At this time every year I remind share investors that an increasing share price is not the only way to make money in equities.

The power of dividends is often overlooked by investors to their financial disadvantage. Australia has some of the highest dividend paying companies in the world. It’s also generally agreed that shares that pay dividends are more stable and resilient. So dividends offer a stable contribution to a an investment’s total return, reducing the year-to-year volatility of capital gains.

Major Australian companies are paying dividend yields of up to 11 per cent fully franked which, when you consider many fund managers are only expecting single digit returns from share prices, is a powerful addition to your returns.

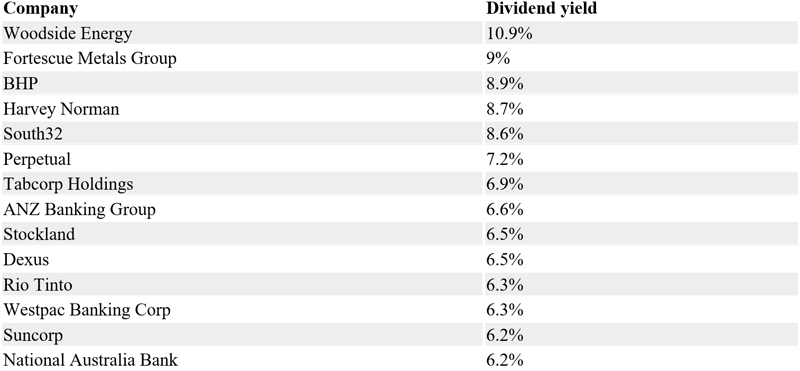

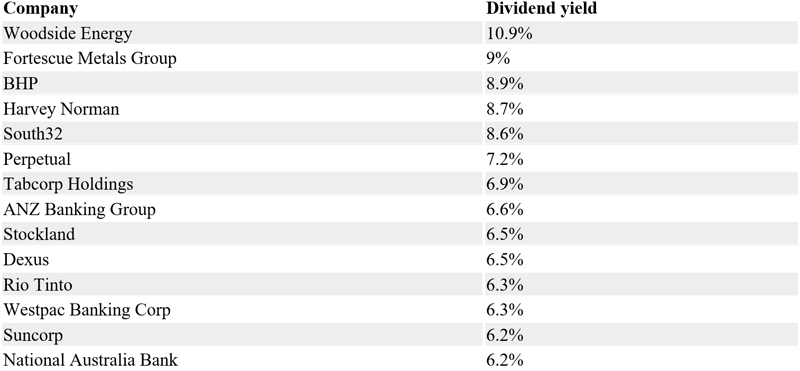

The list I’ve included are the top dividend payers amongst our 50 biggest sharemarket listed companies.

Shares that pay the best dividends

Source: ASX.com.au / ASX 50 Index

Remember, a fully franked dividend means your payment comes with a tax credit equal to the company tax rate of 30 per cent. It means the company paid its full level of company tax, so shareholders receive a tax credit with their dividend… if they didn’t it would be a case of double taxation.

A good dividend yield can often indicate a company has good cash flow, financial strength, a low share price, or a combination of all three.

While most of us follow the fortunes of our share portfolio each day via their share price movements, that dividend cheque twice a year often goes unnoticed… it shouldn’t.

With many top companies paying a dividend yield of 5-6 per cent, add the impact of franking credits and that yield can jump to an impressive grossed up 7-8.5 per cent.

During the profit reporting season, the focus of the tidal wave of results is usually on the earnings and at times the dividend policy only receives scant mention.

The theory is a top 50 company is usually blue chip and would have strong cash flow to be able to pay the dividend. But for traditional growth stocks it usually means the market has marked them down for some reason and that’s why their dividend yield is so good.

The potential is that when market sentiment changes, selected growth stocks will move up with the cycle and you’ve locked in a decent dividend yield at these prices.

Beware of the fact that while the dividend yield is good now, you have to be confident the company has the capacity to maintain dividends into the future.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending