Just when you thought the banks couldn’t get any stingier, they are. Savings interest rates have been reduced again.

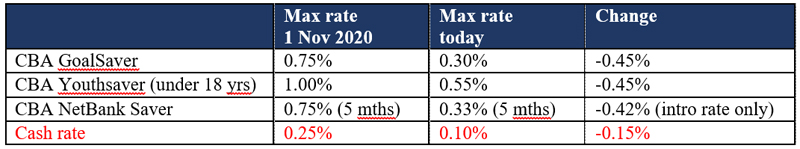

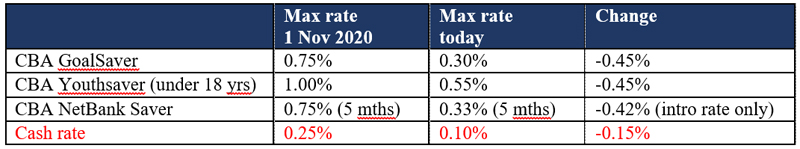

Australia’s biggest bank, Commonwealth Bank (CBA), has cut its savings rates by up to 0.07 per cent. The Reserve Bank hasn’t changed official interest rates since November last year, but the CBA (and the other big banks) has cut savings rates a whopping six times since then.

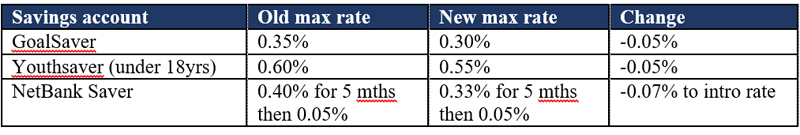

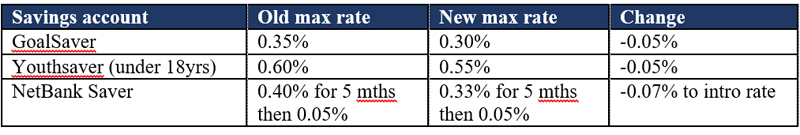

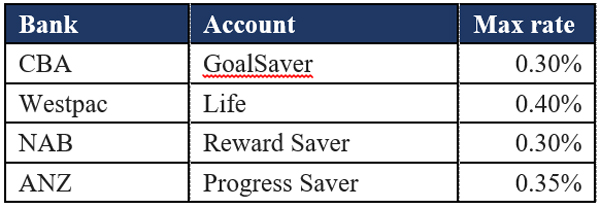

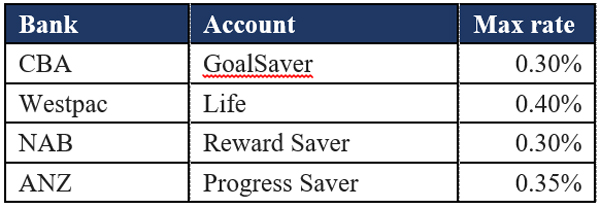

This week’s savings interest rates cuts

Note: To qualify for max rate for GoalSaver and YouthSaver balance must be higher at end of month.

Cuts since 1 November 2020, CBA vs cash rate

Note: The max rate on the GoalSaver on 1 November was for balances of $50K and over. The rate for under $50K was 0.50%.

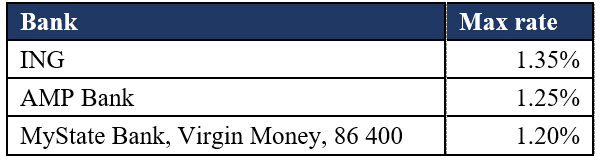

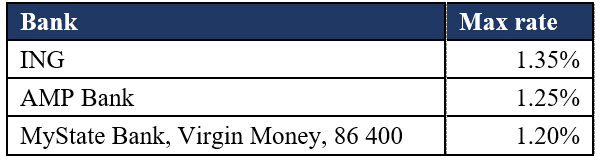

Savings interest rates over one per cent

Research group RateCity’s database shows there are nine banks still offering ongoing savings rates over one per cent, including ING, AMP and Virgin Money.

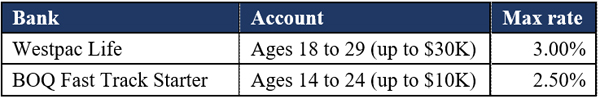

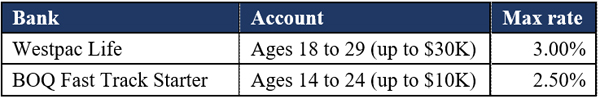

Young savers can get access to even higher rates if they know where to look. Westpac is handing out up to three per cent to Australians aged 18 to 29. That’s a huge difference to CBA offering the same cohort a maximum ongoing rate of just 0.3 per cent.

Just make sure you understand the terms and conditions to ensure you qualify for the maximum rate.

Big Four banks: conditional savings rates

Source: RateCity.com.au. Conditions apply for max rate.

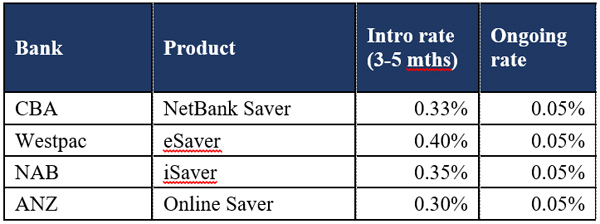

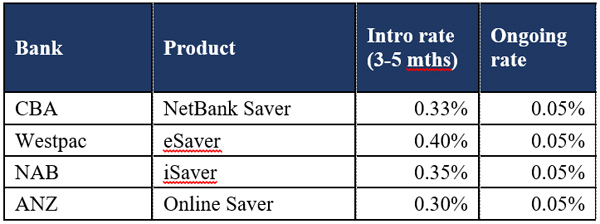

Big Four banks: standard savers

Source: RateCity.com.au Intro rate terms – CBA & Westpac 5 months, NAB 4 months, ANZ 3 months.

Highest ongoing savings accounts: no age restrictions

Source: RateCity.com.au $25k balance. Conditions apply for max interest rate.

Highest ongoing savings accounts: young adults

Source: RateCity.com.au Conditions apply for max interest rate.

Watch out for bank fees as well

If stinging us by offering such measly rates isn’t enough, many are also getting fleeced by bank fees as well. Aussies paid $3.56 billion in personal bank fees last financial year? That equates to around $364 per household in bank fees a year. You better believe most of us are not making that back in interest.

Get out your bank statements. Identify all the common, recurring fees you currently pay. Think account keeping and transaction costs, foreign exchange fees, late payment penalties, overdrawn account charges and ATM withdrawals.

Once all the fees have been listed, the next step is to see whether they’re fair compared to industry averages. There are a raft of online comparison sites to check accounts against the rest of the market, but the best is probably CANSTAR.

Once you’ve compared your current accounts to the market and identified where savings can be made, it’s time to ask your bank a few questions.

Heading into these discussions with the bank it’s important to understand that whatever level of customer you are, there is significant value attached to your business. Banks know that a simple savings account can lead to a credit card, that can lead to a mortgage, that can lead to a lifetime of fees, so don’t underestimate your bargaining power.

It’s essential to shop around

There are a few – but not many – reasons why you might want to park your money in a savings account- your emergency fund being one.

The insights here prove that it pays to shop around to get the best deal. That’s true of all your money decisions – know what you need, research your options, compare what’s in the market, negotiate or move. And keep those four steps on a regular loop.

Trending

Sorry. No data so far.