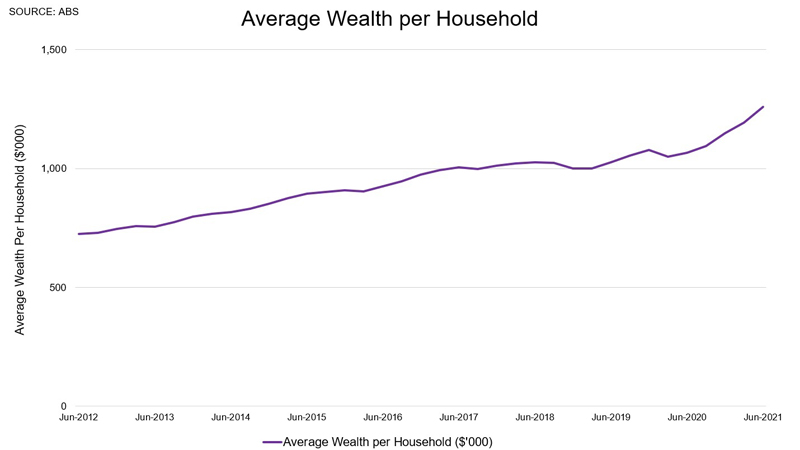

Wargent notes that while the distribution is uneven, the average wealth per household has increased considerably to well beyond $1 million.

“Australian households are now among the wealthiest in the world, and that’s largely been founded upon the strength of the property market,” says Wargent.

Aussies topped the global rankings for median wealth per adult (at USD $238,070), according to Credit Suisse’s annual Global Wealth Report. The current record increase in Australian household wealth has grown our median wealth per adult even further.

A strong coronavirus recovery to date, the strength of the Australian dollar, and continuing low interest rates are behind the huge jump in wealth. It’s also largely driven by the increased equity Australians hold in their homes as property prices climb.

Wargent says: “The value of the dwelling stock is now estimated to be around $9 trillion, so even accounting for housing debt approaching $2 trillion, that means that over half of Australian net worth is comprised of property market equity.”

Source: ABS data / buyersbuyers.com.au

Too big to be allowed to fail

Doron Peleg, CEO of RiskWise Property Research says that the results reflected the financialisaton of the housing market.

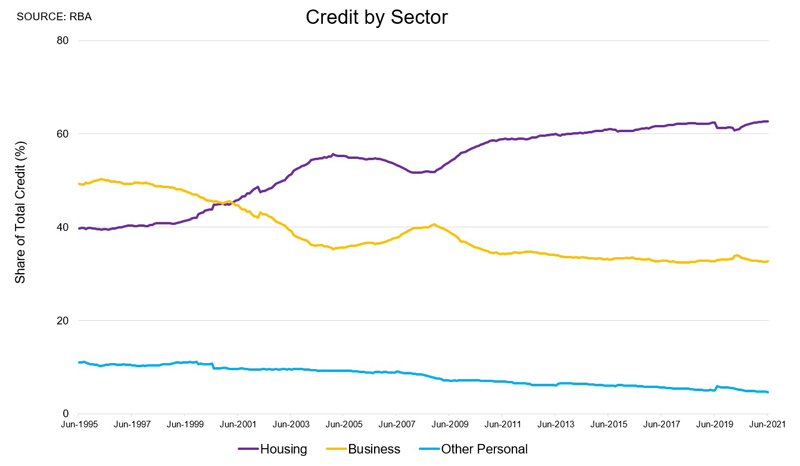

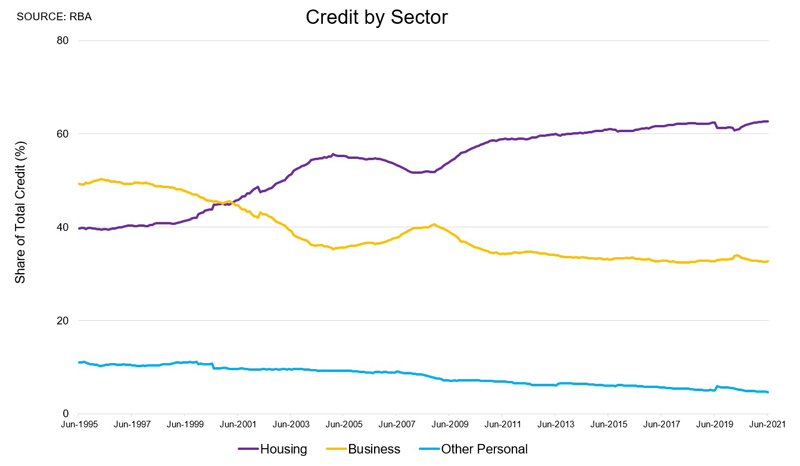

“A quarter of a century ago above 40 per cent of the credit in the system was housing credit, but today that figure is above 60 per cent,” Peleg says. “Entrepreneurs and small business owners often secure business loans using their home as collateral, so the housing market has effectively become too big to be allowed to fail.”

Peleg says that the good news is that gearing ratios have increased unduly. “Mortgage repayments have generally become more comfortable as mortgage [interest] rates have declined,” he says.

Source: ABS data / buyersbuyers.com.au

Wargent agrees, saying that he expects more property investors to come into the market in 2022. He expects that the cycle will continue to be driven by first homebuyers and upgraders.

“Investors are looking for a return on their capital, with the cash rate likely to remain at 0.10 per cent for the next few years,” he notes. “So property is obviously going to feature in their plans. Households have built up a huge war chest of excess savings through the pandemic period.”

Not in bubble territory

While many householders would probably argue that Wargent’s ‘huge war chest’ is more tiny jewellery box, they certainly seem to have plenty to stash into the property market right now. Property prices are through the roof and many are calling it a property bubble, but Wargent disagrees. Despite the increase in property prices Wargent says he did not see the market as being in bubble territory.

“There are some parts of the property market which are at risk of overheating, especially in some of the coastal lifestyle locations around the country,” he says. “But overall mortgage serviceability is at very favourable levels at the moment.

Wargent thinks the bubble predictions are based on a lack of understanding of the impact of low real interest rates. “There have been predictions of housing bubbles and crunches in markets such as Canada, Australia, and New Zealand for years, but they simply haven’t come to fruition.”

Trending

Sorry. No data so far.