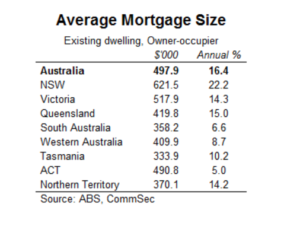

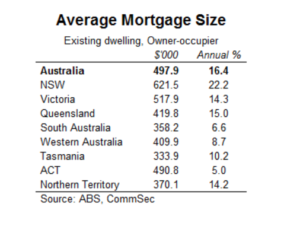

Cheap money also allows people to borrow more with the average home loan in Australia reaching $500,000.

Since the Federal election the average new home loan has lifted by around $60,000 or 16 per cent. Rate cuts and increased buyer enthusiasm for property have driven the gains. But with wages growing at a 2.2-2.3 per cent annual pace, affordability constraints may soon temper the optimism.

Don’t be a sucker… negotiate your existing home loan rate

The RBA and APRA have released data that shows owner occupier home loan customers who have been with their bank for four or more years are paying an average variable rate of 3.64 per cent, while new customers are paying an average of 3.23 per cent.

The moral of the story… constantly ask for a better rate on your mortgage, don’t just leave it until applying for a new loan.

Analysis by RateCity shows that 0.41 per cent rate difference on a $400,000 home loan adds up to $1,634 extra in interest in the first year.

Average mortgage rates

| Loan Type | Average existing customer rate | Average new customer rate | Difference | ||||

| Owner-occupier – all loans | 3.64% | 3.23% | 0.41% | ||||

| Owner occ, principal & interest | 3.57% | 3.18% | 0.39% | ||||

| Owner occ, interest only | 4.25% | 3.76% | 0.49% | ||||

| Investor – all loans | 4.02% | 3.62% | 0.40% | ||||

| Investor, principal & interest | 3.88% | 3.51% | 0.37% | ||||

| Investor, interest only | 4.27% | 3.79% | 0.48% |

Source: RBA housing lending rates

Difference in interest between new owner occupier customer rates and existing customer rates

| Loan size | Extra interest paid in first year | ||

| $250,000 | $1,021 | ||

| $400,000 | $1,634 | ||

| $750,000 | $3,064 | ||

| $1,000,000 | $4,085 |

Source: RateCity.com.au

Note: Rates are based on a new customer rate of 3.23% and an existing customer rate of 3.64% as provided by the RBA. Calculations are based on someone paying principal and interest over 30 years.

Lowest advertised variable home loan rates on RateCity.com.au

| Lender | Advertised rate | ||

| Reduce Home Loans | 2.69% | ||

| Homestar Finance | 2.74% | ||

| Freedom Lend / Pacific Mortgage Group | 2.79% |

Source: RateCity.com.au

Cheap money is leading to strong property growth

This time last year we were all stressing about the residential property downturn in the big capital cities. How quickly that has changed.

And it looks like the turnaround which started late last year is continuing into 2020 and beyond according to property research and listings group Domain.

Here’s what they’re forecasting;

Sydney

Double-digit growth in 2020, putting further strain on affordability. The median house price will be just under $1.25 million by the end of 2020… 3 per cent above the peak reached in June 2017.

Melbourne

Median house price expected to join the $1 million dollar club by late 2021 with 8 per cent growth expected in 2020 and 3-5 per cent in 2021. Home unit prices are expected to grow rapidly in the first half of 2020, following a strong end to 2019.

Brisbane

For the first time, house prices are likely to rise over the $600,000 mark to $620,000 by the end of this year, as buyers look beyond Melbourne and Sydney to buy. After falling almost 10 per cent from the 2016 peak, Brisbane’s median unit prices are predicted to rise by 6 per cent in 2020 then 4 to 6 per cent in 2021.

Perth

Likely to see the fastest price growth since the mining boom ended in 2014. The median house price should be $564,000, which is still 8 per cent below the December 2014 peak. “Views per listing” are up 40 per cent over the year and home loan commitments increased 15 per cent between December and March 2019.

Adelaide

House and unit prices are forecast to rise at around 3 per cent in 2020 and 2021. There has been a smaller rise in home loan commitments in South Australia since mid-2019 than in other states, which points to a more modest rebound in 2020

Hobart

House and unit prices rose by over 50 per cent between 2015 and 2019… that is expected to come to an end in 2020. Median house and unit price will be around $560,000 and $460,000 respectively at the end of next year.

Canberra

Median house price forecast to rise by 4 per cent in 2020 to around $820,000. Unit prices are likely to rise at a more modest pace 3 per cent in 2020 then 1-3 per cent in 2021

House price forecasts

Unit price forecasts

Trending

Sorry. No data so far.