Instead of just accepting the current wave of repayment increases from your bank, it can be really worthwhile to look around for a better deal and refinance. And lots of people are doing just that.

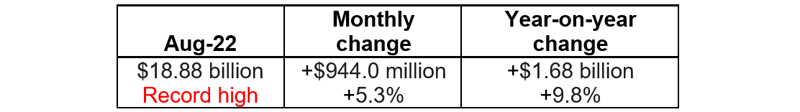

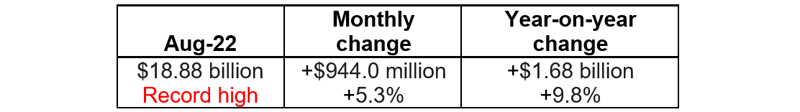

A record breaking $18.88 billion of loans were refinanced in August, while $201 billion worth of home loans have switched over the last year… and the banks are being forced to act.

RateCity analysis shows that since the RBA hikes began in May, 34 lenders have passed on full hikes to their variable rates, only to turn around and cut their lowest home loan offers. The catch is, they’re only offering these new low rates to new customers who own a decent amount of their home, which is typically refinancers.

The discounts on offer don’t stop there. Cold hard cash is on the bargaining table as well. The RateCity database shows 33 lenders are offering cashback for people who are willing to jump ship, in some cases up to $5,000 for the average-sized loan.

Total refinanced – August 2022

Source RateCity.com.au, ABS Lending Indicators August 2022, released 4 October 2022, seasonally adjusted data.

After the October RBA rate hike filters through, a great rate for owner-occupiers will be just over 4 per cent.

BUT RateCity estimate the average existing customer who hasn’t haggled with their bank recently will be paying 5.36 per cent… that’s a gap of well over 1 per cent.

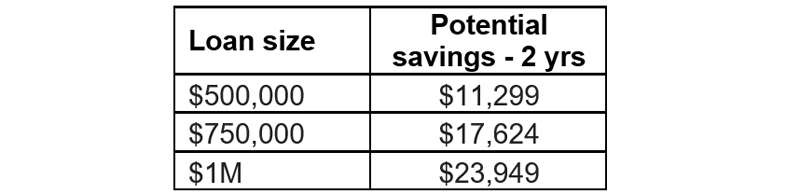

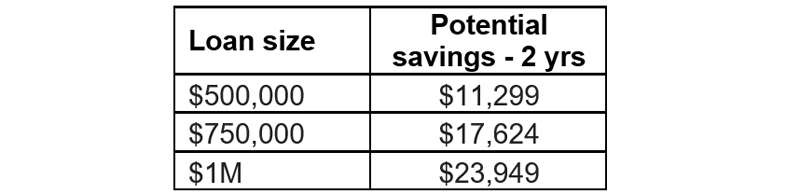

If someone with a $500,000, 25-year loan refinanced from the average owner-occupier rate to one of the lowest rates after the October hike, they could save an estimated $11,299 over the next two years, even after switching costs and factoring in more rate hikes.

The bigger your home loan, the bigger the interest savings will be

Source: RateCity.com.au. Based on an existing owner occupier on a post October rate of 5.36% switching to a rate of 4.09% including switch costs and future rate hikes.

Top tips for borrowers looking to refinance

1. Check your new rate includes the October hike

Lenders move rates at different times. If you’re looking at a rate that starts with a ‘3’ know that this bank probably hasn’t factored in the last one or two rate hikes yet. When you call, ask them what the rate will be after the October hike. The last thing you want is to sign up to a rate, only for it to go up overnight!

2. Ask the new lender to waive upfront fees

Many lenders are willing to negotiate on fees to get you to switch.

3. Beware of cashback deals

The lure of cold hard cash can be ridiculously tempting, but it’s only going to work in your favour if it comes with a good rate.

4. Avoid extending out your loan term

If you are looking to save money, don’t refinance back out to a 30-year loan. It might lower your repayments now, but you could end up paying tens of thousands extra in the long run.

5. Check how much your house is worth

Lenders give extra discounts to ideal borrowers who’ve paid down their debt. If you own more than 30 per cent of your home, you could be eligible for some of the lowest rates.

6. Check your finances

Before you refinance, check you can still pass the bank’s stress tests as you’ll need to prove you can still pay the mortgage if rates rose to over 7 per cent, PLUS you’ll need to own at least 20 per cent of your home.

Some borrowers may find it difficult to refinance as a result of rising rates and falling property prices… like first home buyers who bought recently with small deposits, plus people who’ve have had a change in circumstance (lost a job, had a baby, etc). If you have no luck with one lender, check in with others.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.