I’ve said this many times before, landlords are not the bad guys in this current rental crisis. In fact, an important part of the solution to the crisis is to encourage more people to be a property investor rather than malign them.

The crisis will be solved by Government building more low-cost rental housing, encouraging more Aussies to be property investors and, frankly, limiting the amount of Airbnb’s so there’s a larger number of properties available for long term rental rather than short term tourist accommodation.

A lot of private investors are leaving the property sector because it’s simply becoming too hard. The rights of tenants have swung too far away from the landlord and there’s now a stigma attached to being a landlord by a Government wanting to blame them for the rental crisis rather than take responsibility themselves.

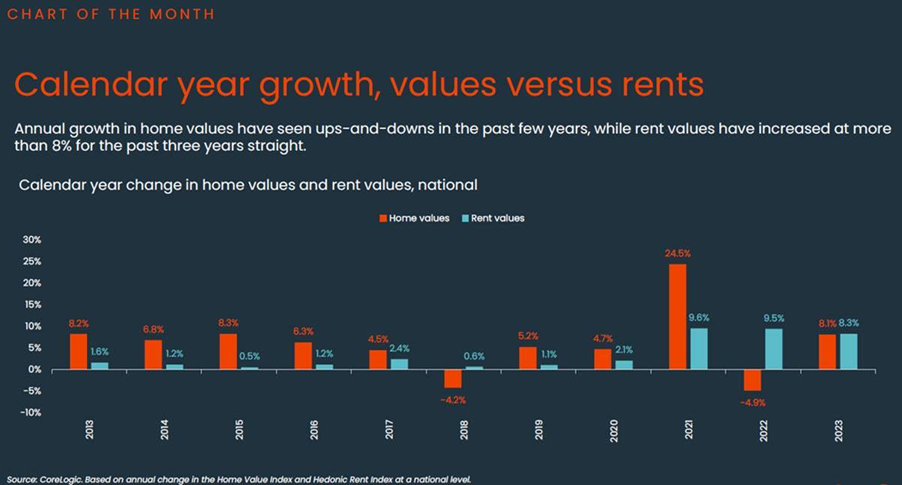

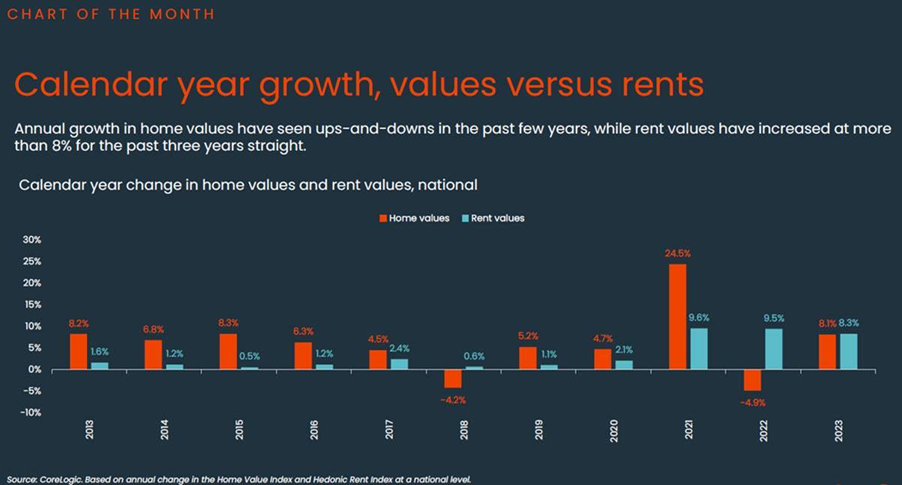

But, having said all that, now is a good time to be a property investor from an investment point of view because there are strong returns from both capital growth and income. Property research group CoreLogic’s chart of the month shows that last year rental returns were higher than the capital growth of investment properties – only the third time that’s happened in the last decade.

Last year investment property recorded 8.1 per cent capital appreciation and 8.3 per cent rental return – that’s a total 16.4 per cent. That is a terrific return and the housing and rental crisis looks as though that return could be maintained for the foreseeable future.

Here are some things to think about before becoming a property investor.

Understand your rights as a landlord

This is the scary bit. However, if you do it before buying an investment property, it can be a good test of your resolve to see whether being a landlord is for you. If not, then property investments can be made through managed property funds such as listed property trusts or property syndicates.

Make yourself familiar with the appropriate Landlord and Tenant Act in your State to fully understand your rights and obligations, as well as your prospective tenants’.

Rent out at the right time for the best price

Like anything else there is a good time to rent out your property and an even better time. The difference can mean an extra 10 per cent on the rent which will mount up over the life of the investment.

Peak renting time is late spring and early summer

This is the time when uni leavers are most likely to cut their cord with mum and dad to venture out “flatting” and when most interstate business transfers occur.

In the depths of winter there is usually a shortage of renters and therefore rents can be lower to make the property more attractive.

It also depends on supply and demand.

Choose your tenant carefully

This is crunch time. Thoroughly checking the background of tenants and ensuring all parties act responsibly is crucial. Landlords also can’t discriminate between tenants on the basis of sex or if they have children.

Your screening process should be formalised with the right application form which outlines the renter’s history as a wage earner, tenant and bill payer. It must have an area where references can be nominated and you must follow up these references. The best references to look at are from employers, bank managers and previous landlords. The biggest pitfall for any landlord is the problem tenant whose rent gets into arrears.

Get the tenant to sign a property condition report that shows you both agreed on the condition of the unit when the tenant moves in. It should include notes on things like cracked ceilings, torn flyscreens and stained carpets, and list what is in the property, e.g. chairs, fridge, cups, towels, light fittings and curtains.

If the tenant leaves before the end of the agreed tenancy, the tenant may be liable for rent until new tenants are found.

Always have your tenancy agreement in writing. Most people are pretty honest, but anyone can forget details about what was agreed.

Hire a good handyman

If you don’t hire a good handyman, you will more than likely kiss your free time goodbye. When something goes wrong at a property, many tenants will simply fix it themselves, but other tenants will be less cooperative and you’ll need someone to take care of maintenance.

If you are a real handyman and enjoy pottering around, then you may be able to do all this yourself. But if not, you’ll need an outside handyman to do the odd jobs but make sure their prices are competitive.

There are all sorts of horror stories of landlords being slugged $100 to change a light globe by a maintenance person, so make sure you find someone reasonable.

Don’t scrimp on repairs

The look and condition of a rental property is a big factor in determining what rent can be charged, so it is imperative your property is kept in good nick.

Remember that maintenance expenses can be offset against rental income for tax purposes. If the bathroom needs fixing, do it right away as it will pay off in the long run.

Don’t forget insurance cover to protect you from the unexpected. There is specific Landlord Insurance available for investment properties.

Many investors buy home units or townhouses because the maintenance of the common areas is the responsibility of the corporate body.

Find a good property manager

As you can see, being a landlord isn’t a simple matter. If you have the time, the application and follow the rules above, you should be okay. If it all sounds too daunting and complicated, let a good local real estate agent manage your property for a monthly percentage of the rent.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Want to become a property investor? 6 simple steps to becoming a landlord

Trending

Sorry. No data so far.