Borrowing power has plunged over $260,000 for some Australian families, trapping many mortgagees that can’t qualify for better rates, and hampering house hunter hopefuls.

Lenders have been far more cautious in an effort to offset the risk of recession and higher rates that could impact long-term serviceability.

Fixed rate borrowers who have just had their record low-interest rates expire may have been subjected to a 4 per cent increase in one hit. Banks typically stress test borrowers at 3 per cent… the cash rate has surged beyond this, so many borrowers may be in mortgage stress right now.

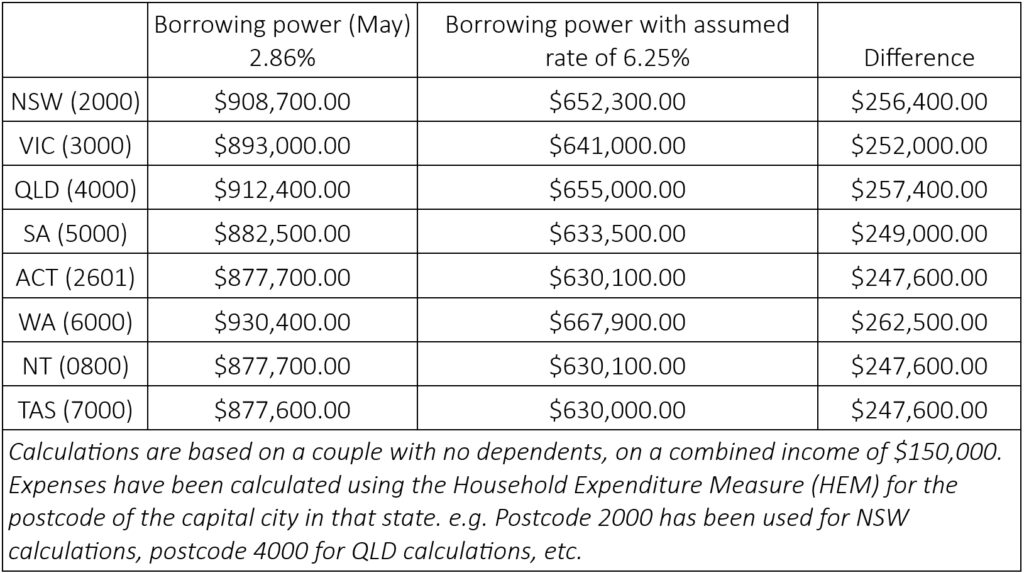

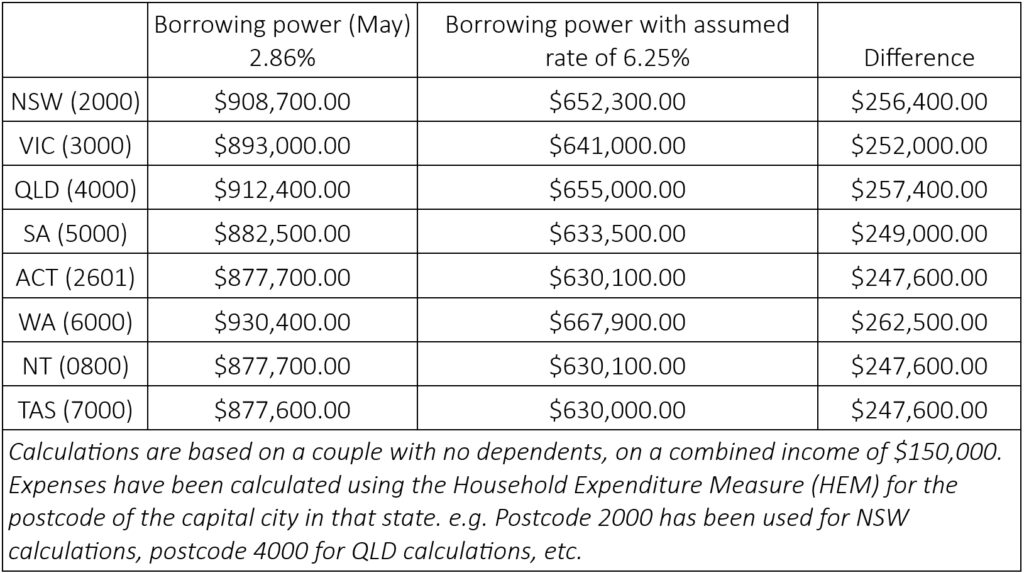

A couple from Western Australia with no dependents on a combined $150,000 saw their borrowing power plummet by 28.2 per cent – that’s a decrease of $262,500 since May last year.

It’s a similar story for a Queensland couple with no dependents on a combined $150,000 who experienced a $257,000 drop in their borrowing power.

Meanwhile, a New South Wales couple with no dependents on a combined $150,000 had their borrowing capacity squashed by $256,400.

Source: Compare the Market

Follow these steps to improve your borrowing power

But there are things borrowers can do to help improve their borrowing power and boost their financial fitness.

Know your credit score

Websites like Compare The Market provide free credit score checks to help you understand how strong your borrowing position is. It’s one of the measures lenders use to calculate the risk of your application. Improving your credit score is one way to improve your chances of being approved.

Reduce your credit card limit … or get rid of it

When lenders calculate borrowing power, they use the entire credit card limit, rather than the balance, as part of their serviceability calculations. Therefore, reducing your limit or closing your credit card may help boost your borrowing power.

Pay off any debts

Banks must include all financial obligations when calculating your ability to repay debt including credit cards, car loans or personal loans. If you work to reduce or eliminate your high interest rate debts, you may be able to increase your borrowing capacity.

Although the Higher Education Loan Program (HELP) can’t accrue interest like credit cards, it can be brought in line with inflation. For example, in July this year, millions of Australian university students or people who are still paying off their HELP debt were slapped with a cruel 7.1 per cent increase in the amount they owe.

If you have the ability to pay off your HELP debt, then consider doing so as it may boost your borrowing power.

Consider a joint purchase

You could team up with a family member, partner or friend if your borrowing capacity isn’t high enough and you’re struggling to meet the lenders income requirements.

Joint purchases have become a popular way for many to break into the property market. Two incomes are usually better than one, so you may find your borrowing power increases with an additional person on the loan.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.