Whether it’s for a home or car or to invest in your business, getting credit is part of life. Knowing how your credit score is calculated is really important – so let’s break it down in simple terms.

We all know that we have a credit score: that magical number that can determine our financial fate, one application at a time.

But do you know exactly what factors make up your credit rating? If you don’t, you should, because it can make all the difference in the world to your financial health and how you go about accessing finance for any moment in your life that calls for it.

What is a credit score?

First, let’s get into the nitty gritty. Each and every one of us has a credit score, a number that essentially gives a lender an idea of how safe a bet you are when it comes to lending you money.

The better your credit score is, the more likely you are to get approved for that loan you applied for; and the more favourable your interest rate is probably going to be.

The further down the credit score chain you are, the more likely you are to be turned down – or, at best, invited to pay a higher interest rate.

Your credit score is usually a number between 0 and 1200. “Good” credit scores are normally from 600 and upwards.

Sounds straightforward enough – but what factors contribute to your credit score, and how are they weighted?

To understand that, let’s imagine your credit score as a big, juicy burger…

The tastiest credit score

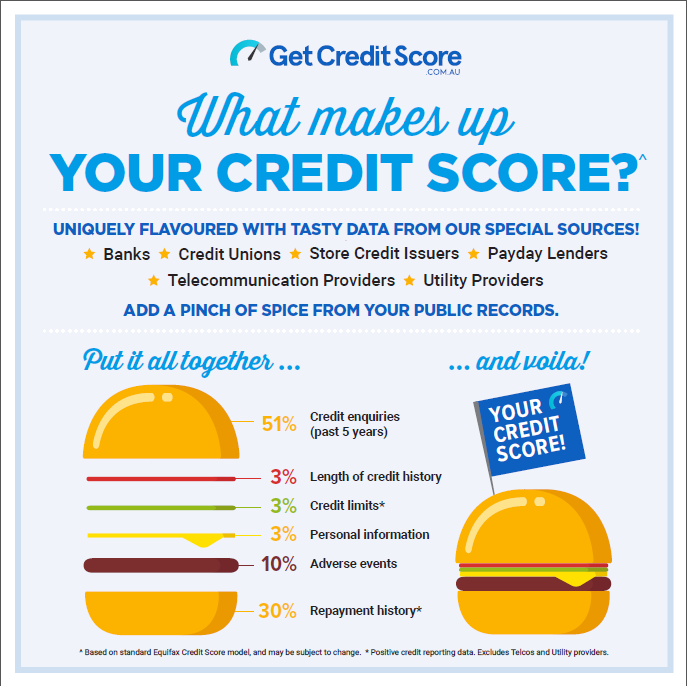

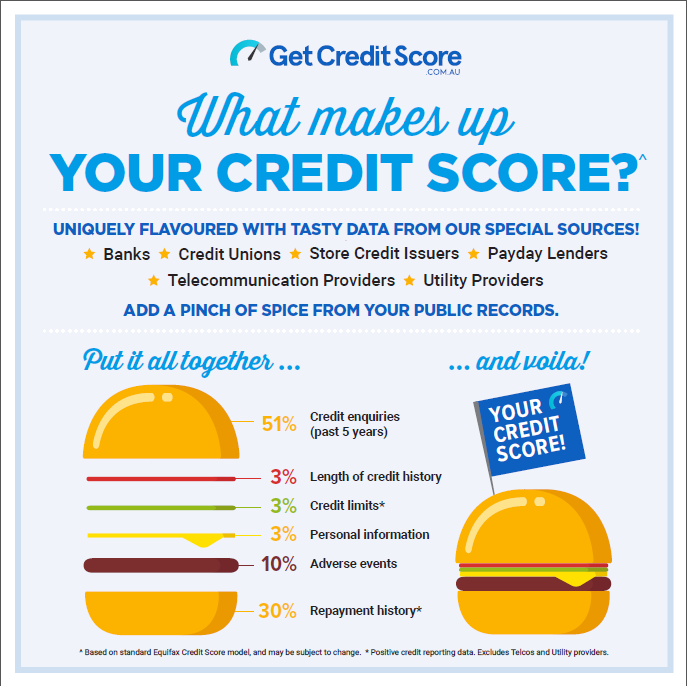

A great burger is an Australian classic – vegetarian options available, of course. So what’s better than a good ol’ burger to help visualise how your credit score is calculated? Here’s a tasty one from GetCreditScore, which calculates your credit score for free.

Image: GetCreditScore.com.au

Your credit burger ingredients

51 per cent credit enquiries

30 per cent repayment history

10 per cent adverse events

3 per cent personal information

3 per cent credit limits

3 per cent length of credit history

First, we roll

First up: the bread roll. Never mind the filling – the bread can make or break a burger, and these two pieces account for more than 80 per cent of your overall credit score.

Let’s consider the credit enquiries you’ve made over the past five years. Think of this as the big, thick bread on top of your burger, which accounts for a whopping 51 per cent of your credit score. So, if you’ve been applying for credit left, right and centre to ‘see what’s out there’, just stop – now. Unless you definitely need all that credit that you’re applying for, you’re causing yourself some pretty serious damage.

Next, we repay

The second most important factor that contributes to your rating is your repayment history – how reliable you have been at meeting your repayments on past loans. Having a history of reliable, on-time payments is understandably important to lenders, and this accounts for a tasty 30 per cent of your overall credit score.

Then, we fill

Finally, the filling is the last component in how your credit score is calculated. Whether a juicy beef patty floats your boat or a chickpea burger is more your style, the filling is a key component. It accounts for the remaining 19 per cent of your credit score.

The filling includes adverse events, making up 10 per cent of your score. So, if you’ve had defaults, credit-related court judgements or bankruptcy recorded, that’ll be accounted for here.

The smaller parts of the burger include having up-to-date personal information, existing credit limits and the length of your credit history. An older file may have a lower level of risk than a newer file, which means an easier approval for a loan. The age of the credit file helps to balance out any anomalies (for example, that time you forgot to pay your electricity bill) against your usual pattern of behaviour (all the many times you paid on time).

Understand your own personal credit burger

GetCreditScore.com.au – backed by Equifax, the leading credit-scoring bureau in Australia – is one of the country’s leading free credit score providers, empowering Australians to achieve their financial goals.

It gives you free access to your credit score to help you understand where you currently sit.

And, by understanding your own mix of ingredients, you can proactively work towards improving your credit score each and every day.

What does your burger look like? Head on over to GetCreditScore and find out now.

This article is brought to you in partnership with GetCreditScore.

Trending