Last week I wrote about how landlords are being driven out of the rental market, which is exacerbating the crisis.

I was interested in an analysis by the research director at Ray White, Nerida Conisbee on the rental crisis and what is causing it.

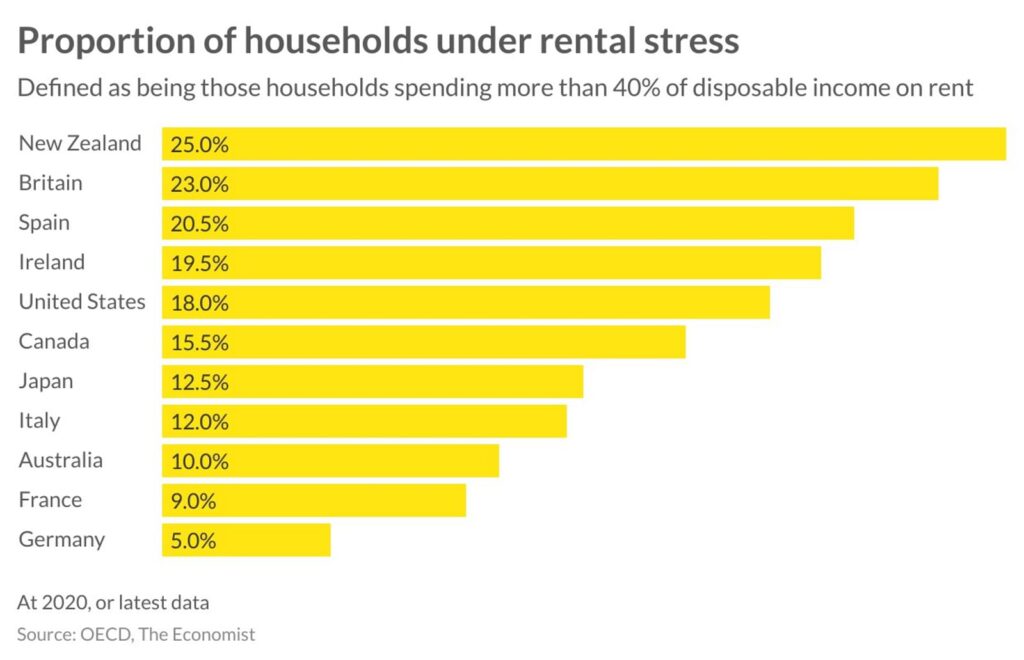

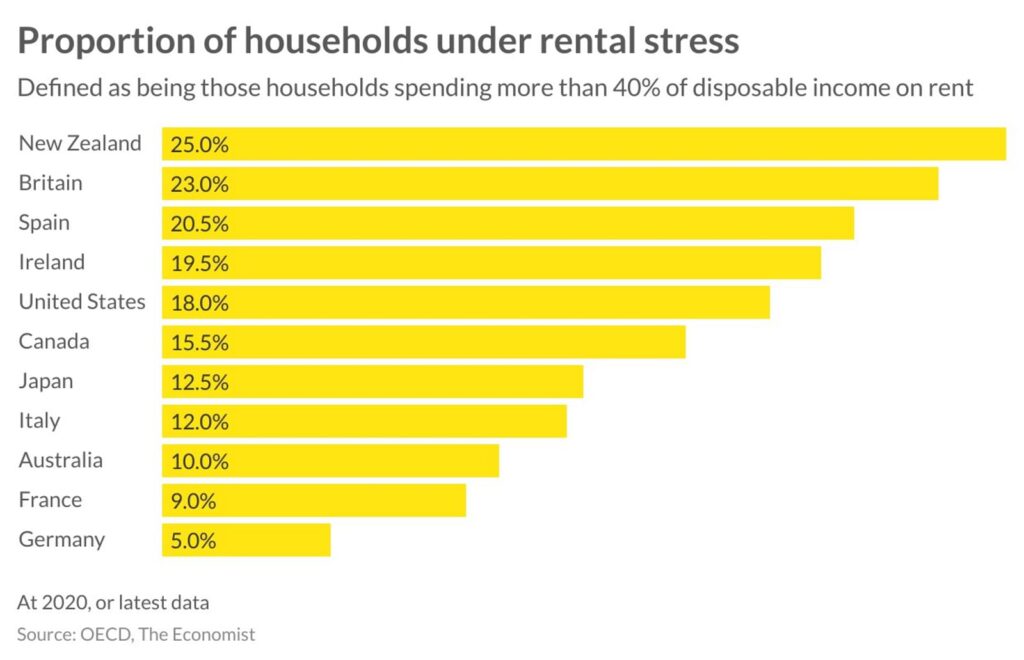

Proportion of households under rental stress

The Economist magazine recently undertook an analysis into OECD data to compare the proportion of households that are seeing very high levels of rental stress. Australia is faring relatively well. Not as good as France or Germany, but remarkably better off compared to New Zealand, Britain and the US.

The current global crisis has been driven by both a reduction in household size during the pandemic (people spread out) and then a return to high migration levels (not enough homes subsequently available). From Singapore to London and to smaller cities in between, the end of the pandemic resulted in double digit rental increases. Only now, as housing construction starts to get back to more normal levels and more people start to share again, are we seeing these increases dissipate.

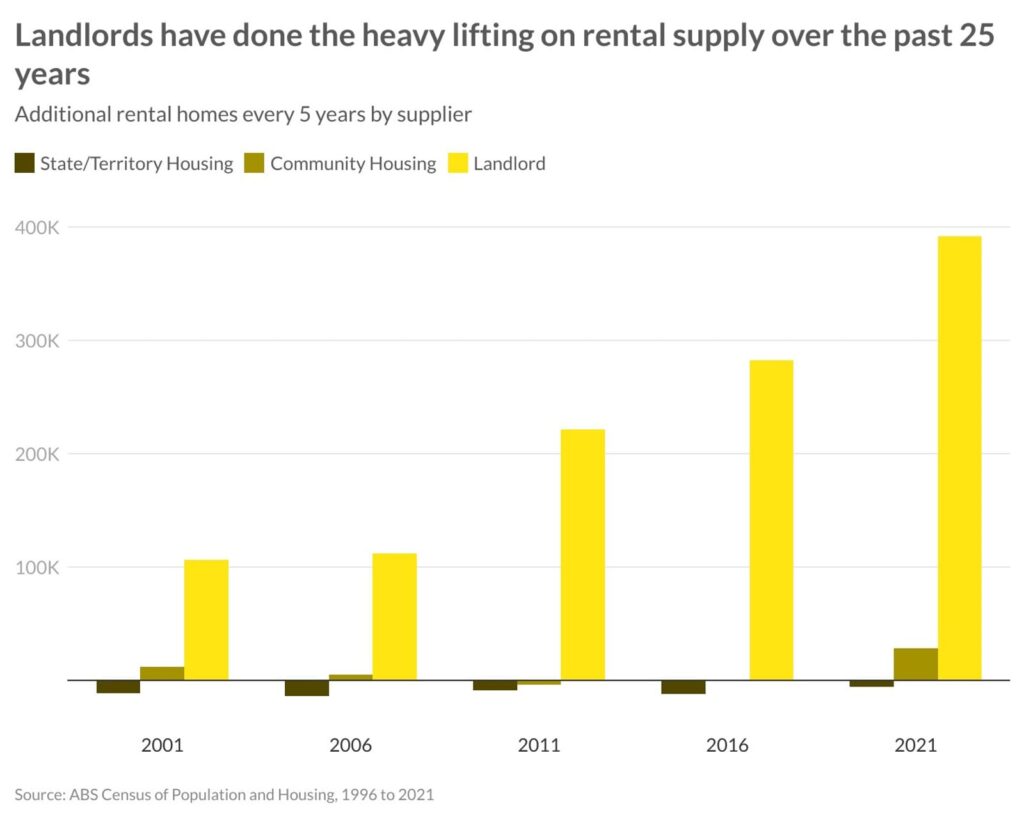

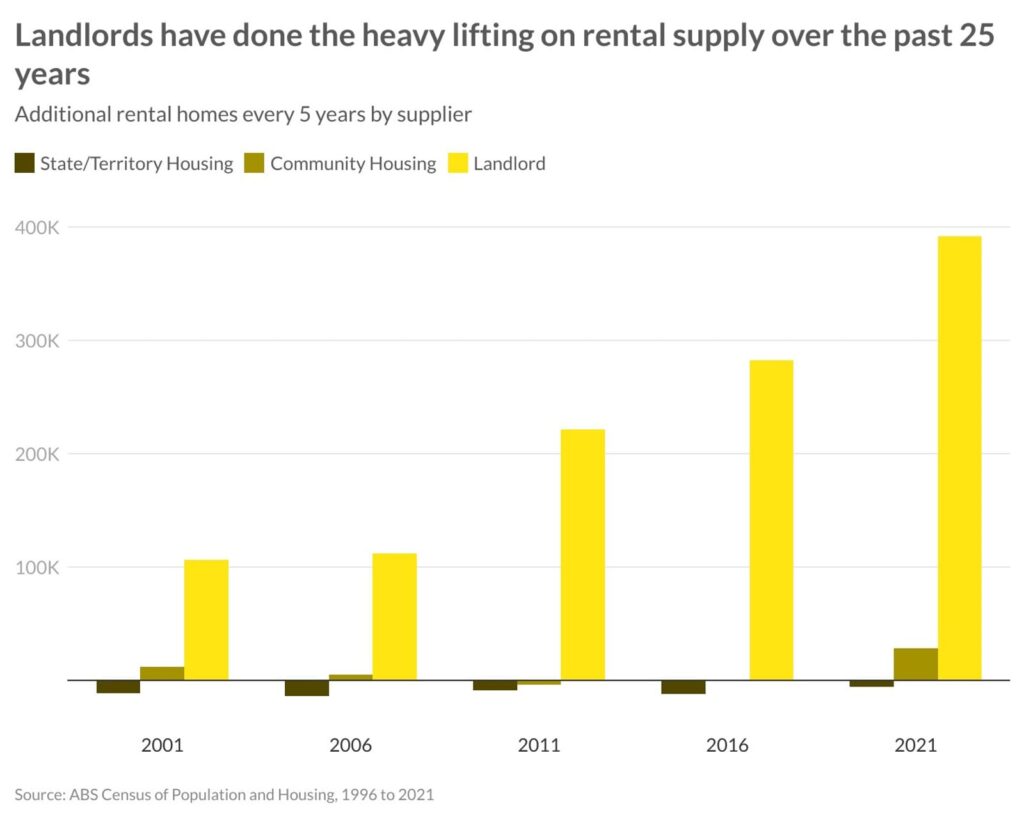

Property incentives have kept rental market steady

According to Nerida, incentives available to property investors in Australia have been overwhelmingly successful in providing a steady stream of rental properties and keeping the proportion of households under rental stress at globally low levels.

Between 1996 and 2021, there were an additional 1.1 million rental properties provided by investors.

But how about this for a shocking comparison: over that period only 41,000 homes were provided by community groups and even worse, a LOSS of 53,000 rental properties provided by the government.

For social and affordable housing, thankfully the $10 billion Federal Government Housing Australia Future Fund was finally passed, promising to provide an additional 30,000 social and affordable homes.

But that is still tiny compared with traditional investor/landlord stock.

Bottom line is for Government to encourage investors to help ease the crisis and not use them as the scapegoat.

The property pipeline of new apartments is being choked.

There is a rental crisis. There is a shortage of properties to rent. Home units are the main type of rental property. But building approvals for home units is plunging.

Conclusion: the rental crisis is going to continue for years.

Supply low, demand high

According to CoreLogic, the latest Australian Bureau of Statistics building approvals data just 4,490 units were approved for construction in July… that’s down 19.9 per cent from the previous month and 39.8 per cent below the decade average. The trend in new unit approvals has largely been below the decade average since mid-2018 and well below the trend in house approvals since late 2017.

The latest ABS building activity data also shows an easing in unit completions, while house completions have held close to the decade average.

In the past 10 years, units have accounted for approximately 41.7 per cent of total new housing completions nationally. However, over the March quarter this year, units made up just 37.1 per cent of completions, around 27.1 per cent below the decade average.

So not enough units are being built to meet current demand. But remember, we are going through a period of record migration numbers and most migrants rent a home unit when they first arrive. They are going to push up demand even more.

In the year to March 2023, net overseas migration reached a new record high, with 454,400 people added to Australia’s population. At the current average household size, this equates to an additional 181,723 households.

That’s just this year. Migration levels are expected to be above 300,000 a year for the next three years.

Tips to secure a rental property in a tight market

- Go early – try to inspect new properties as soon as they are advertised. Be proactive and let local real estate agencies know you are looking and leave your references and other paperwork with them in advance.

- Have all your documents in order – given there is such huge competition for rental properties, be ready to put your application in as soon as you see one you like. You can download a rental application form online and pre-fill it where you can. That way you are ready to hand it in as soon as you see a property you like.

- Get your references ready – inform your referees that you are in the market so they can expect a call from prospective landlords. Give at least three possible references on your application as a landlord will only try to reach someone a couple of times before moving onto the next application. The more references you can provide, the more likely they are to reach someone.

- Be ready with your finances – have your bond and advance rent ready to go. Paying these in a timely manner will ensure you don’t miss out.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.