I know this isn’t very romantic, but have you ever lied to your partner about how much something cost or kept a financial secret from them?

You’re not the only one, with new research revealing we’re a nation of financial cheaters.

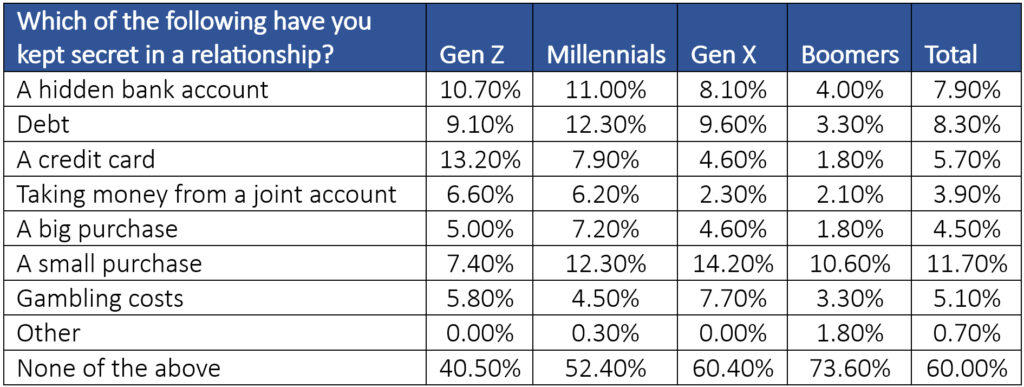

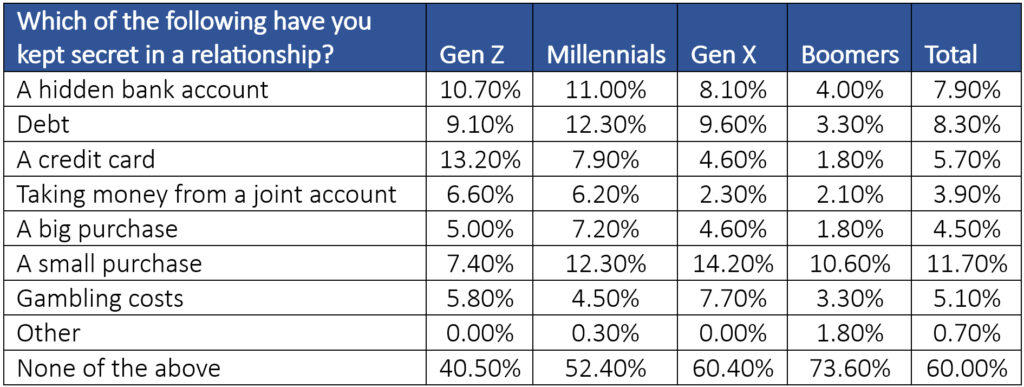

According to a recent Compare the Market survey, almost a third of Australians have confessed to keeping financial secrets from their significant other (31.2 per cent).

More than one in 10 admit to making small purchases without their partner knowing (11.7 per cent), 5.7 per cent have a secret credit card and 5.1 per cent gamble without their partner knowing. Meanwhile, 8.3 per cent have a secret debt, and 7.9 per cent have a secret bank account.

Lying to your partner about finances is a red flag. Whether it’s hiding small clothing purchases or keeping quiet when you lose big on a bet, financial infidelity comes in many shapes and forms.

While it’s most often in the form of minor purchases, there’s also a more serious, damaging level of financial infidelity. That’s when people have secret credit cards, take out loans to make risky investments or hide sources of income.

While couples need to have some financial freedom and independence, people in a healthy relationship won’t keep big financial secrets from each other.

Lying about finances can even be considered a sign of financial abuse in a relationship.

Source: Compare the Market. Survey conducted with 1005 adult Australians, November 2023.

Millennials have the most secrets

The age group that admitted to keeping the most financial secrets were Millennials, followed closely by Gen Z. Millennials were most likely to have a hidden bank account, debt and make a big purchase without telling their significant other.

Meanwhile, Gen Z were more likely to take money from their joint account and have a secret credit card.

The age group most likely to have a secret gambling debt was Gen X.

One of the keys to a successful and healthy relationship is to be transparent about money. It’s important to be open and honest about your finances.

It’s okay to disagree on some things. But you should clearly outline your money goals and divide up the financial responsibilities. Whether it’s opening joint accounts, paying the rent or mortgage, insurance or energy bills, it’s the responsibility of both parties.

Financial infidelity red flags

Look out for the following red flags in a relationship:

-

Your partner’s spending is inconsistent with their income

-

You know nothing about their finances… and they insist on handling everything alone

-

You notice your bank balance has fallen suddenly

-

Hidden purchases: secretly buying items or services and not disclosing them

-

Hidden debt: concealed debt, loans, betting apps, credit cards and loans

-

Stashed cash: keeping physical cash hidden

-

Hidden assets: not disclosing assets such as property or shares

-

Lying about income: inflating or deflating what they earn

-

Making big financial decisions alone: selling assets, incurring debt or making a large investment without your knowledge

-

Hiding financial documents or faking financial documents

-

Using money to manipulate or control you

-

Money goes missing from your wallet

-

They aren’t willing to talk about money with you

-

They aren’t willing to do a credit check with you

What you can do

If you notice any of the above red flags, calmly talk to your partner about it. It’s never okay for someone to take away your access to money, manipulate your financial decisions, or use your money without consent.

You don’t have to have the same spending styles, but there should be some clear ground rules. Each person needs a level of discretionary spending for which they’ve got the freedom to spend on their hobbies and gifts.

But if your partner is lying about money, there’s a good chance this will seriously undermine the relationship.

Financial abuse can happen to anyone, and it can leave you feeling vulnerable and on edge. If you or someone you know is experiencing financial abuse, free and confidential help is available.

Financial infidelity isn’t just about money… it’s about honesty, trust and communication.

Family Relationship Advice Line is free to call on 1800 050 32.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Financial abuse is insidious and rampant – take steps to protect yourself

Trending

Sorry. No data so far.