Let’s go through the facts and disprove some of the mistruths currently being sprouted by the media and politicians about interest rates.

Yes, the Reserve Bank surprised everyone by raising official interest rates 0.25 per cent (instead of the expected 0.15 per cent) to 0.35 per cent.

Yes, home loan monthly repayments will rise almost immediately, as all four major banks, and most other lenders, have immediately passed on the rate hike to borrowers.

Yes, this the first of a number of rate rises which could see official interest rates rise to a peak of 1.5 per cent to 3.25 per by the end of next year… depending on which economist you talk to.

Those are the facts. What annoys me is the hysterical coverage in the media that it is a disaster unfolding and also the utter crap being spruiked by politicians. Which I suppose is to be expected during an election campaign.

So, let me go through the facts and disprove some of the mistruths being sprouted by the media and politicians.

Rates had to rise because the economy is in such good shape

The reason official interest rates have been so low for so long is because the COVID pandemic had the very real potential to push us into a depression. Yes, just like the Great Depression – massive unemployment queues and incredible emotional and financial hardship.

To avoid an economic depression you slash interest rates and pump money into consumers’ pockets to stimulate the economy. Which we did better than most other countries. We avoided a depression.

BUT, the key to good economic management is knowing when to stop pumping the economy. If you don’t stop, inflation will get out of control, then prices will skyrocket and erode the value of money. You have to return to normal economic and interest rate settings, and that time is now.

Unfortunately, everyone has become addicted to the economic sugar hit and it’s hard to break the addiction. But it must be done. Every other major economy is doing the same thing, as evidenced by the 0.5 per cent rate rise in the US yesterday. The Federal Reserve chairman commented that he expected a soft economic landing, rather than a recession.

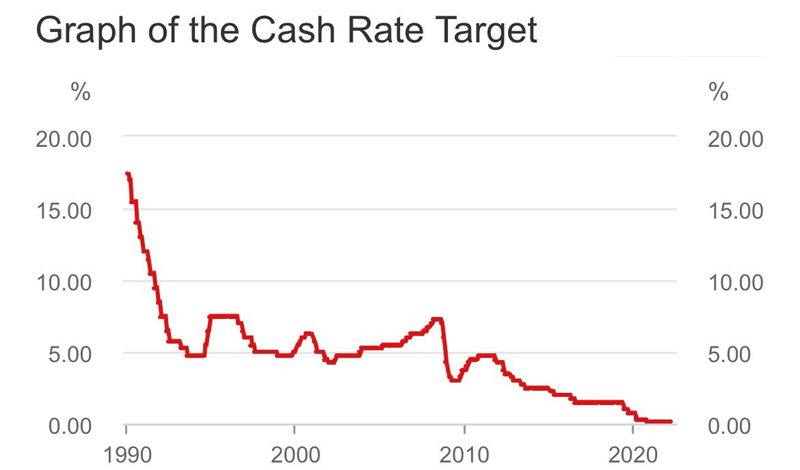

This week was Australia’s first increase in official interest rates in almost 12 years.

Source: RBA

Average Australian households are well-positioned to cope

Look, I know some Australians will be hurt by these interest rate rises … maybe they’ve borrowed too much or paid too much for their property, maybe had their income reduced. Unfortunately, for a range of reasons, there will be Australians hurt by any change in economic policy or conditions.

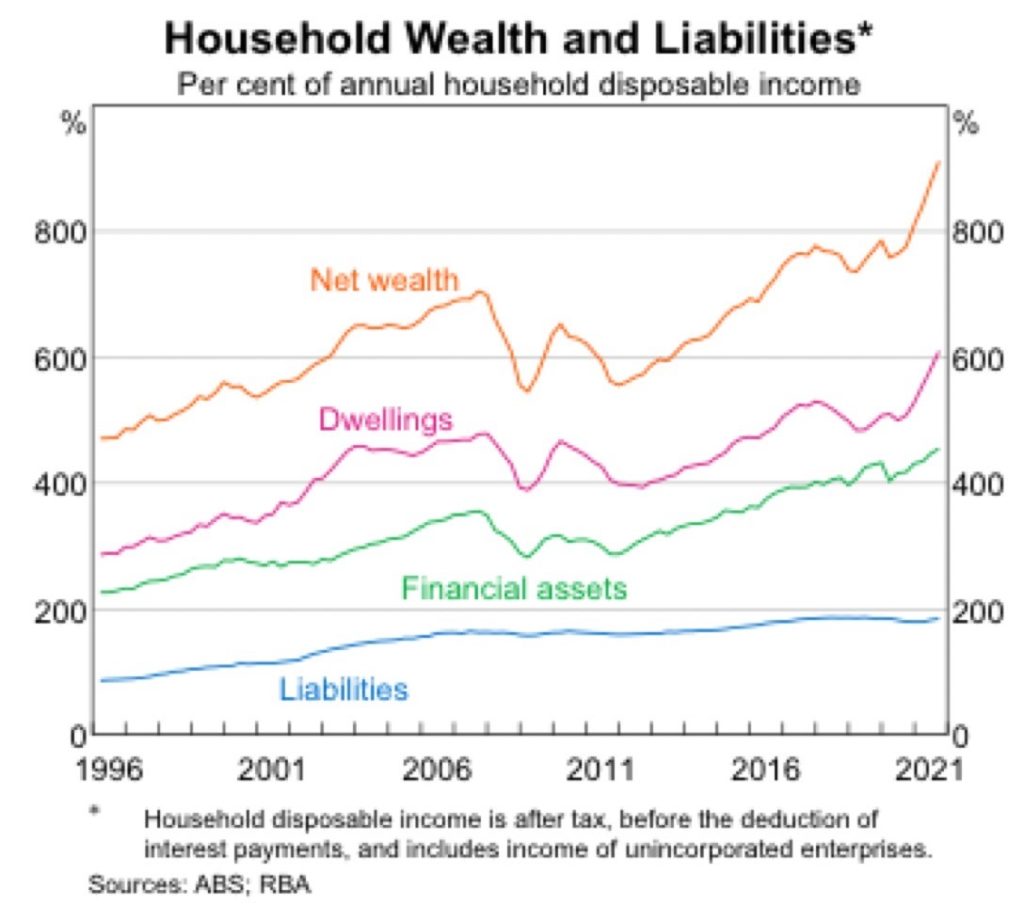

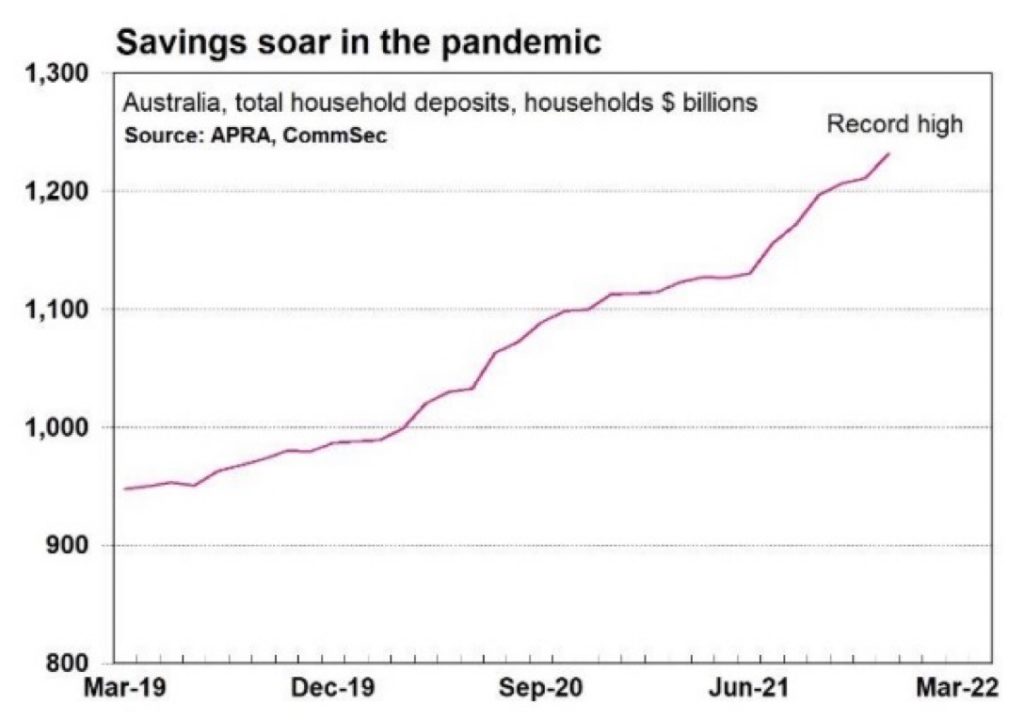

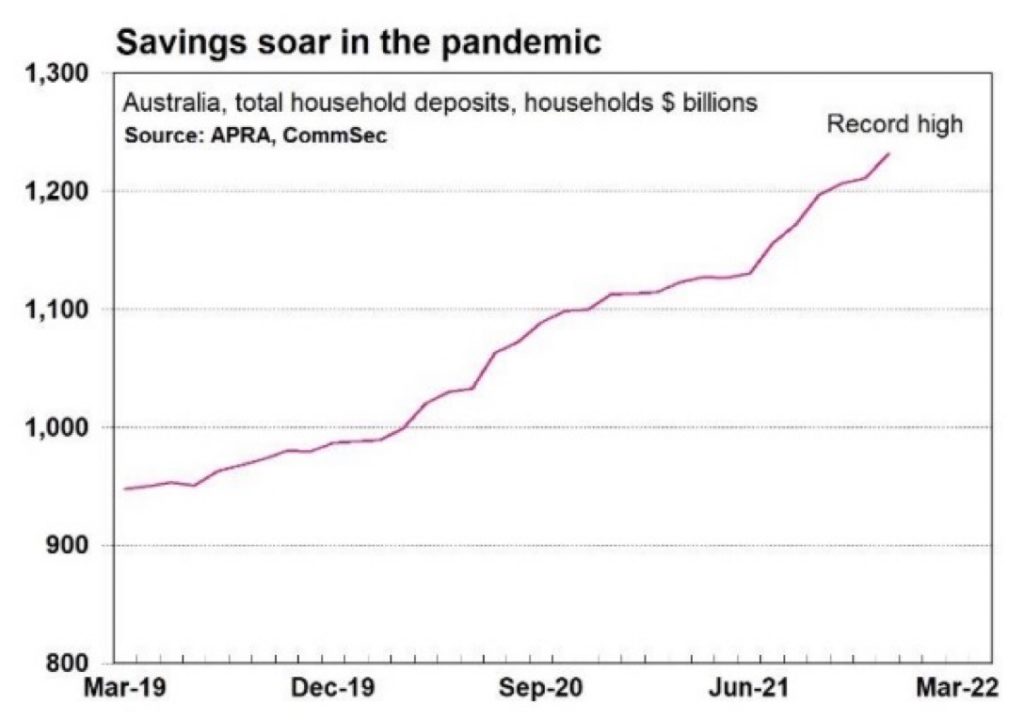

But the average Australian household has a record amount in savings and assets.

While a lot of experts focus on the bad news – that the amount of household debt (the blue line in the image above) is double the amount of household income – they seem to ignore that the debt is supported by huge asset levels.

The value of the average household’s home (the pink line) is six times higher than the household income. And the value of household financial investments (the green line) – like superannuation, savings accounts and other investments – is nearly five times higher than household income.

So take household debt away from the value of household assets and the net wealth of average Australian households (the orange line) is almost nine times higher than household income.

Never have Australian households been in better shape to cope with a rise in interest rates.

How much mortgage stress is there likely to be?

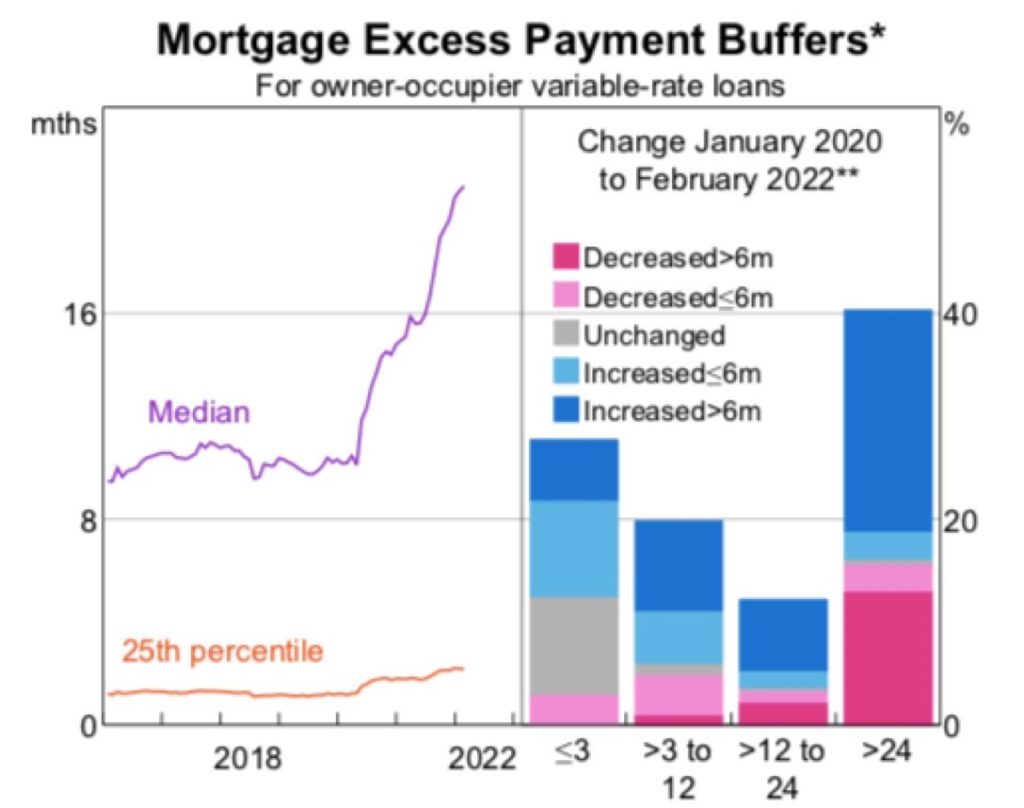

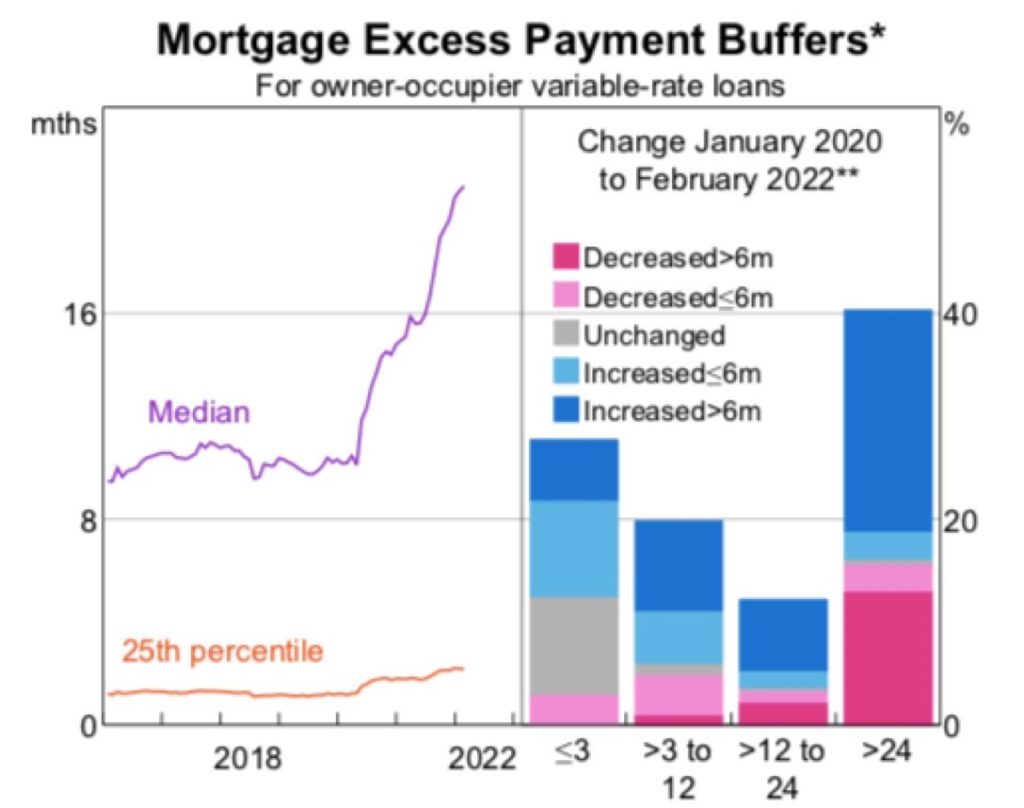

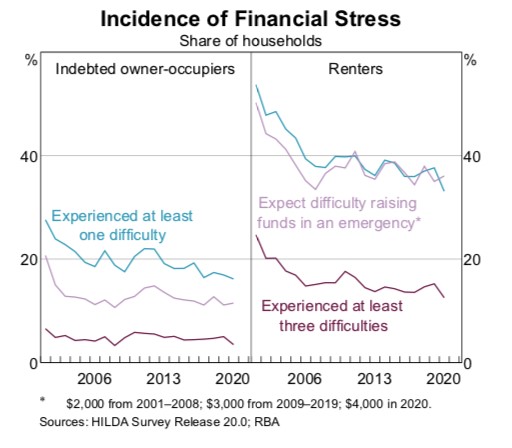

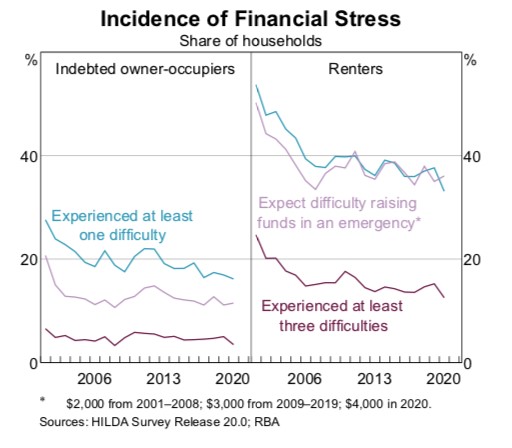

The facts are that only one third of households have a mortgage and around three-quarters of them have a small debt relative to the value of their house and their household income. As you can see from the graph below, many households are 20 months ahead in their repayments.

So the average Australian has used this period of low interest rates to build a significant buffer against rising rates… and financial stress has been falling.

And while Australians have been getting ahead on their mortgage, the value of their house (which is the asset behind that debt) has grown 35 per cent since 2018.

Even if property prices fall 10 per cent because of these ongoing rate rises, average house values will go back to the same level they were last October.

When it comes to rates rises a good rule of thumb is:

For each $100,000 of mortgage debt with a principal and interest 25 year mortgage, a 0.25 per cent interest rate increase means a $13 per month increase in your repayments. On a $500,000 mortgage, it’s $65 a month per $100,000 of debt.

A 2 per cent rise in rates on a $500,000 home loan will be an extra $520 a month in repayments.

So, as you can see, most households will be able to cope with this new interest rate rise and quite a few rises to come.

Trending

Sorry. No data so far.