Lot to get through with the release of the National Accounts … which we used to refer to as the “economic growth” figures until we didn’t grow.

As expected the economy contracted 7 per cent in the June quarter, and 6.3 per cent for the year, as the economy was smashed by the impact of the Coronavirus… the biggest economic contraction in 60 years

No-one saw this coming. It was caused was a health pandemic rather than any financial, economic or structural issues.

Look the figures are bad, really bad.

Unemployment is expected to rise to atleast 10 per cent and probably closer to 15 per cent in real terms… which could take years to fall back to the pre-covid levels.

BUT… there are some positives (hard to believe I know) to come out of the figures.

. growth in retail spending is at 19 year highs.

. Australians saved more with the household savings ratio rising by 19.8 per cent in the quarter.

. hours worked rose 3.1 per cent

On top of that, the sharemarket has rebounded 36 per cent from its March lows and the Aussie dollar is souring.

For me, the other important thing to remember is that you wouldn’t want to be in any other country right now.

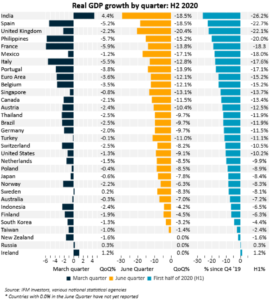

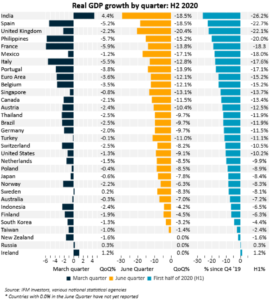

Take a look at this chart from Alex Joiner at IFM investors.

Our economic contraction from Covid is one of the lowest in the world. Lets hope that continues.

Economy is really mixed at the moment… here’s a snapshot

. Retail spending is up for the third straight month to be 12 per cent higher over the year… the strongest growth in 19 years since the GST was introduced.

Job Keeper and JobSeeker seems to have encouraged consumers to spend up big…. electrical goods is up 33.3 per cent with take-home liquor up 37.1 per cent, spending at cafes, restaurants and catering services was down 21.6 per cent with newspaper and book retailing down 16.9 per cent.

. The political spat between Australia and China is starting to bite? Rural exports fell by 15.1 per cent in July (down $539 million) – the biggest monthly decline since January 1983. Our largest trading partner has recently imposed tariffs, duties and anti-dumping measures on our wine, barley and beef exports.

Exports of meat (down 9.7 per cent), cereal & grains (down 38.2 per cent) and “other” rural goods (down 13.8 per cent) all fell. Not good news for our farmers hit by bushfires, drought and COVID-19 restrictions.

But exports to our biggest political ally, the US, hit record highs on a rolling annual basis in July at $18.7 billion… but tiny compared to what we export to China.

. New vehicle sales: In August, 60,986 new vehicles were sold – the weakest August sales month in 23 years – to be down 28.8 per cent on August 2019. Victorian sales fell by 65.9 per cent to 8,347 units.

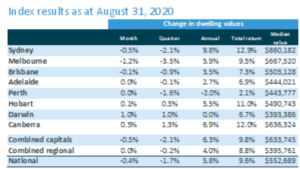

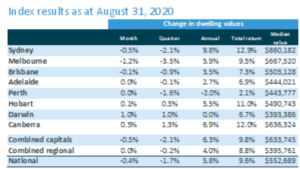

Residential Property values continue to fall in Sydney and Melbourne… flat elsewhere

The CoreLogic home value index recording a 0.4 per cent fall in August. Although housing values continued to trend lower from their pre-COVID highs, at least the rate of decline has eased over the past two months and five of the eight capitals recorded steady or rising values through the month.

According to CoreLogic’s head of research, Tim Lawless, the Melbourne housing market is the main drag on the headline results.

“Following a similar decline in July, Melbourne home values fell by 1.2 per cent in August, the largest fall recorded amongst the capital cities, demonstrating the impact of a worse viral outbreak relative to other cities, along with a larger demand side impact from stalled overseas migration. Through the COVID period to date, Melbourne home values have fallen by 4.6 per cent.”

Outside of Melbourne, the remaining capital cities all recorded slightly better conditions relative to July. The rate of decline eased across Sydney and Brisbane, while home values held firm or showed a subtle rise across the remaining capitals.

But Regional home prices held up, highlighting the increasing divergence between virus ‘hotspots’ and the rest of the country.

In fact, home prices rose in 34 out of 88 SA4 regions in August with home prices lifting the most in the NSW Southern Highlands & Shoalhaven (up 1.2 per cent), South East Tasmania (up 1.1 per cent), Coffs-Harbour-Grafton (NSW), North West Victoria, Queensland’s Wide Bay and Darwin (all up 1 per cent).

It appears that ‘lifestyle’ regions could stand to benefit from a potential virus-induced exit of people from big cities and changing working arrangements to work from home.

Home prices hit all-time highs in 11 SA4 regions in August, including the ACT, Adelaide-South (SA), Brisbane-East (QLD), Brisbane – North (QLD), Moreton Bay – North (QLD), Capital Region (NSW), Central West (NSW), Coffs-Harbour Grafton (NSW), Richmond-Tweed (NSW), Gold Coast (QLD) and South East Tasmania.

Trending