Given the strong October rise in housing values, is this just further confirmation that this is always the best time of year to sell a property? The sun is out, gardens look great, sellers and buyers come out and there is a rush to finalise sales before the summer break.

But I was fascinated by a report from Ray White chief economist, Nerida Conisbee, that spring selling season could be a myth.

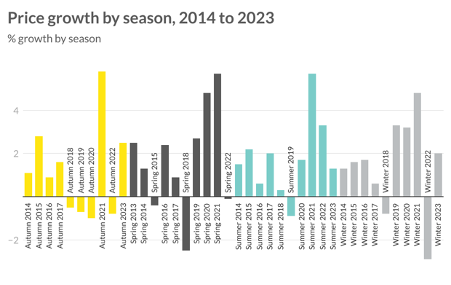

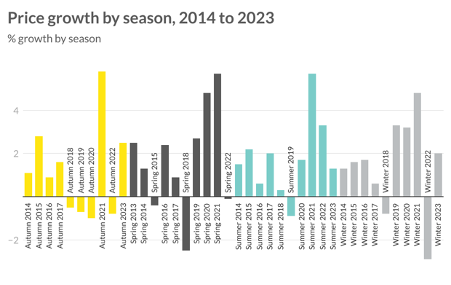

Ray White analysis shows that summer is the period in which prices rise the most. Having a look at price growth by season over the past 10 years has shown that prices on average increase by 1.8 per cent, marginally higher than spring at 1.7 per cent. Autumn price growth is lowest at 1.2 per cent while winter comes in at 1.5 per cent.

Source: Neoval

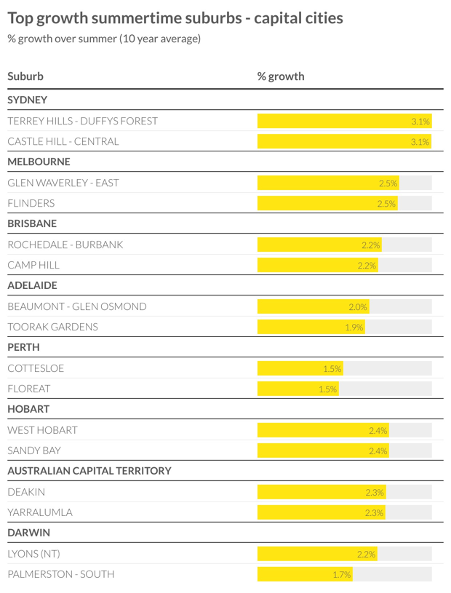

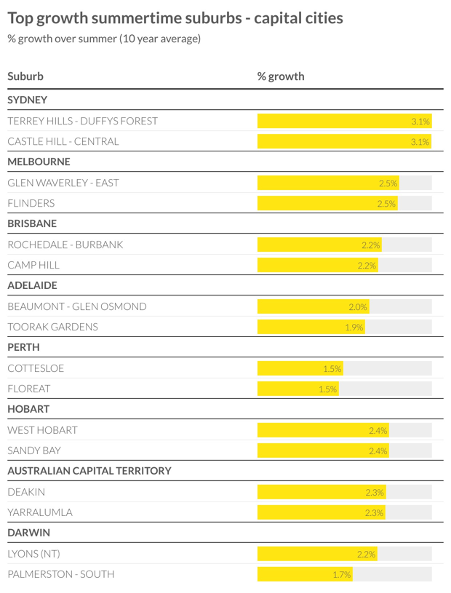

Many of the suburbs that do best over summer are not surprising. Beachside Flinders on the Mornington Peninsula is a strong performer. Similarly, Cottesloe is Perth’s most expensive beachside suburb and would get great exposure during summer.

This beachside trend becomes even more apparent in regional areas. Summer is also Byron Bay’s peak season, Noosa Heads in Queensland and Goolwa in South Australia would be similar.

While beachside areas dominate the strong performers in summer, there were some surprises. Terrey Hills in Sydney is relatively close to the beach but would be considered more an urban rural area with large homes on large blocks. Canberra has no beaches but Deakin is one of its most desirable suburbs, even during the quieter summer months.

Source: Neoval

Source: Neoval

Looking to buy or sell?

No matter what time of the year you want to jump into the property market, there are 10 things you should do before getting your feet wet:

1. Do your research

Look at as many properties as possible to get an idea about prices in your area. What adds value, which types appreciate faster, how to get a good deal, and the pitfalls are of a too-good-to-be-true deal.

2. Get the property valued before you buy

Even if you’ve done sufficient research, buyers can still pay overinflated prices for properties so it’s smart to get a property valued before you make an offer.

3. Get the property valued before you renovate

One of the biggest misconceptions buyers have is that the more capital they spend on a property, the more profit they will make. This isn’t always the case.

A valuer can tell you what your home is worth now, what it will be worth after, and whether your $30,000 kitchen renovation will actually add $30,000 to the home’s value.

4. Find a good property manager

If you’re buying an investment property, it’s important to know the best way to maximize your rental income to ensure that it rises with the market.

Most self-managed properties are under-rented as owners are often hesitant about upsetting tenants. The property manager will also be able to keep on top of maintenance and other issues to do with the property.

5. Location, location, location

Look for areas with potential to maximise capital growth and create high yields. Important things to look for are proximity to public transport, leisure activities (parks, beaches and lakes), and to work and schools. Pay for some independent research which will tell you what the highest-rated suburbs are – it’s worth it!

6. Buy “better” properties

Physical factors to look for when researching properties are:

- good-sized bedrooms;

- off-street parking;

- good positioning;

- and a uniqueness that sets the property apart from others in the street.

These will ensure the property grows in value and desirability.

7. Buy blue chip properties

Cheap properties are often cheap because they are not in great demand. That’s a red flag during the current market conditions.

8. Buy at, or below, market value

Unrenovated properties in good areas can fetch lower prices and offer excellent opportunities to maximise capital growth. You can also achieve good yields if you renovate. Another is buying an emergency sale when sellers are hard-pressed to sell to finance a recent buy or relocation.

9. Get a good mortgage broker

A good broker should be one of the most important professionals on your team. The more legwork the broker does for you, the more time you can spend finding a great property.

10. Stick to your strategy

Work out what works for you. Once you find the strategy, stick to it.

You need to be aware of other opportunities and get advice, but often these can be distractions. A good strategy doesn’t have to be complicated – it’s often the simple things that work.

Trending

Sorry. No data so far.