The Reserve Bank has been constantly saying that as it monitors the economy for any further need for interest rate increases, apart from inflation its focus is on jobs, household spending and the property market.

This week we received key data on all these areas. First up jobs.

Unemployment up but job creation still strong

The great fear of the RBA is that a strong job market will lift wages as employers bid against each other to hire staff and that would flow into inflation. Plus, if everyone is in a job they’ll go and spend more at the shops which, again, feeds inflation.

Yesterday’s unemployment rate rose from 3.6 to 3.7 per cent, but 80,000 new jobs were created when the markets were expecting just 20,000. So while unemployment rose (which the RBA would be happy with), strong jobs growth shows there is still strong demand for workers (which the RBA won’t like).

And, as a result, wages are booming

The Wage Price Index measures pay rises across all private and government jobs. In the September quarter it rose 1.3 per cent and 4 per cent for the year. That’s the strongest growth since March 2009.

But the Bureau of Statistics did point out this very strong growth in September was because of a number of one-off factors in the September quarter which wouldn’t be ongoing. Such as:

- The Fair Work Commission lifting the minimum award wage 5.75 per cent in July. The full impact of this decision was felt in the September quarter alone and won’t spill over to the December quarter outcome.

- The Aged Care Work Value case resulted in a 15 per cent wage rise for workers in that sector which, when the Fair Work decision is added, meant average wage increases of between 5.75 per cent and 21 per cent for aged care workers.

- The traditional 1 July new financial year inflation adjustments for many workers.

- The formal ending of public sector wage caps by state governments, which meant 34 per cent of public sector jobs received an average pay increase of 3.3 per cent. In fact, public sector wage growth is the highest since 2011.

So while the Wage Price Index surge in September is worryingly strong, it did include a number of factors which won’t be repeated.

Despite big wage increases, household income is falling

According to the Australian Financial Review, Australians have suffered the biggest fall in standard of living of any advanced economy in the world. Household income dropped 5.1 per cent in the last financial year, the sharpest fall recorded across the OECD.

Inflation-adjusted disposable incomes have hit their lowest level since June 2019 as high inflation, a rapid increase in mortgage repayments and rising income taxes ravage household budgets, newly released data from the OECD show.

It is something I’ve been talking about for months. Yes, high inflation and rising interest rates are draining household budgets, but even though there was strong growth in wages for the September quarter all those extra dollars don’t go to you. The Federal Government gets in the way and takes a slice of it.

A pay rise means being pushed into a higher tax bracket, you pay more in tax and the Federal Budget is the big winner. The reason why the Federal Budget has such a healthy surplus is because of you and your wage rise.

The cold hard facts are… your spending power is being eroded by inflation, higher interest rates AND higher taxes.

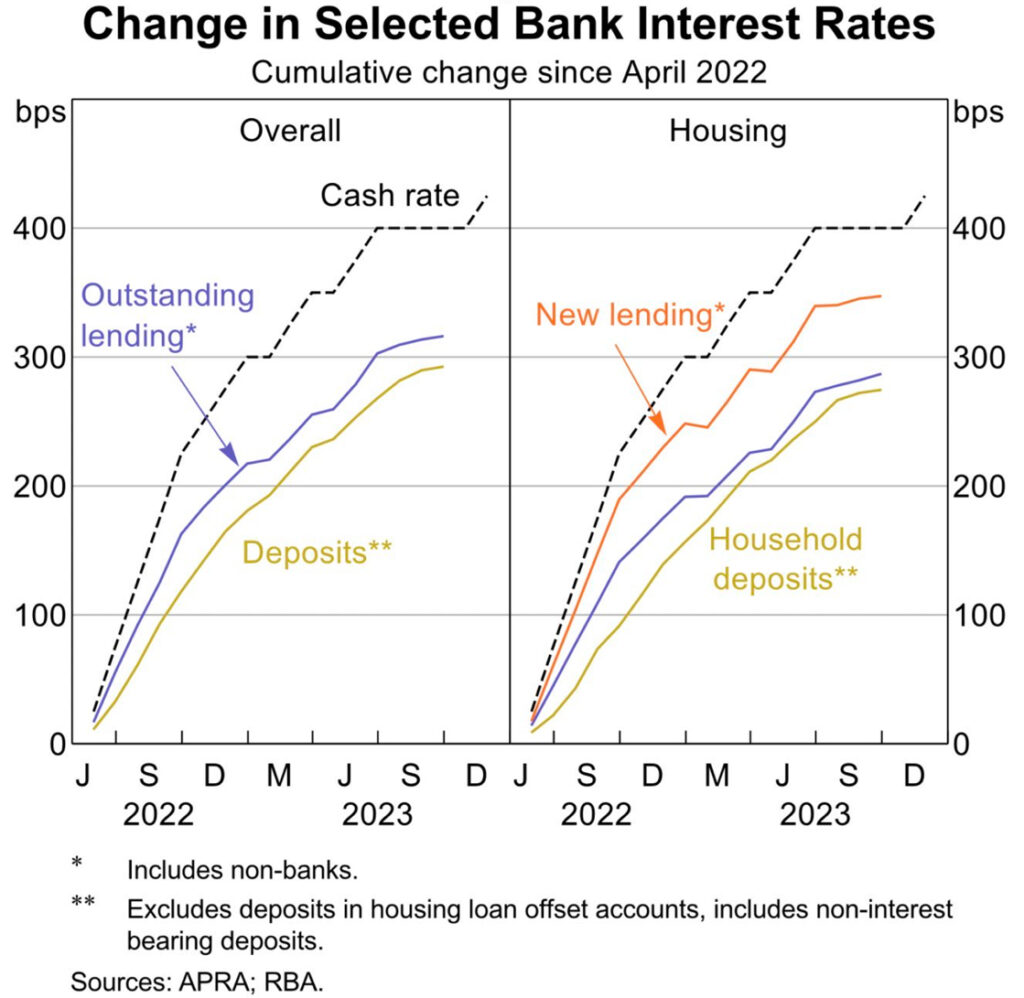

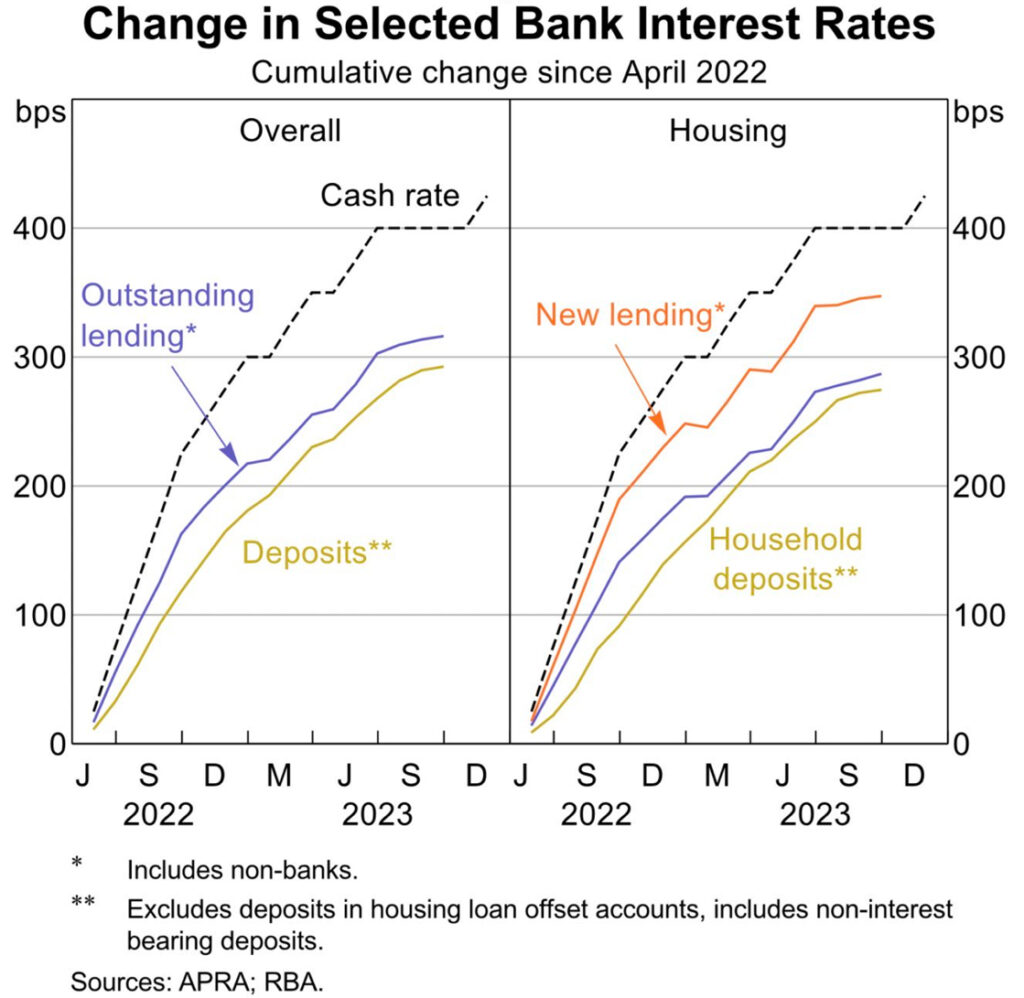

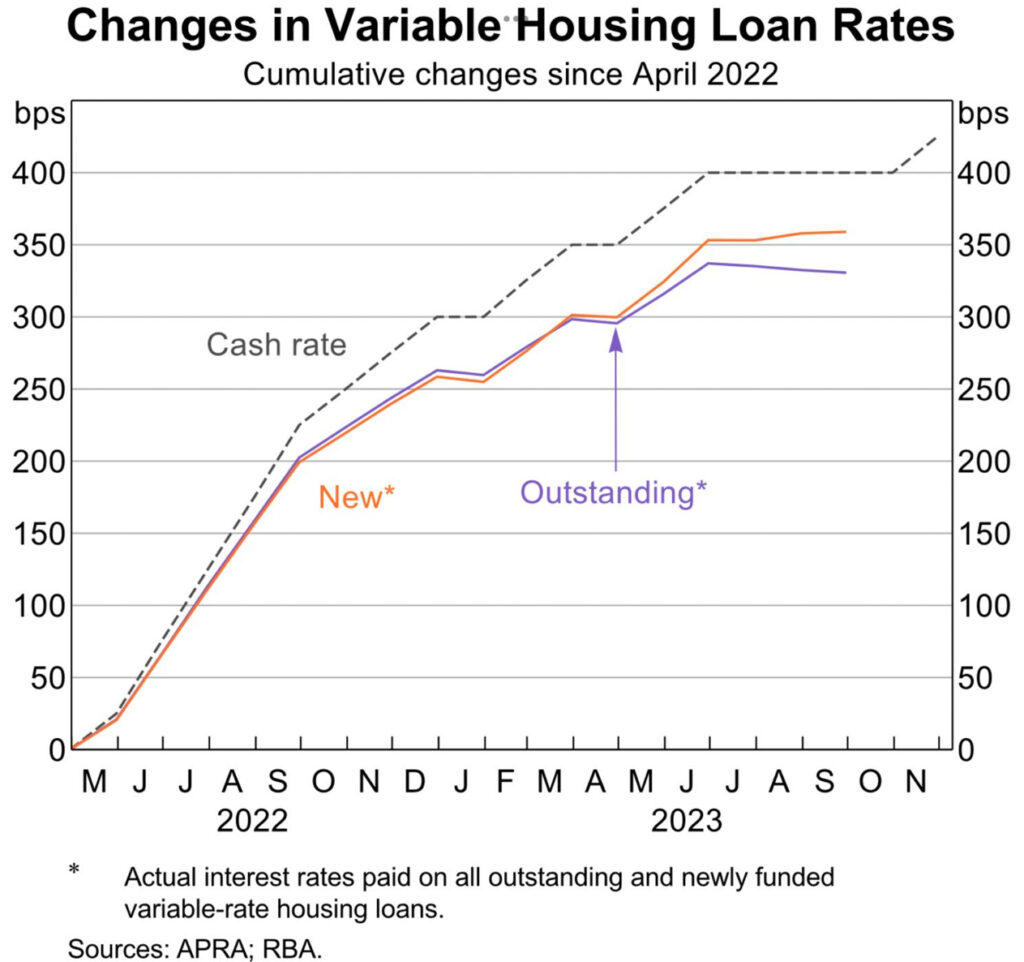

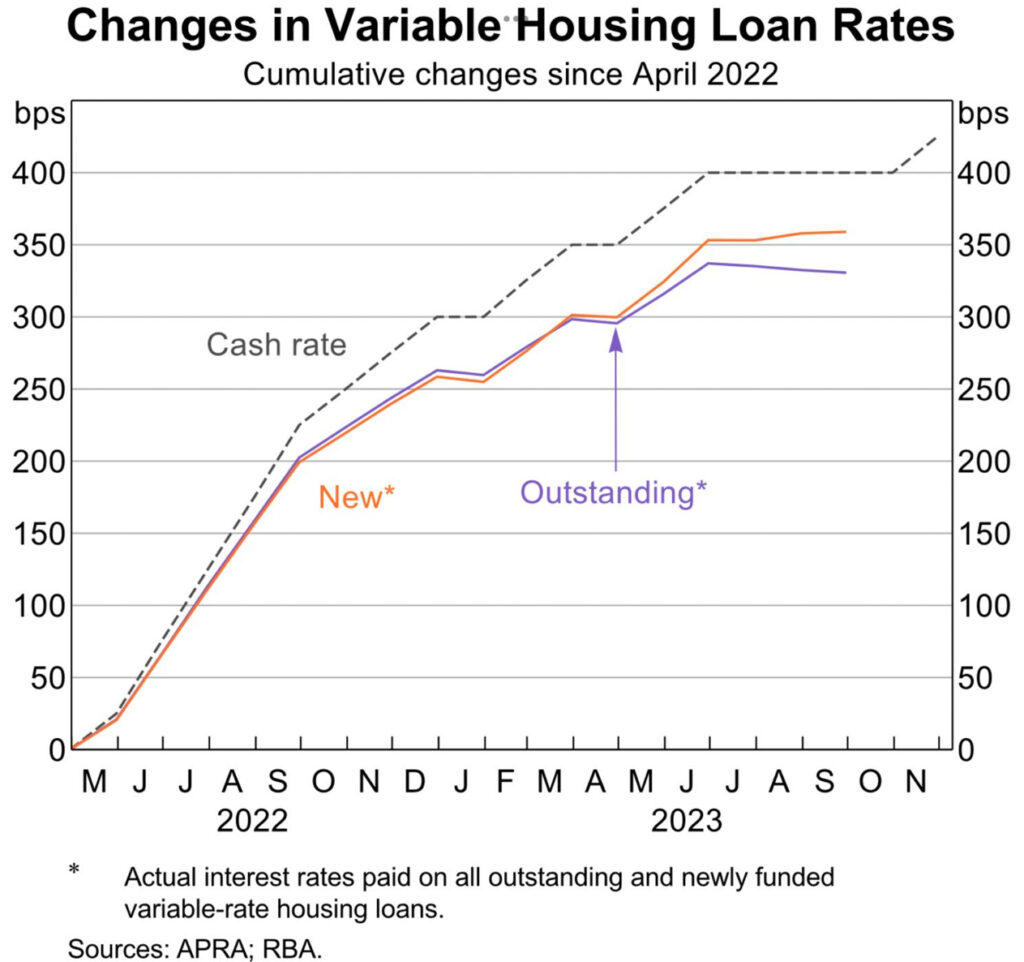

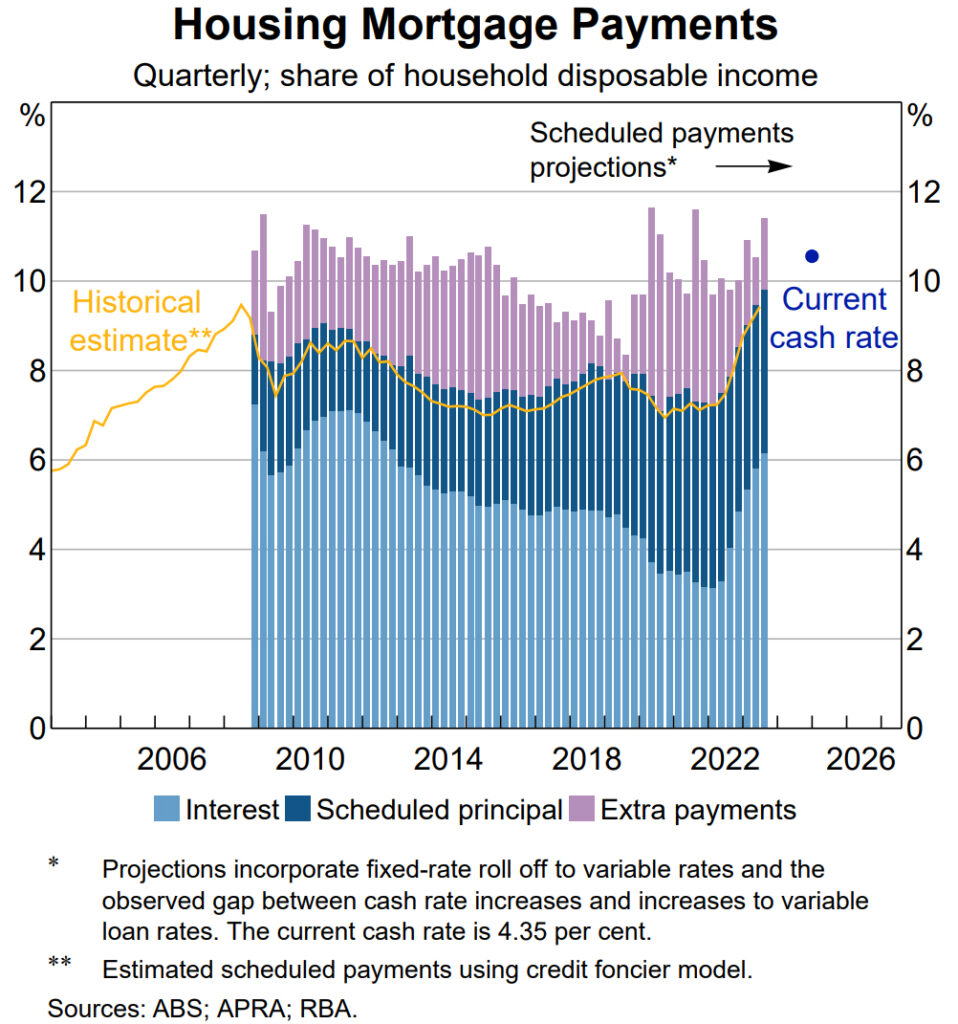

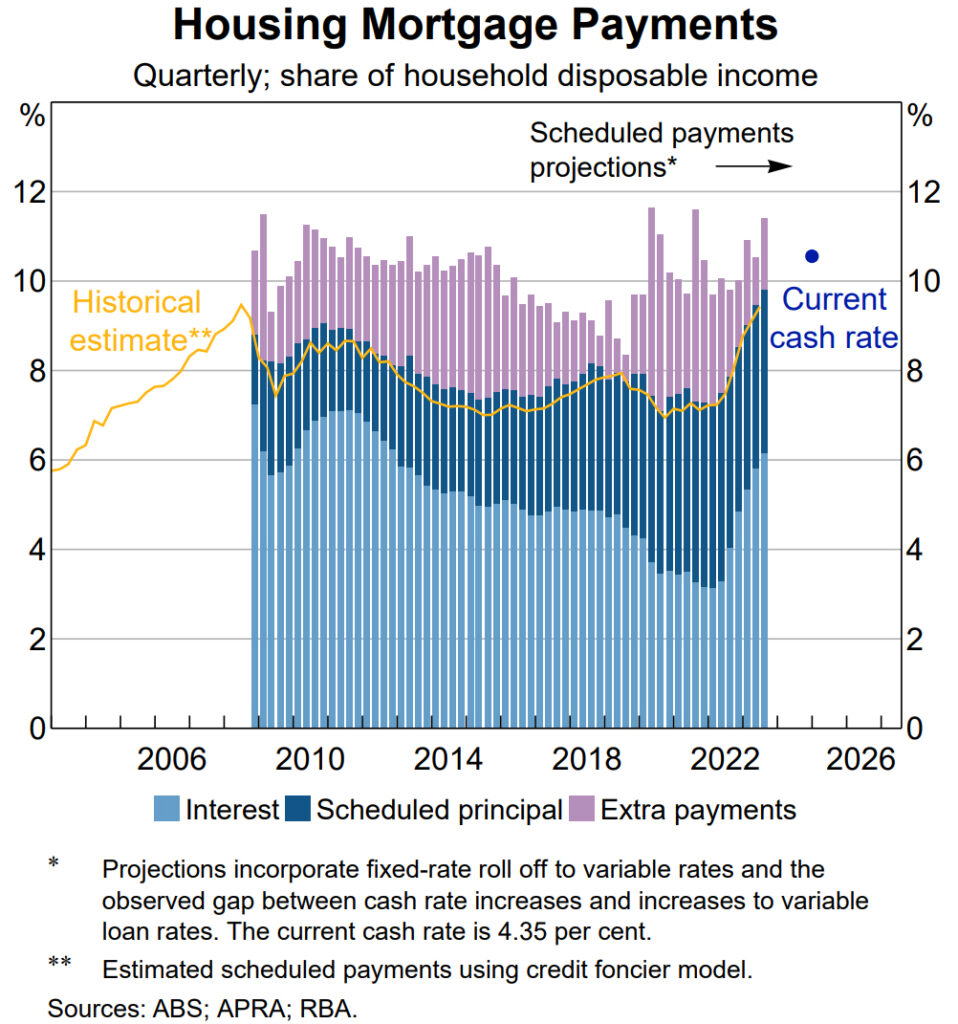

The impact of rising interest rates on your household

Let’s go behind the headlines and look at the facts behind the impact of rising interest rates.

Yes, we all think the banks are “so-and-sos” for making us pay more on our loans, but what may surprise you is that they haven’t passed on the full rate rise to borrowers. And they haven’t passed on the full rate rise to savers either.

Surprising, isn’t it?

It’s more a reflection of just how competitive the mortgage market is at the moment and the deals and sweeteners being offered to new borrowers.

That’s why it’s so important to shop around and make sure you have the best rates because if your existing lender isn’t doing the right thing, other lenders are itching to do business with you.

Even though the banks haven’t passed on the full RBA cash rate increases, this interest rate cycle has been the shortest and sharpest in a generation. It has been devastating to Australian families with a mortgage.

By the end of this year mortgage repayments are expected to reach a record high 10 per cent of disposable income. And remember those mortgage repayments are being made in after-tax dollars, whose value is also being eroded by inflation.

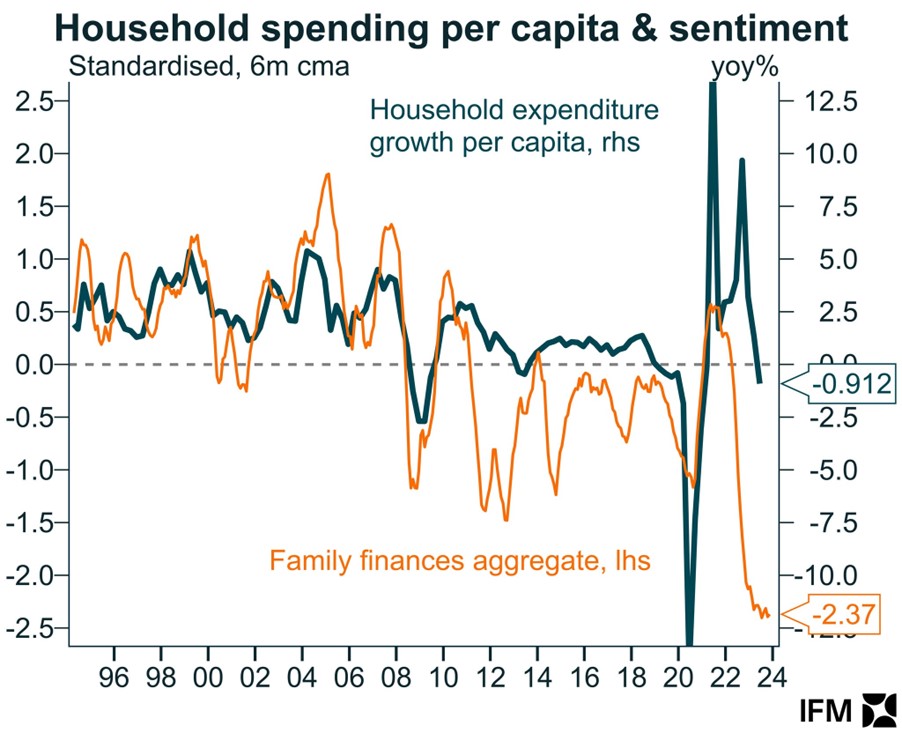

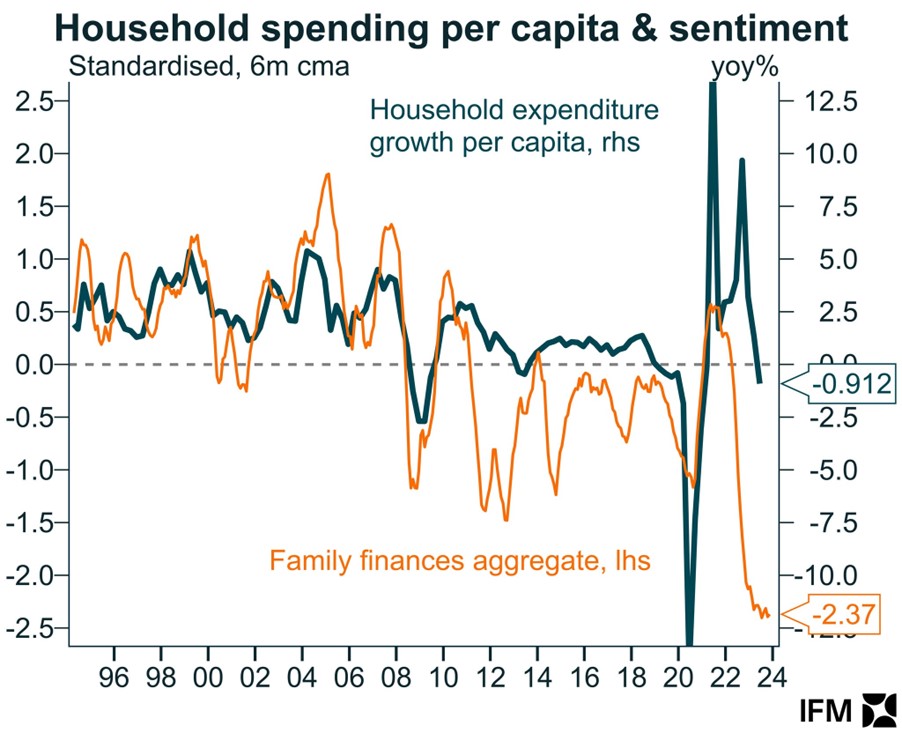

Is it any wonder that consumers are tightening their belts and we’re become gloomier about the future? Retail sales are still reasonably strong, but that’s because of the huge influx of new consumers through immigration. On a ‘per person’ basis, we are all spending less.

Trending

Sorry. No data so far.