It may not feel like it but, it’s official, the average Australian has never been richer… on paper at least.

Before I go through the figures, I should point out that Aussies are asset rich but cash poor. The value of their superannuation and houses have skyrocketed, but not their wages. That’s why you don’t feel rich. You can’t eat or spend your super or house unless you sell it.

The average wealth of each Aussie household rose 4 per cent in the March quarter and 15 per cent over the year to be worth a record $492,000. That’s the strongest annual gain in 11 years. Of that 15 per cent annual gain, rising share prices accounted for 8 per cent and strong property prices 4 per cent.

Australian households held record levels of cash and deposits and record amounts invested in shares. Interestingly household debt only rose one per cent in the quarter, so wealth was up 4 per cent for the quarter and debt by 1 per cent. That’s a pretty good result.

The bottom line is not only that higher wealth could lead to higher spending, but overall economic growth could be stronger than expected as well. And that could mean higher demand for workers, higher wages and higher prices.

What a year. The best in a generation.

To be really frank, if you didn’t make money in the last financial year, then there was something seriously wrong.

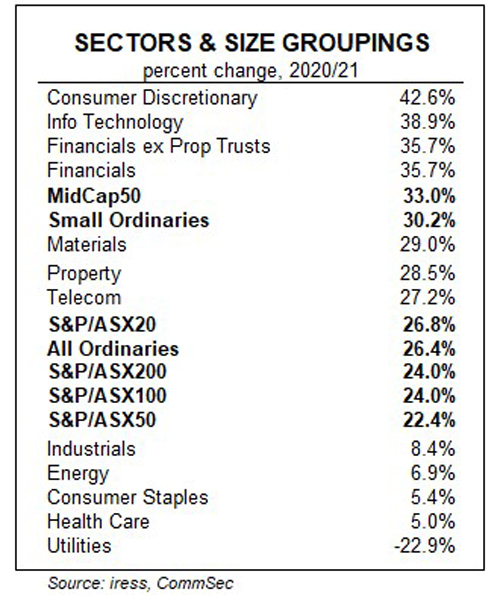

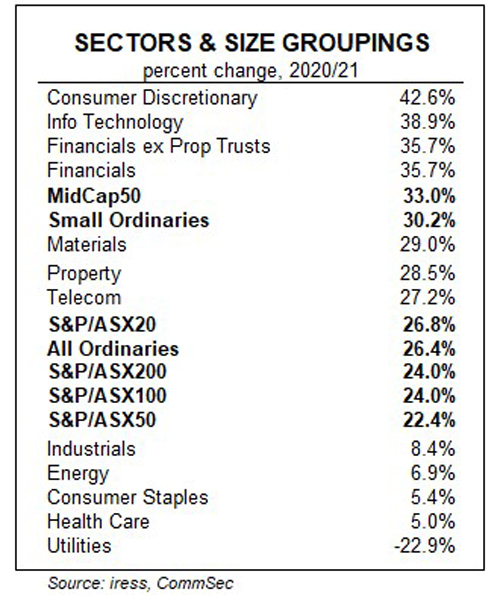

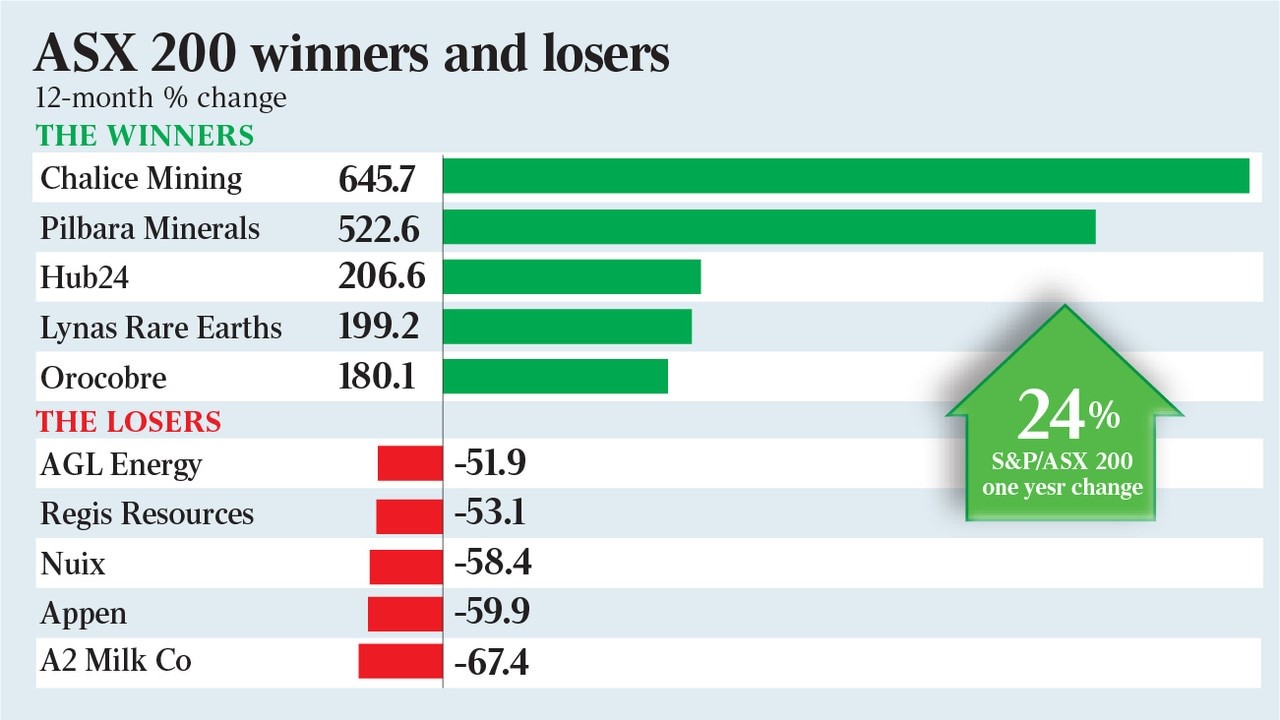

The Australian sharemarket rose 26 per cent over the 12 months to the end of June, which was the best annual performance since 1987. That’s just share price rises. Add in dividends paid to shareholders and it’s a total 30 per cent return. The 200 biggest Australian companies produced an average record return of 24 per cent.

In terms of the sectors which performed the best, it was led by consumer discretionary stocks like retailers, food and auto stocks, followed tech stocks.

When it comes to individual stocks, if you’d invested in nickel and copper explorer Chalice Mining you’ve multiplied your investment 6 times over the year. Lithium miner Pilbara Minerals produced a 500 per cent return while financial group Hub24’s share price rose 200 per cent.

They were the winners among the top 200 stocks listed on the sharemarket. At the other end of the scale, the biggest losers included one of the previous year’s big winners… A2 Milk. The powdered milk/infant formula group has been a casualty of the trade war with China which was its biggest export market. Its share price dropped 67 per cent over the 12 months.

Tech stocks Appen and Nuix were also horrible performers.

And booming property prices made for investor nirvana

This is what I mean about investors never having it so good. Booming shares AND property prices.

According to research group CoreLogic, National Home Values rose 13.5 per cent for the financial year. That’s the best result since 2004. Houses rose 15.6 per cent and home units 6.8 per cent.

Darwin maintained the highest annual rate of growth across the capital cities, increasing 21 per cent in value over the financial year. This was followed by Hobart at almost 20 per cent. But all capital city property markets recorded double digit growth.

Across regional Australia, regional NSW had the highest annual growth in dwelling values at 21 per cent, just ahead of regional Tasmania.

Data source: CoreLogic RP Data Daily Home Value Index: Monthly Values – 30 June 2021

Your superannuation has also boomed this year

As I’ve said, your superannuation is such an important part of your personal wealth. The performance of your super fund is more important now than ever.

Let me tell you, in the last 12 months your retirement nest egg has done very nicely indeed.

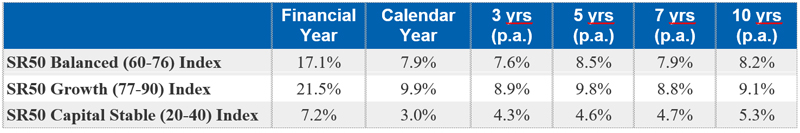

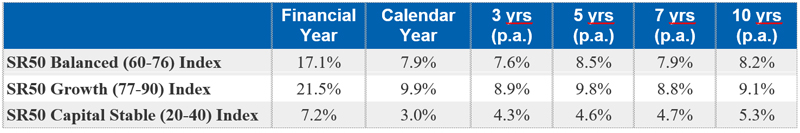

According to research group SuperRatings’ forecasts of performance for June, the median balanced option rose an estimated 1.2 per cent over the month. The median growth option rose 1.6 per cent and the median capital stable option delivered an estimated 0.5 per cent return.

Over the 2020-21 financial year, the median balanced option is on track to deliver a return of 17.1 per cent, the second highest figure since 1992 when compulsory superannuation was introduced.

The key drivers of this result have been a rapid recovery in domestic and global sharemarkets since falls of 20-30 per cent at the outset of the pandemic, and strong listed property returns.

Accumulation returns to June 2021

Source: SuperRatings estimates

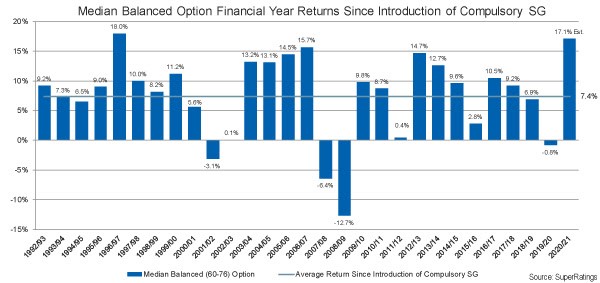

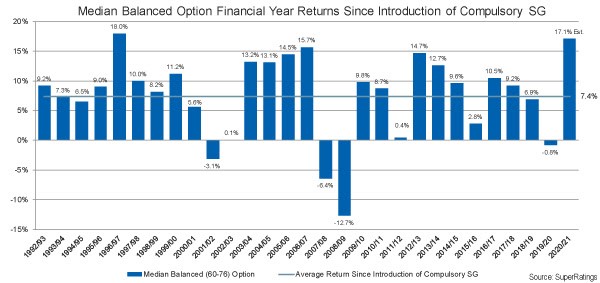

The chart below shows the return on the median balanced option over each financial year since the inception of the superannuation system.

Source: SuperRatings

Since 1992, the benefits delivered by super funds are clear, with an average return of 7.4 per cent each year. This is over two per cent per annum ahead of fund objectives and demonstrates the value added to everyday Australians over the long term.

The way funds have weathered the COVID storm also shows the resilience of funds’ portfolios, as well as the levers they have in place to protect members when the market ride becomes bumpy.

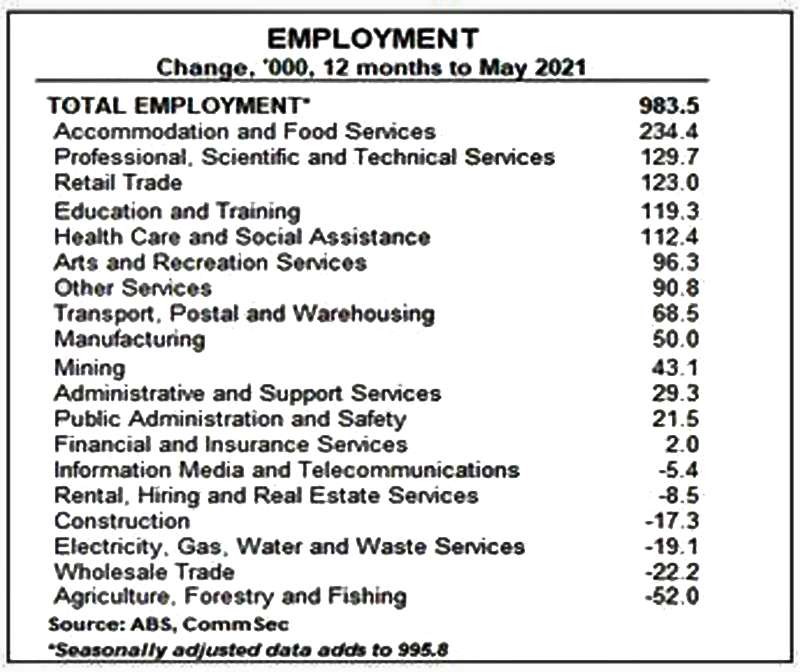

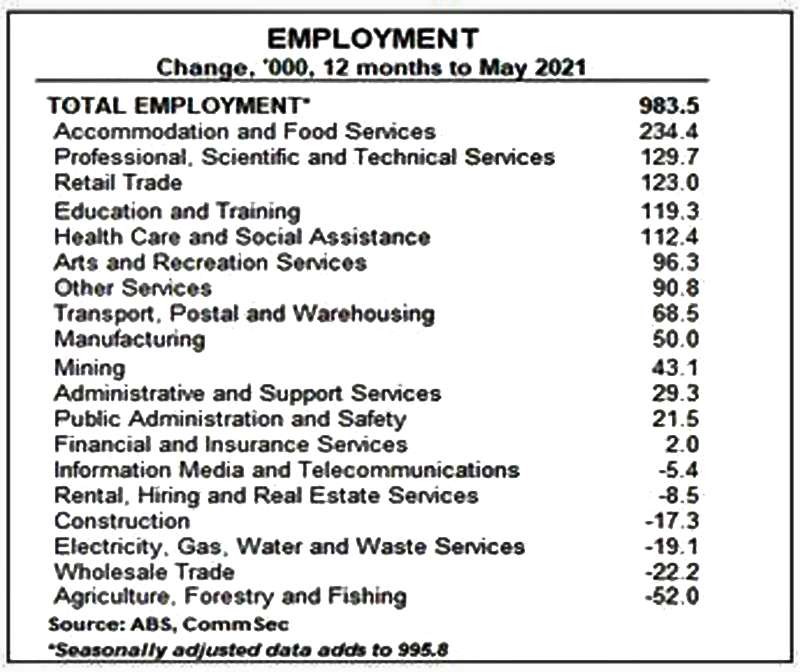

Jobs have also been booming, but where have the new jobs been?

Since May last year a whopping 983,000 jobs have been created. While many of these would have technically been “returning” jobs after lockdown stand-downs, it is still interesting to see where the growth has been. And it’s worth noting that more people are in work now than before COVID hit.

While COVID restrictions and border closures have hit the hospitality sector particularly hard, the Accommodation and Food Services industry added 234,400 jobs over the year.

And well over 100,000 jobs were added in the Professional, Scientific and Technical Services, closely followed by Retail Trade, Education and Training, and Health Care and Social Assistance industries.

Source: CommSec Economic Insights, May 2021

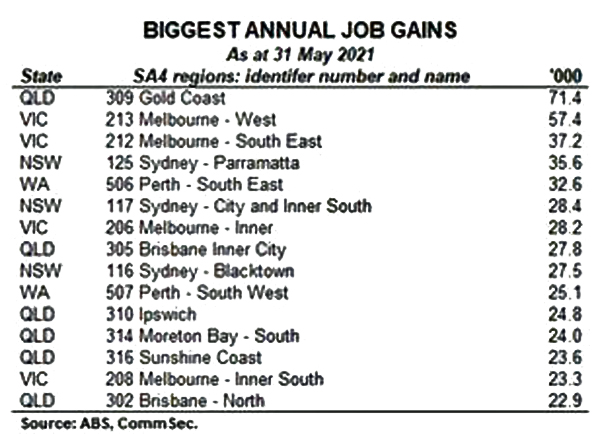

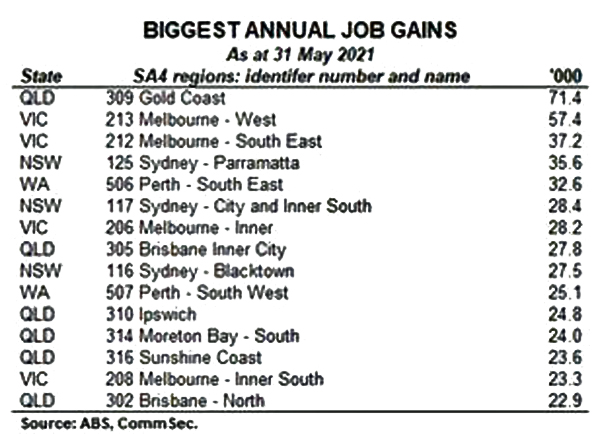

In terms of where these new jobs are located, the Gold Coast was the star performer adding 71,000 positions. In fact, six Queensland local government regions made the top 15 regions for annual employment gains, with four Victorian regions also recording strong job gains.

Source: CommSec Economic Insights, May 2021

In all, it’s been a very good financial year indeed. Let’s hope we’ve all got our ducks in a row, ready for the new one. If you feel like you need a refresher, here are a few places to start:

Trending

Sorry. No data so far.