For weeks I’ve been pointing toward Wednesday’s December quarter Consumer Price Index (CPI) announcement as being crucial to setting the tone for interest rates this year.

Well, the result was really encouraging and basically signalled the top of this interest rate cycle. The headline CPI rose 0.6 per cent for the December quarter and 4.1 per cent for the year… well below what economists were expecting and down from the 5.1 per cent annual rate for the September quarter.

The headline was good news, but the RBA actually focuses on the “trimmed mean” which takes out one-off, volatile components of the CPI basket to give a more stable reading. The trimmed mean CPI came in at 0.8 per cent for December (it was expected to be 0.9 per cent) and 4.2 per cent of the year.

Trimmed mean has halved in a year

But here is the important part. The RBA expected this annual trimmed mean figure at the end of 2023 to be 4.5 per cent. So, Wednesday’s figure came in better than the RBA prediction. They have to be happy with that.

To put it into perspective, this time last year the annual rate was a whopping 7.8 per cent. It has nearly halved in a year on the back of the steep rise in interest rates.

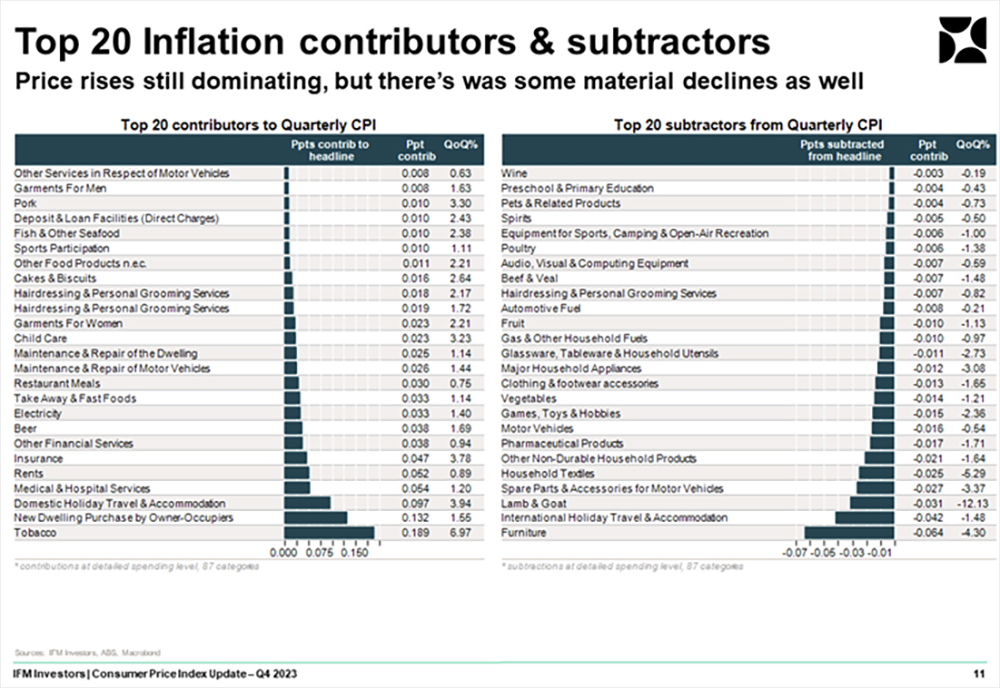

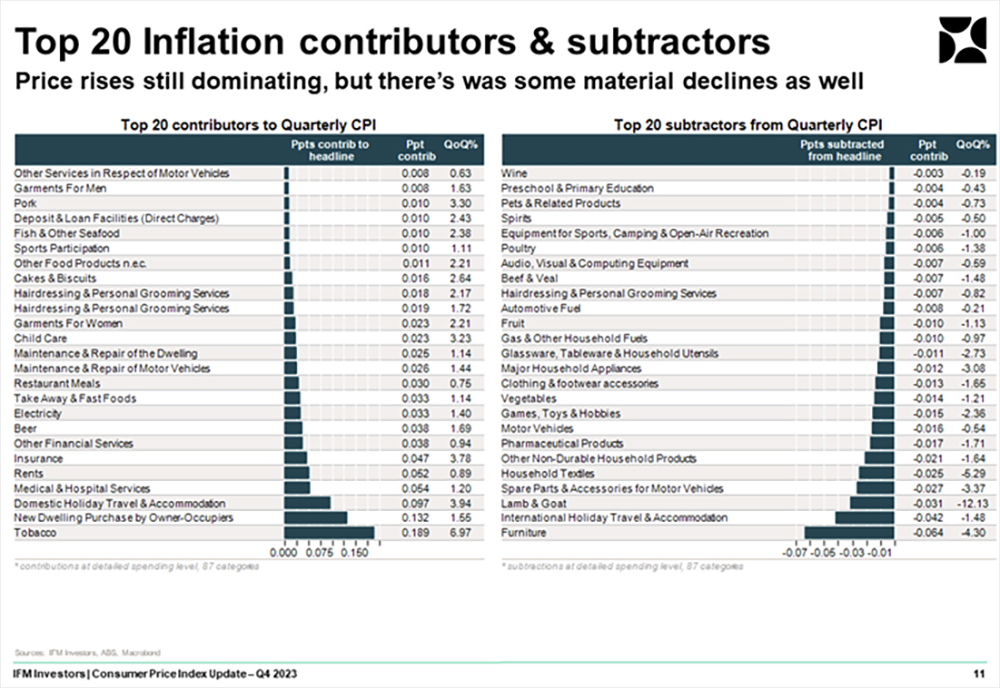

If you want to see what’s driving inflation (and which prices are dropping to make sure you are getting the best deals), IFM Investors have put out this great summary.

Source: IFM Investors

Now is the time to buy any new furniture and look at those lamb and goat prices – that helps with the cost of meals.

But the increases were in tobacco (because of the rise in excise taxes), new dwelling costs, rents and insurance premiums.

Speaking of which, you should never automatically renew an insurance policy. Always check whether you can get a better deal elsewhere. You’ll be amazed at what you can save. I’m biased as the economic director of Compare the Market, but comparison sites are just so easy to use to find a better deal.

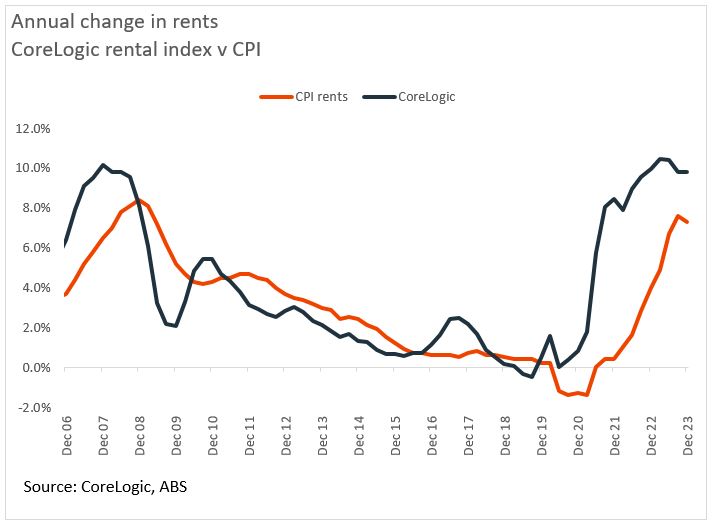

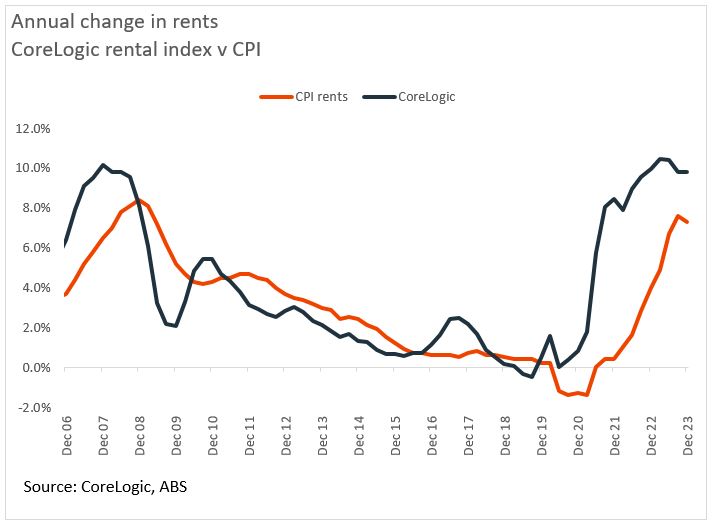

Housing is easing

Housing is the biggest sub-sector of the CPI at 22 per cent of the CPI basket. It measures the change in the cost of newly constructed dwellings and major renovations by owner-occupiers, and the change in rents paid to landlords.

For the purchase of new homes, the CPI measure eased to 5.1 per cent, down from 5.2 per cent in the previous quarter and a peak of 20.7 per cent in the year to September 2022. While the rate of increase is easing, residential construction remains a substantial contributor to inflation overall and was the most significant contributor to inflation in the last quarter. High labour and material costs continue to put pressure on the price of new homes.

Annual growth in the rent component of CPI was 7.3 per cent, down from 7.6 per cent. Over the decade before COVID, average annual rent rises averaged 2.3 per cent. So, still very high but they seem to have steadied and hopefully continue to slow. Fingers crossed they eventually get back to that 2.3 per cent level.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

6 things the government can do to ease the cost of living crisis

Trending

Sorry. No data so far.