If you’re like most people at the moment, you’re probably sick of hearing about the cost of living crisis and endlessly rising interest rates. Here’s one actionable solution to help put more money back into your pocket.

Retirement might not be top of mind for you right now, but the good news is you can get a nice little cash injection without even barely lifting a finger.

Yes, you can earn cashback rewards straight into your super every time you shop for groceries, or book your holiday accommodation.

Recognising that superannuation contributions were so often being neglected by anyone who isn’t receiving automatic payments from an employer, entrepreneur Pascale Helyar-Moray founded Super-Rewards, encouraging everyone to take an active role in managing their retirement savings.

Speaking to Your Money & Your Life, Pascale shares the unexpected benefits that anyone across Australia could be taking advantage of.

From little things big things grow

With costs rising everywhere, the idea of regularly contributing a portion of your earnings to an untouchable fund is often the last thing we have time to think about.

But, like sunscreen in the Aussie summer, reaping the benefits of your super requires consistent legwork, and when it comes to starting, the earlier the better!

“Superannuation is intangible, it’s not like a house where we can literally see or touch the asset or a bank account or a share portfolio. We often feel distanced from our superannuation, yet for many, it may be their most important asset,” Pascale tells YMYL.

That distance felt between an individual and their super only grows when regular employer contributions are taken out of the equation.

“Certain groups of people, such as stay-at-home carers, casual workers, those in between jobs, and anyone who’s had changes in their work or life situation, may have difficulty accruing super,” Pascale says. “With the rise in inflation and the cost of living, it is essential for everyone to plan their retirement.”

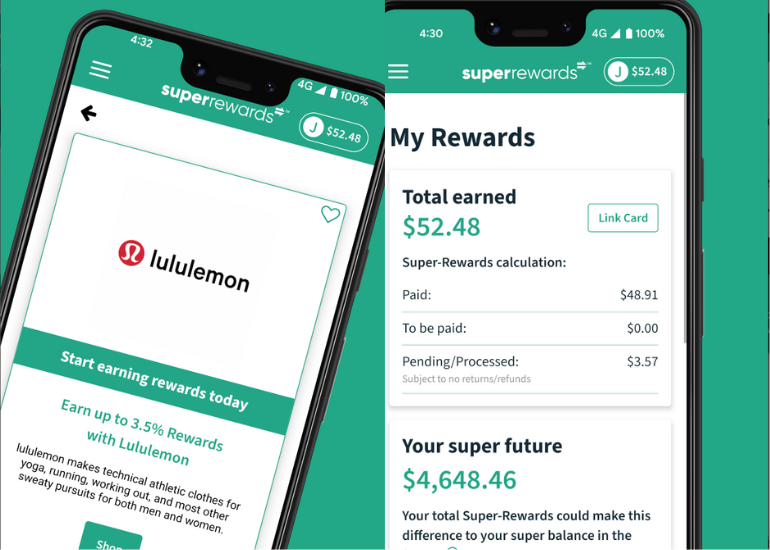

With Super-Rewards, the idea is that anyone can effortlessly earn super without having to actively change anything. It’s a ‘set and forget’ rewards program where a percentage of the value of any eligible purchase you make is paid straight into your superannuation fund by the retailer, whenever you shop with participating retailers.

This is the key difference between Super-Rewards and other cashback programs.

Preparing for retirement has never been easier

Super-Rewards simplifies the process of super contribution, removing ‘choice’ in terms of how and where to spend the rewards. The structure makes it easier for anyone to make contributions towards future retirement savings without impacting your overall cash flow.

So how does this actually play out? Whether you’re updating your wardrobe, stocking your pantry, buying house supplies or booking your next getaway, you could be contributing to your future security.

Essentially, the service offers peace of mind, making it easier than ever to prepare for retirement.

“The hidden beauty of Super-Rewards lies in its simplicity, as all cashback is deposited into your super fund without any need for decision-making. It really is set and forget,” says Pascale.

The brands you can get cashback rewards from are the brands you’re likely shopping with anyway: Apple, HP, Lenovo, The Iconic, The Good Guys, Big W and many more.

From home supplies to your weekly groceries, all eligible purchases can contribute to your super without you even having to think about it.

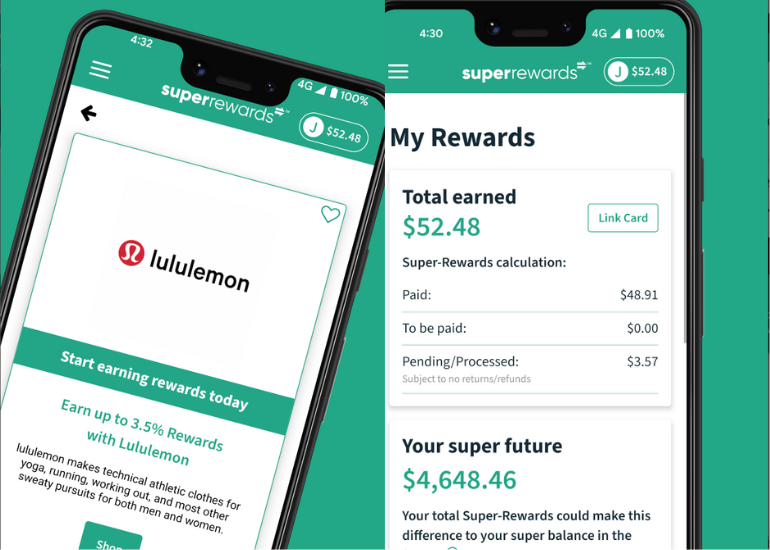

With the Super-Rewards app, it’s easier than ever to keep track of and watch your super grow. Image: Supplied.

The benefits you just can’t ignore:

You can effortlessly earn super every time you make an eligible purchase.

Whether you’re shopping online, using the app, or visiting in store retailers, you’ll be swiftly rewarded with cashback into your Super-Rewards account. With hundreds of retailers and services on offer, you could be growing your retirement fund every time you shop. It’s a no-brainer for people who want to get the most out of their money.

Super investments usually earn better returns than bank savings accounts.

When you make a purchase through Super-Rewards, you’re diversifying your potential to grow your retirement savings. The award-winning and industry-recognised platform is compatible with any Australian super fund or SMSF. It’s completely free to join, with no upfront fees or other hidden costs.

Sign up for Super-Rewards and receive $10 credited to your Super-Rewards account. All you need to do is use the code SUPERSUPER when you sign up and spend $150 before 31 August 2023.

*Excludes eBay, Kogan, Chemist Warehouse, AMART

To start earning super with every eligible purchase, sign up in less than a minute, or download the app today.

This article is brought to you by Your Money & Your Life in partnership with Super-Rewards.

Feature image: AdobeStock

Trending

Sorry. No data so far.