Sydney property has better investment potential than Perth property – right?

I’ll declare my bias up front. My daughter and son-in-law moved to Perth as the pandemic started and have been looking to buy after renting for a few years. They have a townhouse in Sydney and the family discussion has been around the usual questions: should you keep the Sydney property and continue renting? Or buy in Perth on a smaller scale and keep Sydney? Or sell Sydney and buy big in Perth?

We have all been there. This is part of life for a mobile family and workforce. And, of course, there are lots of individual factors to take into consideration, such as whether the move is long term, the size and ages of the family, etc, etc. No one answer fits everyone.

The instinct is to keep the property in Sydney as it’s the biggest residential market and has always shown strong growth. It has this aura of leading the national property market. So it must have the best investment potential.

Or does it?

Perth has higher gross rental yields

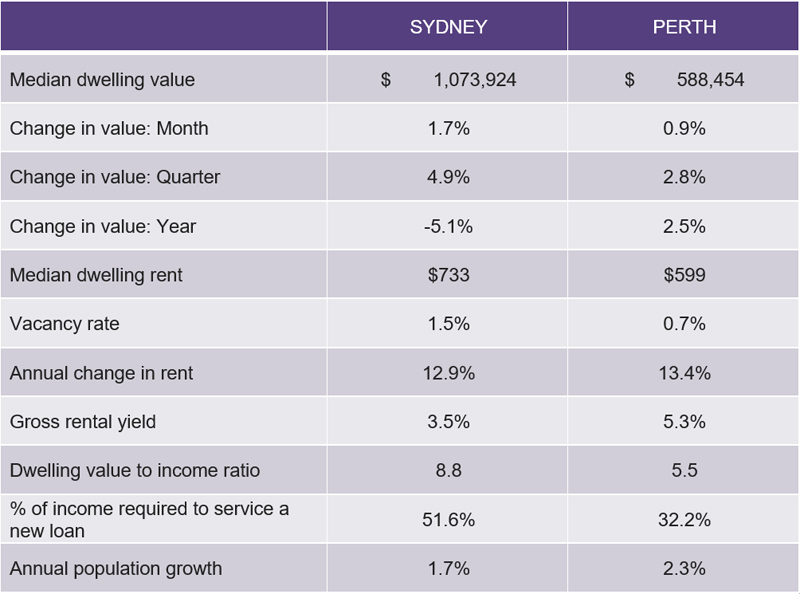

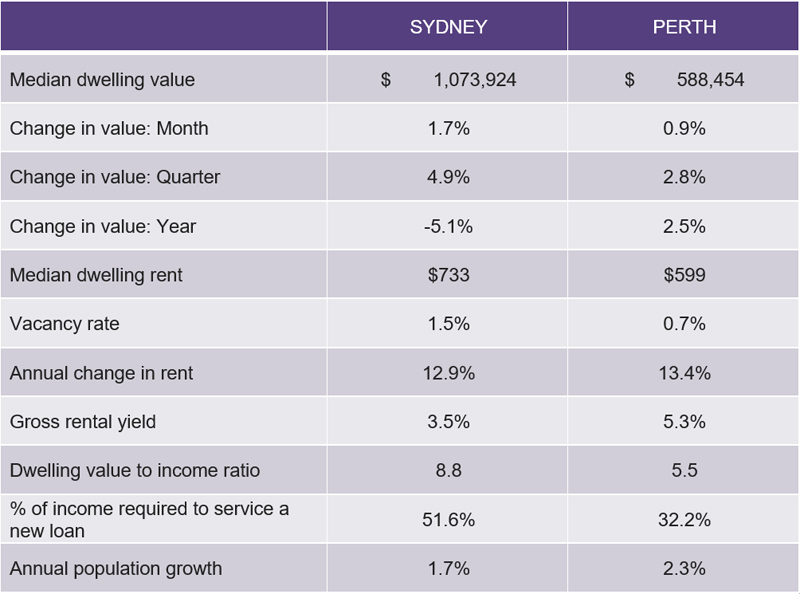

That’s why I was naturally interested in the recent CoreLogic comparison of Sydney versus Perth for property investors.

According to Australian Bureau of Statistics lending indicators, at a state level NSW is receiving the bulk of the interest, with investors accounting for 38 per cent of the value of new mortgage lending across the state.

At the other end of the scale, only 24.5 per cent of mortgage commitments were for investment purposes across Tasmania and 28 per cent in Western Australia. But while Perth has a lower portion of investment activity, it has the highest gross rental yield among the state capitals, at 4.9 per cent. And arguably some of the best prospects for capital gains.

Perth has a lower entry point

The entry point to the market in Perth is also more achievable, with home values recording the lowest median dwelling value of the state capitals and prices proving to be pretty resilient through the rate hiking cycle so far… In fact, Perth is the only capital city where housing values have recovered to a new record high.

According to CoreLogic’s Tim Lawless, the fundamentals suggest Perth is a location that presents one of the best investment opportunities around the country. And yet investors aren’t very active in that marketplace.

Investors are more active in NSW, where rental yields are the lowest of any state and in Sydney the lowest of any capital city. The buy-in price is significantly higher, and arguably the prospects for capital gains could be less significant when you consider the affordability challenges across the Sydney marketplace.

It could be because of the herd mentality of investors that Sydney always appears to deliver strong property return. Or investors could be wary of the historic boom/bust cycle of Perth.

Who knows.

Source: CoreLogic, ABS, ANU. Dwelling values and rents as at June 2023, dwelling value to income ratio and income required to service a loan as at March 2023, population growth as at December 2022.

Another good options for investors

According to Tim, the Perth market could be a strong option for investors, as is the southeast Queensland housing market, due to strong fundamentals like higher rental yields, a lower buy-in price, and rapid rate of population growth driven by overseas and interstate migration. Both Western Australia and Queensland have strong interstate migration, which tends to drive purchasing demand; while the strong overseas migration of other states tends to be toward rental demand.

If you’re looking for capital gain, Sydney and Melbourne do have a stronger history of capital gains, but they’re also relatively expensive, which could dampen capital gain opportunities going forward.

The other downside is a very low gross yield profile, with Sydney dwellings returning a gross yield of 3.1 per cent and Melbourne a gross yield of 3.5 per cent.

If you’re looking for the best of both worlds, again, Perth and southeast Queensland have a higher yield profile but also, arguably, stronger prospects for capital gains. Especially considering their healthy mix of housing demand from a blend of interstate and overseas migration, along with more affordable housing prices relative to the largest capitals.

5 foundations to building a property portfolio

1. See a mortgage broker

As well as assessing your finances, a mortgage broker will help you work out your property investment goals. They will then work to find the best finance options to suit your needs and situation.

2. Assess your financial needs

Bear in mind that wealth from real estate investing is generally a long game. Unless you’re particularly handy with a hammer, residential properties are mostly not a high-yielding, short-term investment. It’s long-term capital appreciation of assets and the ability to borrow against this equity that leads to the best returns.

3. Research investment location

As outlined here, the most obvious place to invest is not always the right place. As for the ‘right’ property, it’s the one that best suits the demographic in the area you’ve chosen. Speaking to local real estate agents and property managers will help you understand the local market.

4. Know your alternatives

There are other options besides buying a property to rent out under the traditional model. One example is becoming a short-stays accommodation host via websites like Stayz and Airbnb . These can provide good rental returns that can be higher than traditional long-term renting.

5. Don’t fall victim to analysis paralysis

If you’re not careful, researching possibly locations and properties can quickly become your life’s work. You’re spending shedloads, so you definitely want to get it right, but you don’t want too much information either. Take it slow and steady, but do move forwards.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.