A major consequence of the ongoing rate rises is that the number of Australians defaulting on their home loans has surpassed the mortgage stress peaks during the Global Financial Crisis.

Borrowers can’t take this hit lying down though, they need to be proactive, and spring clean their finances to make sure they’re on the best deal for them and the lowest possible rate.

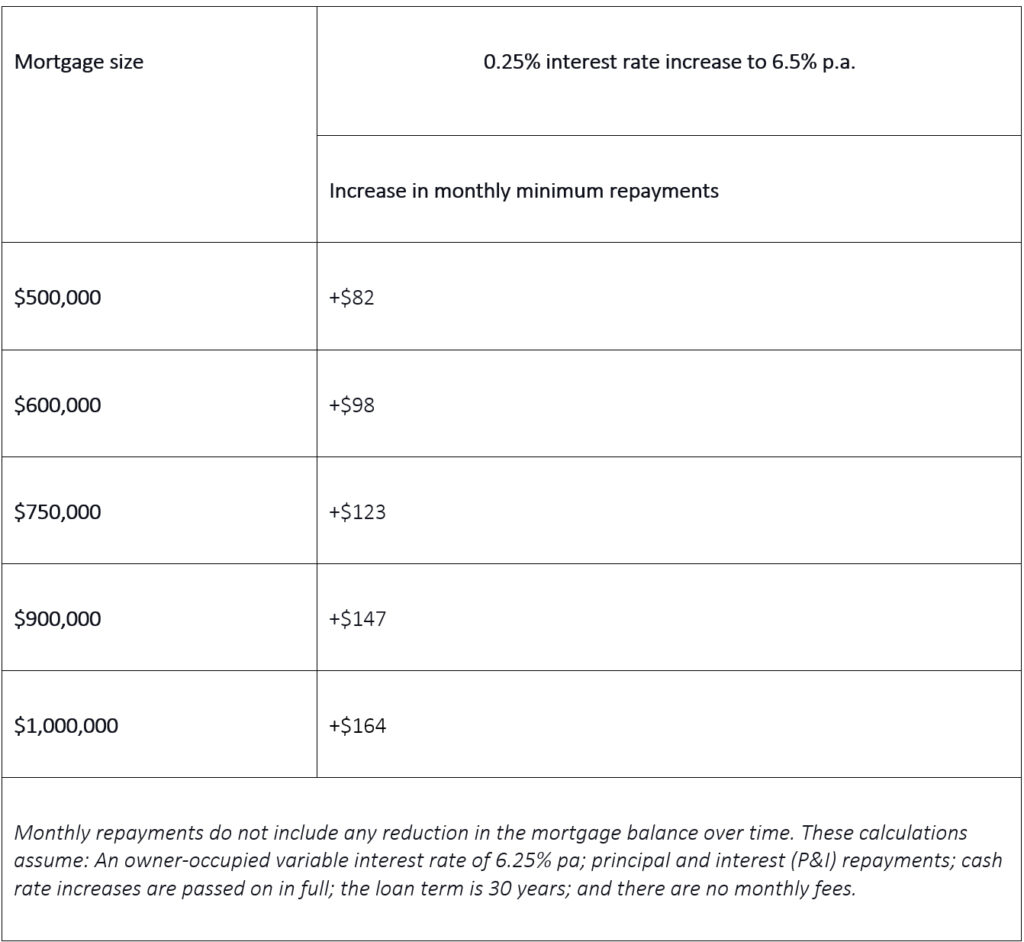

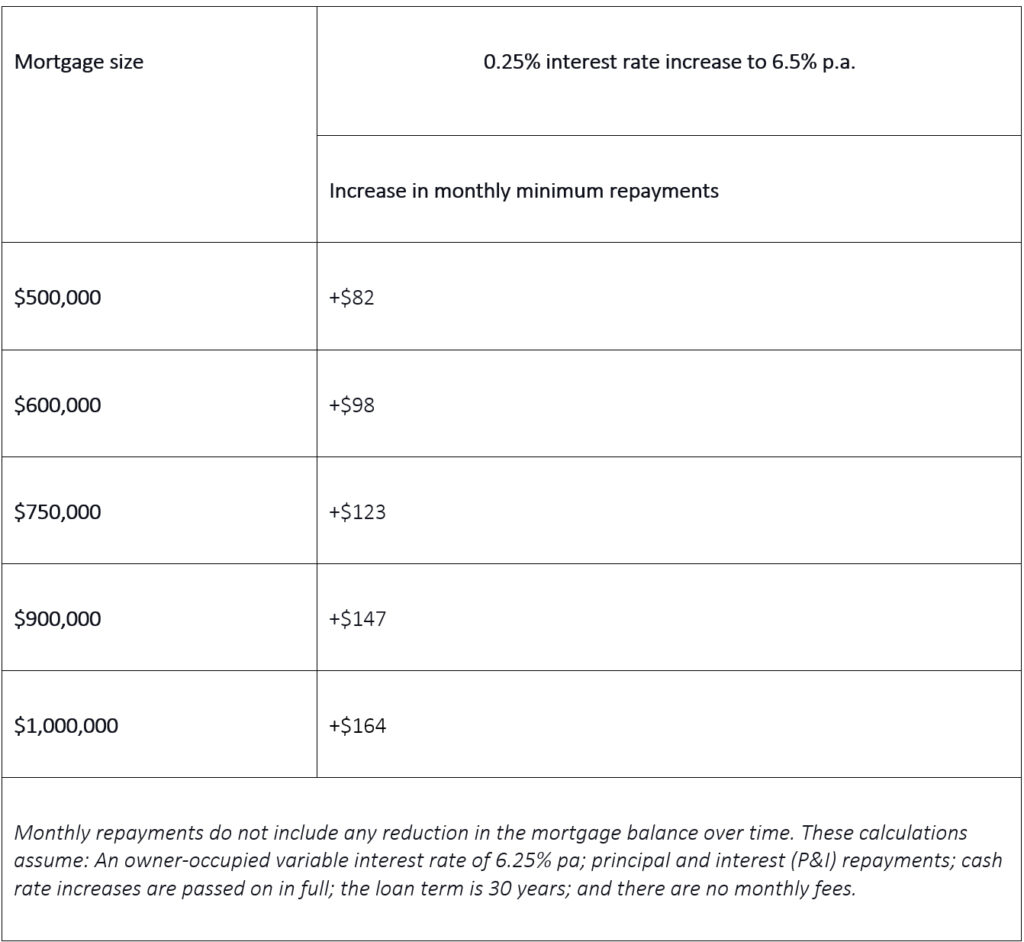

Lenders are already starting to pass on the 0.25 per cent rate rise in full, so a borrower with a $600,000 loan size could see a $98 increase in their monthly repayments.

Source: Compare the Market

From lucrative cashback offers and discounted rates, the home loan market is back and bubbling away with competition.

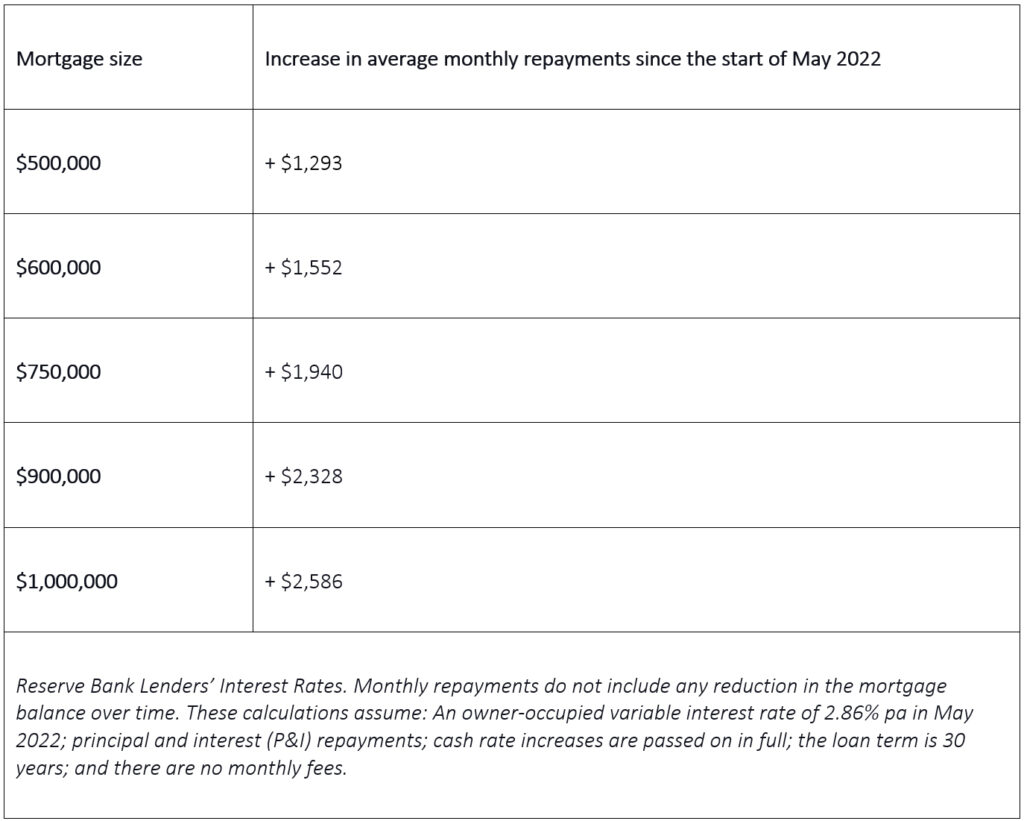

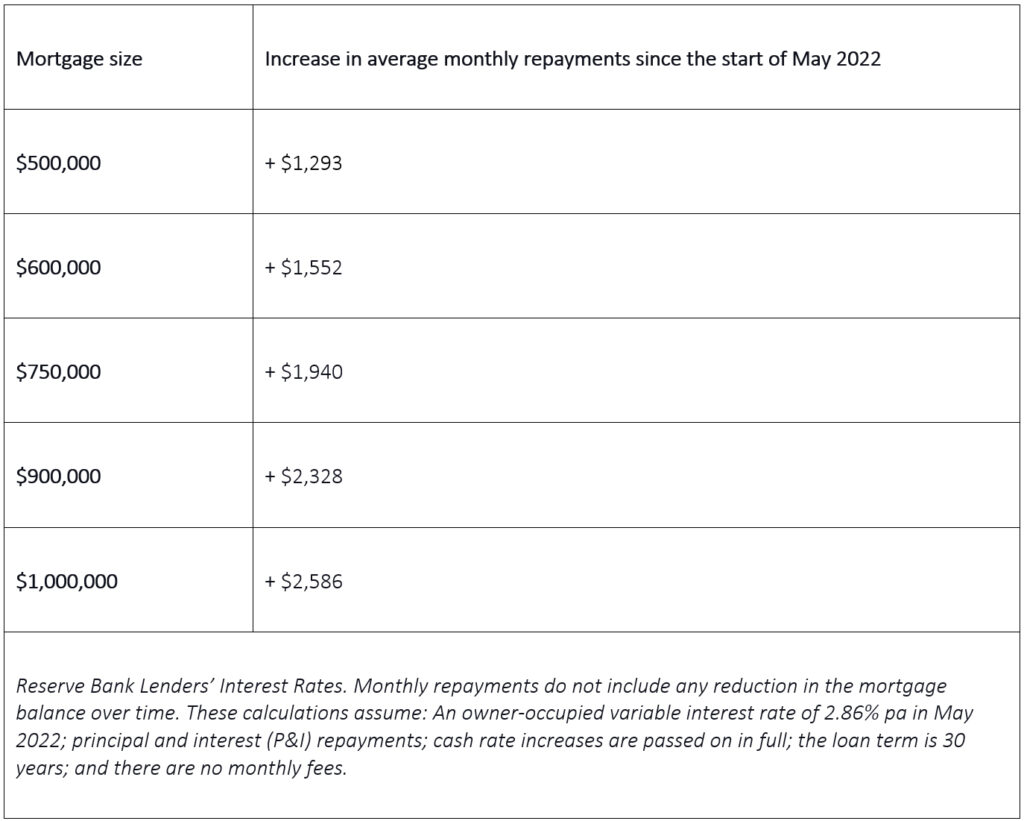

But it’s up to borrowers to take advantage of the market and to do their research… rather than aimlessly sticking with their existing lender who might not have a good deal. Australians with a $600,000 variable mortgage may soon be paying $1,552 more each month than they were at the start of May 2022, following a 4.25 per cent jump in just 12 months.

Are cashback deals worth it?

Home loan cashback deals are offered by banks and lenders in the form of cash deposited into your bank account as a lump sum or a reduction or elimination of their refinancing fees. Cashbacks can sometimes be offered in the form of gift cards for a store or brand.

There are plenty of cashback deals lingering around for owner occupiers. For refinancers, they currently range from around $2,000 offered by lenders like IMB, Bank of Queensland, St George, ME Bank and others to a whopping $10,000 offered by Reduce Home Loans (although you’d be looking at a $2million plus mortgage to be offered that).

First home buyers get a look in with $3,000 offered by ANZ and Bank of Melbourne, BankSA and St George all offering $1 lenders mortgage insurance.

While all that sounds ideal, you’ve got to make sure you don’t get sucked in by the sugar hit. Make sure the cashback deal is attached to a low rate, otherwise it may not be worth it.

Refinancing for a cashback deal

Before you refinance to take advantage of a cashback deal, be sure to ask yourself these questions.

Have you made sure you’re eligible for the cashback?

Read the terms and conditions carefully. Cashbacks are most commonly offered to customers who are refinancing and often the total loan amount is taken into account. In addition, your loan-to-value ratio will also be assessed for eligiblility.

Is the interest rate competitive?

Check how competitive the ongoing rate being offered by the cashback lender is in the general market. Then compare the monthly repayments between the interest rate offered with the cashback and a lender offering a more competitive rate without the cashback. How many years would it take for the lower rate to offset the cash bonus?

For example, say your cashback loan offered a rate of 7.5 per cent per annum with $2,000 cashback on a 25 year loan paid monthly. Your monthly repayments for the loan will be $3695. Elsewhere, there’s loan with no cashback offering a rate of 7 per cent per annum and you’d pay $3,534 per month. Which means you’ll pay $161 extra month and your cashback offer will be meaningless in just over one year. Meanwhile, over the life of the loan, you’ll pay an extra $48,318.

Are the fees high?

Higher fees can really impact the amount you pay over the term of your loan. For example, compare a $500,000 loan on a 7 per cent per annum rate over 25 years. The first lender will charge an annual fee of $20 per month; the second has zero fees. Going with the first lender will end up costing you an extra $6,000.

Does the loan offer the flexibility you need?

This may include an offset account or the ability to make extra repayments and redraw if necessary.

Are you in position to refinance?

This typically includes having a steady job and owning at least 20 per cent of your home. You also need to make sure that you’re not currently on a fixed rate, as break fees may apply.

Can you put the cashback bonus into your mortgage?

The cashback can then reduce your mortgage upfront, helping to reduce your interest charges over the years to come. If you can’t do that, put the cashback straight into your offset account.

Remember to refinance your mortgage regularly

The bottom line is, don’t set and forget your loan. Especially if you are on a fixed loan, as potentially high revert rates may quickly eat away at any savings you’ve made.

Compare your mortgage regularly and renegotiate with your current lender if you’re not getting the best deal.

Staying on top of your mortgage can save you thousands.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending