This Sunday some of the nation’s biggest health funds, including Bupa, NIB, GMHBA, Qantas and Frank, will be lifting their premiums. So, it’s important you get onto it now to make sure you have the best deal.

Libby checked our cover this week through the Compare The Market (I’m CTM’s economic director) comparison site and found our fund (Australian Unity) wasn’t lifting premiums until next April and remained the best for us. The next best was an extra $60 a month… there was one which would charge us an extra $180 a month.

From 1 October, most health funds will increase their premiums by an industry average of 2.9 per cent, but the exact percentage increase varies between funds and individual policies. The increase will mean that some Australians will be forking out as much as $170 a year more than they currently are for cover.

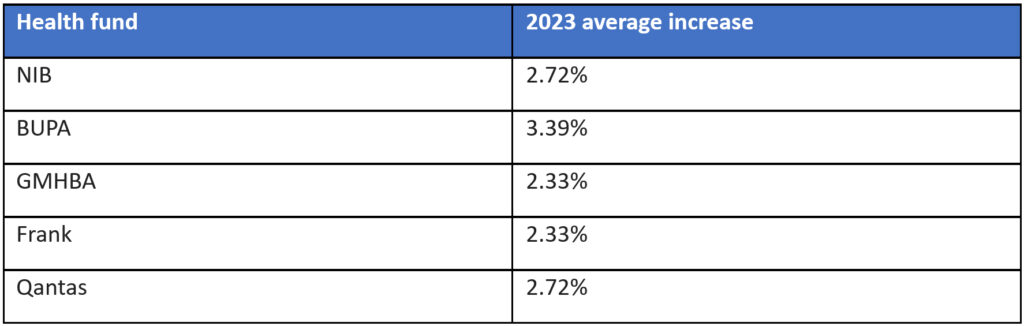

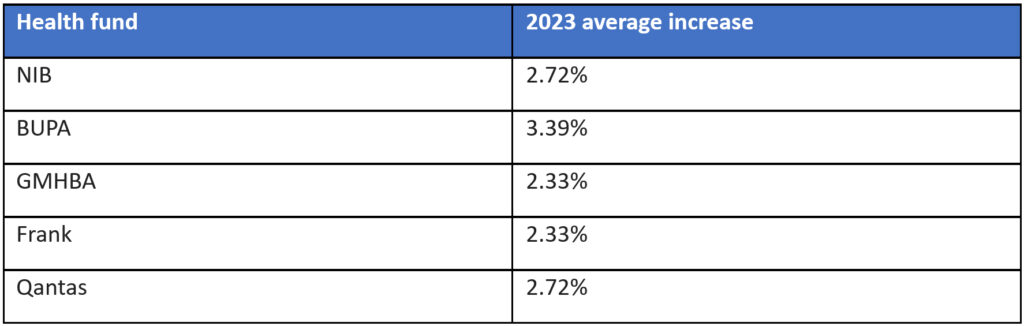

2023 average increase for popular health funds

Around 4.1 million Australians with Bupa, 651,000 with NIB (including Qantas) and 370,000 customers under the GMHBA umbrella (including Frank) will soon receive a notification from their health fund, detailing their premium increase if their policy is impacted.

The increase varies widely between funds and customers

One Compare the Market customer with a Qantas Gold Complete Hospital Plan with $750 excess received a letter explaining that their policy will increase by just $2.75 a month ($33) a year. However, another customer with a Bupa Silver Plus Prime $500 Excess plan will see their monthly premium rise by $14.44 a month ($173.28 a year).

This just shows that your health insurance premiums are determined by many different factors, such as your health fund, which policy you hold, where you live, your level of cover and whether you hold a couples, family or single policy. That means the average increase varies between funds, so now is a good time to ensure you’re getting the most value from your policy.

Review both your needs and your policy

If your circumstances and health needs have changed, confirm you’re on the right policy to suit your needs. You may be able to save money by switching providers for similar coverage or by changing from a more comprehensive policy to a reduced level of cover that still caters to your health needs and requirements. We also know that there’s still pressure on the public system, so maintaining a private hospital policy is a key way to ensure you receive inpatient hospital treatment when you need it. That’s because you can avoid the public waiting list by seeking treatment in a private hospital.

Health funds want your business and there are a number of attractive perks, offers and rewards available for new customers at the moment. Some are offering several weeks for free, while others are waiving some waiting periods, to help sweeten the deal. You may even be able to access exclusive wellbeing and reward programs.

Just be mindful that free periods, perks and rewards are usually available for a limited time on eligible policies, so ensure that you’re factoring this in when weighing up your options.

Tips for reviewing your private health insurance

Compare The Market offers these tips when reviewing your private health insurance.

Cheaper doesn’t always mean you’ll save

While there are many policies available and different levels of hospital insurance tiers, you’ll usually receive fewer inclusions if you opt for a lower level of cover. As such, choosing a level of cover that caters to your health needs is vital.

Don’t pay for what you don’t need

While comprehensive policies have the most inclusions, it comes at the price of higher premiums, and you may be paying for inclusions you don’t require. If your health circumstances have changed, you may be able to switch to a lower hospital insurance tier that still includes everything that’s important to you.

You won’t need to re-serve waiting periods

If you switch policies, your new fund will recognise any waiting periods you’ve already served on the services you held previously. However, you’ll still need to wait for any new or upgraded services and benefits.

Read the terms and conditions before switching or taking out a new policy and ensure you’ve read your policy brochure carefully. Be aware of any inclusions or exclusions, as well as any waiting periods, excess amounts and more, as these can vary between funds.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending