While credit card debt has been significantly reduced over the past few years, 28 per cent of credit card users say they wouldn’t be able to manage their finances without one. So, what can you do to manage your credit card better?

RBA figures show that Australia’s national credit card debt clocks in at over $20 billion dollars, with the average standard credit card interest rate siting at a whopping 19.94 per cent.

Mind you, a poll by independent research agency fiftyfive5 commissioned by Defence Bank found that 1 in three Aussies don’t know what interest rate they’re paying on their credit card anyway.

Which is mind-blowing when you consider the fact that banks charge 20 per cent interest to borrow money at a time when the RBA official cash rate sits at 0.10 per cent, mortgage rates are below 2 per cent and savings rates are dismal at less than one per cent for most banks.

An “unreasonable and unfair burden”

In April this year, Victorian Treasurer Tim Pallas wrote to the federal government recently saying that “the banks really do need to amend their behaviour” on credit cards. He called on the government to investigate the option of mandating a maximum margin between the cash rate and the interest on credit cards.

The Victorian government was backed by the Finance Sector Union who confirmed that bank employees despise selling credit cards. “It really is open slather when it comes to the credit card market, where interest rates fail to reflect the cash rate,” said Finance Sector Union State Secretary Nicole McPherson.

Pallas’ letter was inspired by Reserve Bank Governor Philip Lowe, who expressed “frustration” in February about the high interest rates on some credit cards and urged people to find “better products”.

Incidentally, current rules in place cap the maximum interest rate at a ridiculous 48 per cent. So the banks probably think they’re giving people a fair go.

No movement on interest rates since then

Since Pallas sent his letter, precisely nothing has been done. Which once again puts the onus on individuals to manage their credit card debt. Not the banks to make it fairer for people to do exactly that.

The awful truth is that the people trying to pay down high credit card debt can afford it the least. But there are ways to get out of the credit card quicksand.

Here are my top tips to manage your credit card debt better and get rid of it as quickly as possible.

A strategy to manage your credit card debt better

1. Rework your budget

Look at your spending habits to work out where you can make easy cuts to save money.

Those savings can then be used to reduce your debt quicker. Once the card is paid off, you’ll be able to put the money you were paying your credit card down with towards supercharging your savings.

2. Repay more than the minimum

If you only make the minimum repayment each month, you’ll get nowhere.

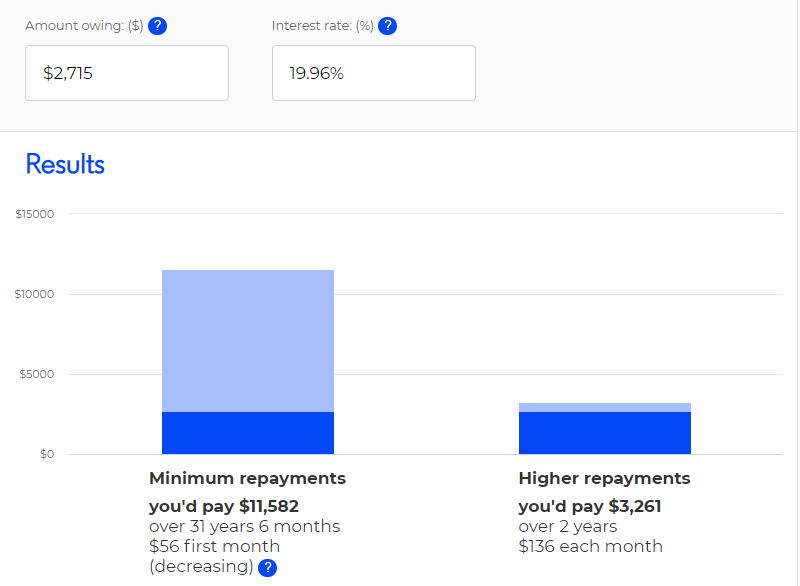

I’m serious… it would take you over 30 years to pay off the average Australian credit card debt of $2,715 making minimum repayments.

Of course, that’s exactly what the banks want you to do. So don’t be a sucker.

Pay as much as you can above the minimum every month to manage your credit card better and ditch your debt as quickly as possible. In the above scenario, paying an extra $80 a month means you’d pay the balance off in two years and save yourself a huge $8,321 in interest. Find that extra $80 a month or more, no matter what.

3. Arrange a balance transfer

Many banks offer you an interest free deal if you take out a new credit card with them and transfer the balance of your existing credit card to the new one.

This can be a highly effective way to get some breathing space and make a real dent on your debt.

Just do one thing for me.

When that new card arrives, cut it up. Whatever you do, don’t spend a cent on it.

Any new purchases on the card will incur interest at the usual exorbitant rate, but your existing balance won’t. So, if you avoid using the card, you can pay off what you owe without any extra charges.

4. Get a loan

It might sound counterintuitive, but if you have multiple credit card debts incurring interest, consolidating them by taking out a lower interest rate personal loan can save you money.

Plus, you don’t get the temptation of extra credit purchases.

Again, just make sure to cut those cards up once they are paid off.

Trending

Sorry. No data so far.