If we had to mention a single commonality between investing and gambling, it would be that both contain an element of risk. But that’s where the similarities end.

The high-stakes action of GameStop, an American chain of video games stores, triggered users of the internet forum Reddit (r/wallstreetbets) to make headlines earlier this year. This had its positives because it drew an unconventional crowd into the world of investing.

What happened with GameStop

In January 2021, users on Reddit’s forum WallStreetBets fostered the belief that GameStop, a retail chain which was struggling due to the up-rise of digital distribution services, was significantly undervalued.

GameStop’s shares were being bought short – a strategy whereby investors or short-sellers target falling stocks to gain a profit. This occurs when short-sellers borrow stocks from a broker and immediately sells them, hoping the price of the stock will fall. They can then buy the stocks back later for a lower price, return the borrowed stocks to the broker and pocket the difference.

Users of the forum rallied to purchase even more GameStop shares to drive up the share price value and expose short-sellers.

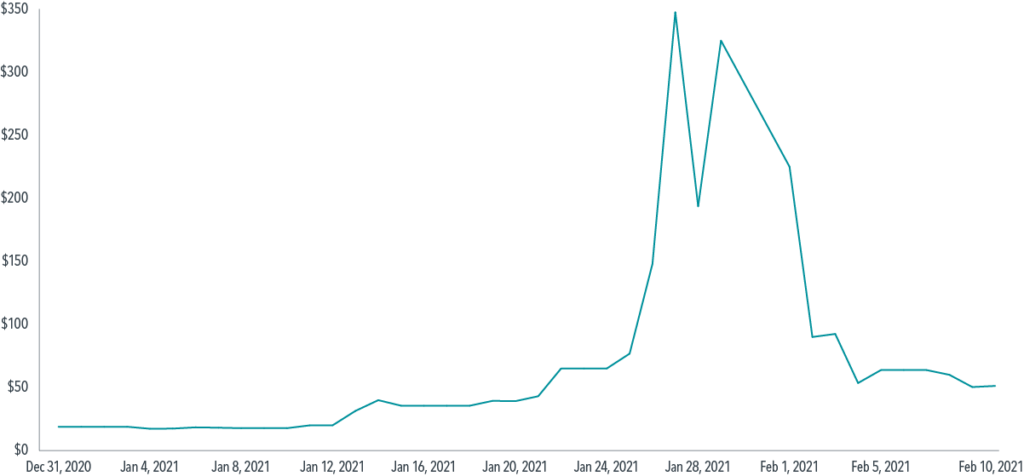

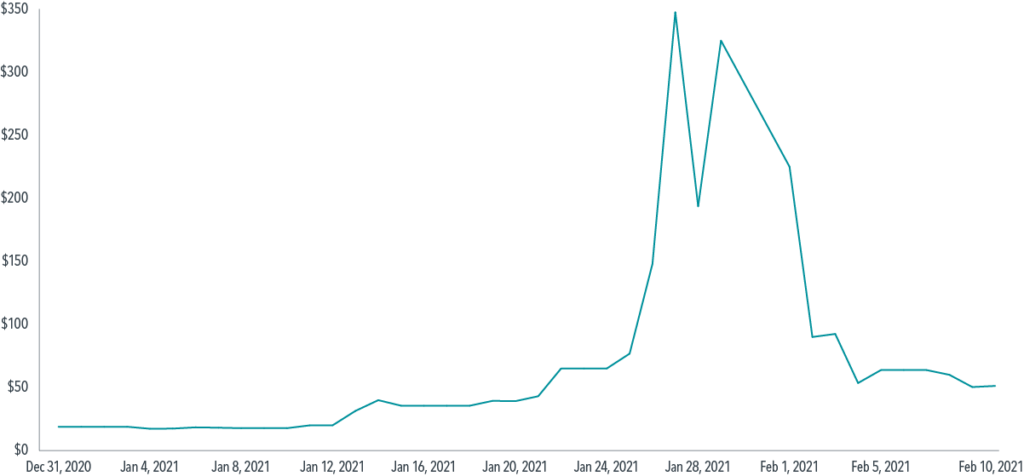

As a result, at the end of January 2021, GameStop shares went up almost 30 times to $350 USD per share.

Less than a week later, the share price dropped by 80%.

GameStop Closing Prices from 31 December 2020 to 10 February 2021

Source: Dimensional Fund Advisors

Investing is a long-term game

Gamestop’s highs and lows emphasise the importance of investing for a consistent, long-term solution. There is high volatility in placing all your eggs in one basket – or one stock.

Individual stocks are one of thousands of options. Trying to ‘pick a winner’ is like betting your hard-earned savings in a casino – while you can win big on a single bet, the odds are against you when it comes to picking the right stock and also at the right time.

Empirical data tells us that you’re better off betting with the whole market, rather than on individual companies. Through a low-cost, highly-diversified portfolio, investors can grow their investments by letting time and compounding interest do the work.

Investing and gambling are therefore very different

Investing is fundamentally different to gambling in the following ways.

Time and patience

Investing requires time and patience. It’s a long-term process that requires you to stay-put, ride out the bumps and trust in the market to provide you with higher than cash returns over time.

Investing for the long-term teaches you to block out media noise and put aside certain emotions. You simply follow your plan to achieving your goals. Gambling tends to ride your emotions and short-term impulses, which can be very detrimental to your wallet.

Diversification

Spreading your money in a variety of asset classes is typical of an investor striving for long-term success.

Diversification and cushioning mitigate any potential losses is a strategy that helps you prepare for any market downturns.

When you’re gambling, there’s no loss-mitigation strategies; if you don’t win you can end up losing all of your savings.

Information

With investing, increasing your odds of winning requires knowing the right information to help you make educated and informed plans.

It involves making sound decisions based on good research that have a high likelihood of success.

By contrast, gambling often entails little to no research or information. If you sit at a roulette table in a casino, you have no idea what happened the day or week or month prior (nor does it really matter as neither a plastic ball nor a spinning disc have a memory).

Investing and gambling approach risk differently

Investing and gambling use very different methods to try to increase your money. One is systematic and aims for the long-term, while the other does not. Investing behaviour is risk-averse, while gambling behaviour is risk-seeking.

The question comes down to this: on the spectrum of risk, what can you afford to lose?

The GameStop incident serves as an opportunity to highlight the importance of investing in a diversified portfolio, rather than on a few concentrated stocks that risks losing your entire wealth pot.

This is an edited version of an article that originally appeared on Align Financial and is republished here with permission. This article contains general information only. This should not be relied on as independent finance or tax advice. If you are after specific professional advice, speak to your registered tax agent/financial advisor or reach out to Darren at Align Financial.

Trending

Sorry. No data so far.