Economists talk about much needed productivity gains and simplifying our tax system is a key part of that. The changes to the stage 3 tax cuts won’t help.

I don’t have an issue with watering down the benefits to top income earners and shifting them to lower to middle income earners – those who’ve been hit hardest by inflation and the steepest, sharpest rise in interest rates in our history.

But I do have an issue with abandoning the tax reform element which goes with it to ease bracket creep. It is an important differentiation. Economists talk about much needed productivity gains, well simplifying our tax system is a key part of that.

Bracket creep remains an issue

Bracket creep is where you get a pay rise and it pushes you into a higher tax bracket. You pay more tax and lose a bigger chunk of the pay rise because it goes to the government.

Under the stage 3 tax cuts the 37 per cent rate would be dropped altogether and anyone on an income of $45,000 to $200,000 would be on a flat 30 per cent tax rate. That would eliminate bracket creep for the vast majority of Australians.

But under the Government’s amendments the 37 per cent tax rate will stay when you get over $135,000 up until $190,000 when you jump up to the 45 per cent tax rate.

To put all this into perspective, Australia’s top marginal tax rate which currently comes in at $180,000 hasn’t changed since mid-2008. Back then that $180,000 would be the equivalent of $270,000 today when adjusted for wage rises over that time.

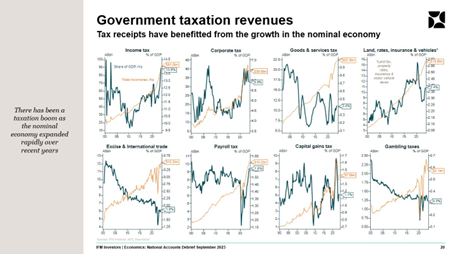

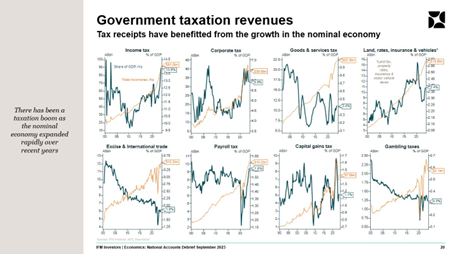

Wage earners contribute a growing proportion of government income

The big winner out of all this has been the Federal Government. Take a look at where the government’s income comes from.

As you can see, the vast bulk of it comes from you and me and our pay packets. But look at how it has grown. From under 10 per cent of GDP (the value of the economy) to 13.9 per cent now.

Bracket creep is a major reason for that, combined with low unemployment… the more people in work, earning a wage, the more tax rolls in.

Tax revenue from business is less than half that from wage earners. And other taxes earn a lot less than that.

Under the amended stage 3 plan, the cost of living relief for the average wage earner is an extra $15 a week compared with what the Coalition legislated for when they introduced the three stages.

Those on incomes of more than $200,000 will lose half their promised $9,000 tax cut. Those on incomes of $190,000 will miss out on close to $3,000 in relief, while those earning $180,000 will be about $2,200 worse off.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Australia’s top income tax rate is comparatively the highest in the world

Trending

Sorry. No data so far.