Investing for the long term is all about getting the trend right.

While the Australian sharemarket finished 2023 at near a record high (and who would have predicted that at the start of the year… or even as recently as October), this chart from one of my favourite analysts Carl Capolingua shows it is part of a strong, long-term trend.

Source: X / @CarlCapolingua

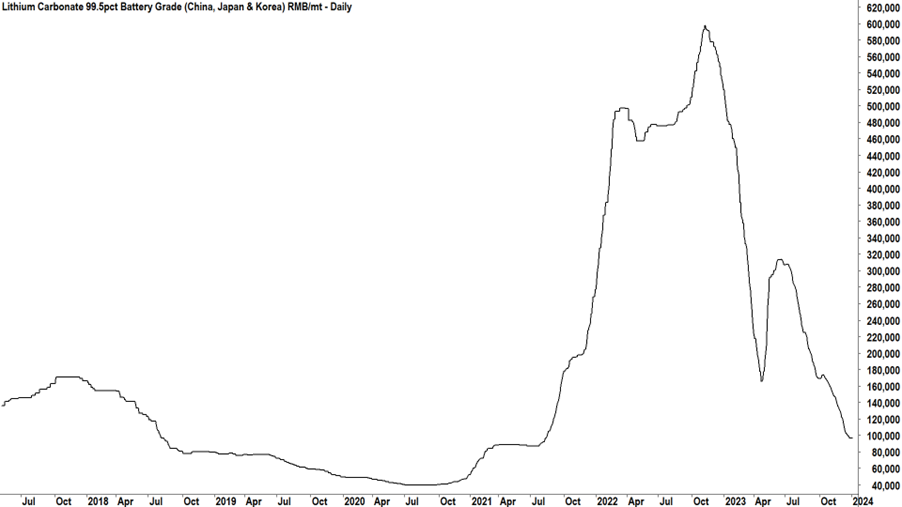

But within those long-term trends there are plenty of short-term investment bubbles which come and go over time. In the recent couple of years one such bubble has been lithium whose commodity price reached stellar levels based on the future demand for electric vehicles (EV) and the need for lithium in producing their batteries.

The lithium theme ignited the share price of most Australian lithium producers and explorers. Values reached ridiculous levels even for explorers who were just sitting on deposits and weren’t even close to developing a mine to dig the stuff out of the ground and earn revenue.

It’s a great example of how commodities move in cycles up and down. So as an investor, knowing where you are in the cycle is critical.

You see, when a commodity is “hot” it attracts even more suppliers who are chasing those higher prices. More explorers find more deposits and more companies open mines. In the end, there is an oversupply of the commodity and prices fall.

It happens time and time again.

Look at this lithium price commodity chart and you’ll see what I mean – a classic commodity cycle.

Source: X / @CarlCapolingua

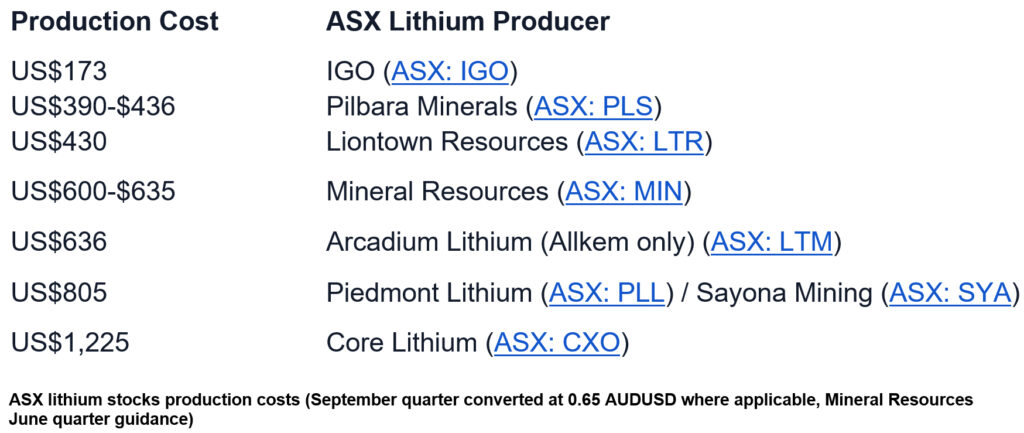

The question then becomes who can mine the commodity at the lower price and still make a profit.

Last week the sharemarket was shocked when one of the previous investment darlings of the lithium sector, Core Lithium, said they were pausing plans to develop their lithium mine in the Northern Territory because their cost of production was higher than the price they could sell it for.

The news rocked investor confidence in lithium stocks and brought their focus back to a traditional investment principle: being able to produce something at a profit.

This data from a story in The Australian newspaper underlines the point. Investment themes are one thing but reality is bringing the product to market.

Data source: The Australian

Core Lithium’s cost of production was a lot higher than its competitors who would have a competitive edge as the cycle turned.

Which brings me to the current hot commodity theme: uranium. This week the share price of the market’s favourite uranium stocks (Paladin, Boss, Deep Yellow) reached all-time highs.

The theme is that if countries have any hope of reaching their climate change targets, uranium will be needed in nuclear power stations to produce base load electricity and replace coal. As a result, demand for uranium will surge. A bit like what lithium would do because of EVs.

This is the chart for the uranium price. Looks familiar? No wonder the value of uranium miners and explorers are at all-time highs. And as the chart shows, it has happened before, 12 years ago.

Source: TradingView

Look, I have no idea whether the world will build more nuclear power stations but, here’s the thing, there is a lot of uranium around. The world’s biggest uranium mine is BHP’s Olympic Dam in South Australia which is in mothballs.

The danger is that if there is a big pick up the demand, there is plenty of supply which can be brought out of mothballs to meet it.

Beware the commodity cycle.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Index investing can have a big impact on your share investments

Trending

Sorry. No data so far.