Mixing love and money can often kill the romance, according to some fascinating research from comparison website Finder.

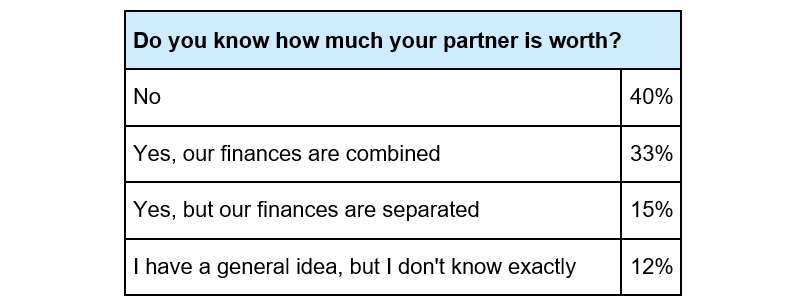

It found no savings, unpaid debt and poor financial knowledge have all led to Australians getting dumped from a relationship. And 40 per cent of people have no idea what their partner is worth… now that is a real warning bell for any long-term, committed relationship.

Love and money are a romance buster

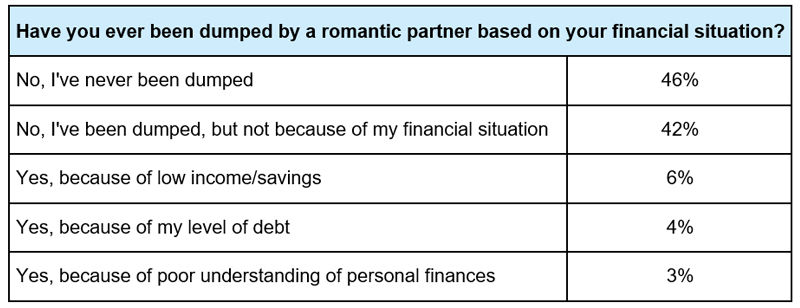

A survey of 1,007 respondents revealed 1 in 8 Australians (13 per cent) have been through a break up due to their financial situation.

Source: Finder survey of 1,007 respondents, August 2021

The research found 6 per cent have been dumped due to having low income or savings. While 4 per cent became single after their level of debt became a problem for their partner.

A further 3 per cent were dumped due to their lack of understanding of personal finances.

Men are four times more likely to be dumped by their partner due to financial concerns than women.

Source: Finder survey of 1,007 respondents, August 2021

Almost 1 in 2 (48 per cent) know how much their partner is worth, however, this includes only 1 in 3 (33 per cent) who admitted to having their finances combined. More than 1 in 9 (12 per cent) have a general idea, but don’t know exactly.

NSW residents were twice as likely to have been dumped by a romantic partner due to their financial situation than Queensland residents. Love and money clearly don’t mix in the southern state.

My 5-step plan to keep the financial romance alive

Love and money can absolutely mix. You just need a strategy to keep the conversation open and expectations realistic.

Step 1: Work as a team

You’re a couple, so it’s important you resolve problems and make financial decisions together.

Money matters are a responsibility that should be shared. You don’t want one person deciding how to spend and invest for you both, it’s a huge responsibility and can be very stressful.

Step 2: Educate yourselves

For two people to jointly manage their finances, each partner must have a basic understanding of money. You don’t have to do a fancy investment course. Start by opening your eyes and ears to financial news and websites.

The more knowledge you have the more you will understand advice from your bank, financial planner, and those well meaning family and friends.

Step 3: Find a financial mentor

Seek as much free information as you can get.

If you know someone who manages money well ask them to be your financial mentor and pick their brain. If you want to keep your finances confidential, look for guidance from someone outside the family.

Step 4: Develop a plan

Your relationship will be strengthened when you work out a routine for handling your money and find solutions to any financial problems.

Start by doing a family budget together. Tally your income, family benefits and any money from investments. Then get your bills and receipts and try work out how much you’re spending each month.

Your budget will show you where your money is going, how much is left over at the end of the month and where you can cut back.

Step 5: Save what you can

You and your partner need to have a common vision of where you are going with your money.

Start by setting savings goals. Talk about where you want to be financially in the short, medium and long term and how you’re going to get there.

The biggest thing I’ve learnt is that couples on average weekly wages, who are disciplined with their money and work towards the same goals, often end up with more wealth than those earning three or four times as much but spend the lot.

Trending