When you’re in debt, the stress can feel like you’re completely snowed under. Debt snowballing is a way to put all that snow to good work…

Debt snowballing is a structured, goal-based approach to debt reduction, which also has strong psychological benefits. It involves paying off smaller debts first by making extra repayments, and gradually working up to larger loans.

The genius of this strategy is that once each smaller debt is paid off, the money that was used to repay it is added to the repayments on the next largest loan. This then pays the next loan off quicker and so on. Hence, debt snowballing. But rather than your debt getting bigger and bigger, you’re gradually paying it down faster and faster.

As you snowball, you also owe less money to less creditors, which relieves some of the debt stress. Not only does paying off smaller loans quickly feel great, there are less bills to juggle each month. Debt snowballing effectively simplifies your life – especially when you eventually pay the lot off, much sooner than you thought possible.

How debt snowballing works

It’s a simple method of debt reduction that you’ll quickly get the hang of. It works like this:

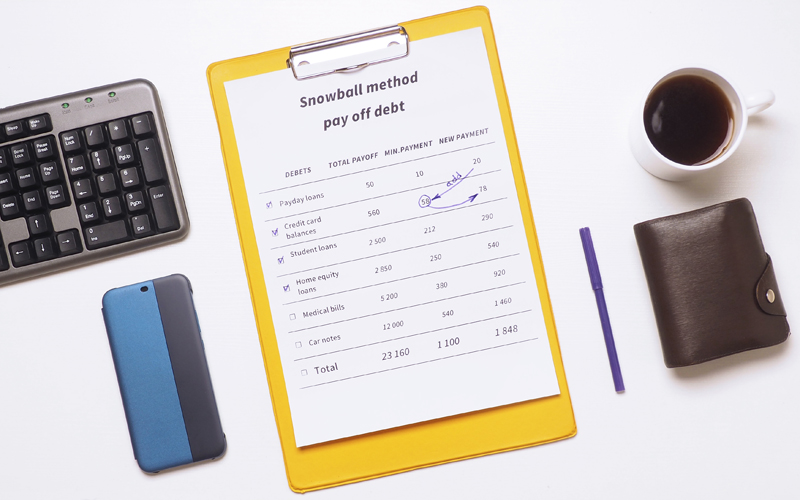

- List your debts in order from the smallest balance to highest. Include a column for the amount owing and one for the minimum monthly repayment.

- Each month, pay as much money as possible to the first debt on your list (ie, your smallest debt). Make the minimum repayment for every other debt on your list.

- Once you’ve paid off the smallest debt, cross it off your list. Then put any extra money each month toward the next debt on your list. Continue to make only minimum monthly payments on all the other debts on your list.

- Keep going with the debt snowballing method until all of your debts are paid in full.

As an example, someone struggling to repay four credit cards would switch the three cards with the highest balances to the minimum repayments. Then they’d funnel all their extra money into paying off the card with the lowest balance first. Once the smallest debt is paid off, all the money that was going towards repaying it is then used to start chipping away at the card with the next largest balance. And so on, until all four credit cards are paid off in full (and cut up in full, too!).

Why debt snowballing works so well

Note that debt snowballing doesn’t take into consideration the interest rate on any of the four credit cards. Rather, this method is only concerned with the amount of debt owed on each card. It focuses on reducing the number of debts you have, as well as your overall debt balance.

The main reason for this is to capture the maximum amount of motivation that crossing debts off your list can bring. The higher-interest debt might be your largest debt and take a long time to pay down. It’s easy to lose momentum when you’re endlessly chipping away at the one debt and the other three are also still hanging over you.

In addition, debt snowballing is a super-simple method of debt reduction. It’s easy to implement and doesn’t require a lot of spreadsheet work. You just need to make the list, know your minimum repayments and figure out a way to find some extra money each month to pay down the debt at the top of your list.

Where debt snowballing doesn’t work

While the simplicity of debt snowballing makes it an easy debt reduction strategy to stick to, there are a couple of major issues.

The first issue we alluded to above: interest. If your largest debt is also the debt accruing the highest interest costs, that interest will keep racking up while you diligently make your extra repayments on your other debts. So overall, you’ll probably end up paying more interest on your debts. It usually makes financial sense to pay off the higher interest debt first, even if it’s the largest.

This leads us to the second big negative of this method: time. The extra interest your largest debt is accruing adds to your overall debt. Which means, you’ll most likely take longer to pay off your debts using debt snowballing over other methods.

Psychological versus financial

Despite the drawbacks, the main reason to implement debt snowballing is to take advantage of the big psychological wins. It’s a simple strategy that’s easy to implement and keep going with.

A 2012 US Northwestern University study of over 6,000 debt settlement clients found that paying off smaller debts first significantly increased the chances that a borrower would repay their debts in full.

The idea is that starting small “could motivate you, because you check something off your list,” explained researcher Blake McShane. “It can make you think that you potentially have it in you to complete the whole list.”

While other debt repayment strategies might pay your debt down faster, they are harder to stick to for most. And the best debt repayment strategy is one you can consistently stick to until the debt is gone.

So start building your snowball and just keep on rolling, rolling, rolling.

Trending

Sorry. No data so far.