Rents are skyrocketing across Australia, but it’s all just a matter of supply and demand.

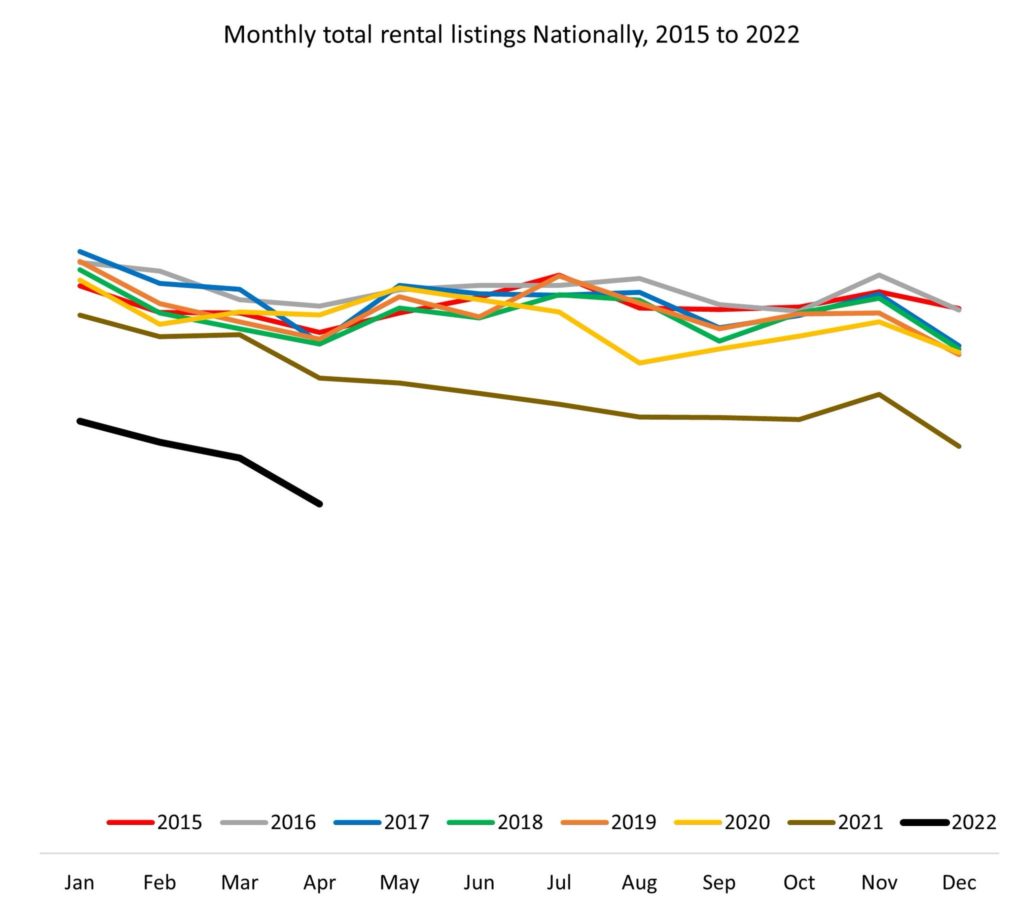

In March REA reported a huge reduction in rental listings, highlighting the challenges faced by those seeking a rental property. The number of total properties listed for rent nationally fell a further 11.6 per cent over April and is down 26.5 per cent year-on-year.

Yes, housing stock is low at the moment – both for sale and rent – but there is a construction boom underway, so hopefully the balance will realign.

It boils down to supply and demand and this chart from real estate platform REA Group sums it all up.

Source: REA Group

But I reckon the biggest impact is from Airbnbs coming off the long term rental market. When borders were closed and tourism dried up, property investors withdrew from Airbnb and put their properties onto the long term rental market to try and generate some income.

That’s why rents dropped so much during the pandemic – there was so much rental stock on the market. At that point some inner city rents dropped 30 per cent.

Now the borders are open and tourism is coming back, the reverse is happening… and rents are surging back to pre-pandemic levels.

Meanwhile, bidders are withdrawing from auctions

FOMO is the secret ingredient of every property auction. The hothouse competition which gets potential buyers bidding against each other in a mad scramble to grab a property. That scramble is, of course, designed to push the price up when bidders get emotional from that fear of missing out.

It is a tried, tested and popular method of selling property in Australia. But it is based on luring the maximum number of potential buyers to the auction to bid against each other and drive values higher.

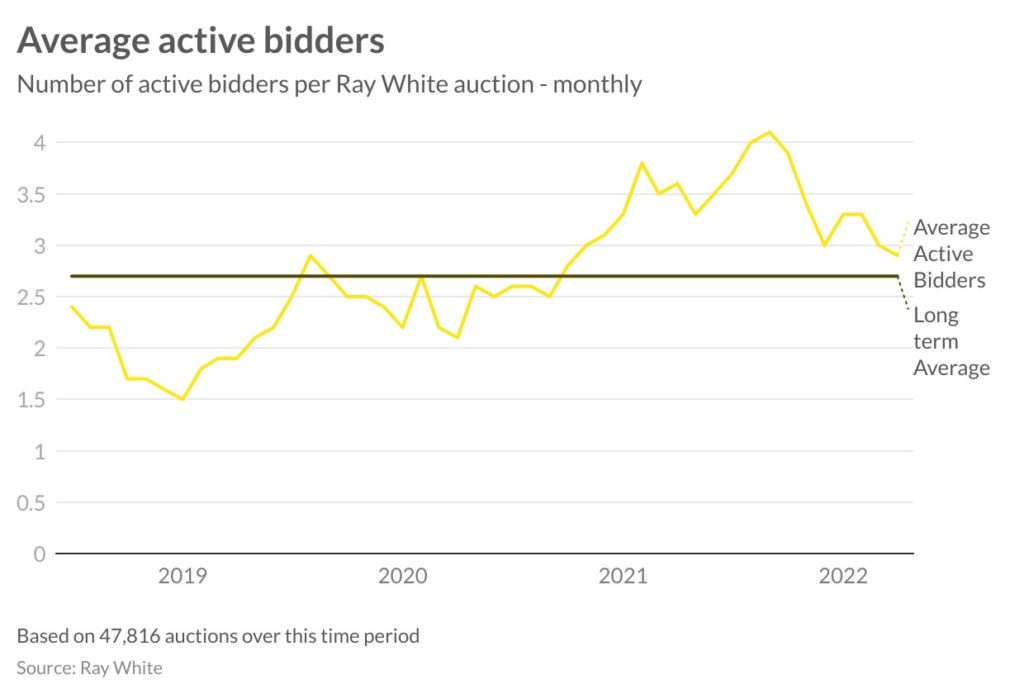

That’s why I found the latest report from Ray White chief economist Nerida Conisbee so interesting. If the number of bidders falls, the frenzy goes and you’d think sale prices would weaken.

Since real estate agent Ray White started tracking bidding activity in July 2018, they’ve found an average 2.7 bidders per auction (based on 47,816 auctions over this time period). The lowest number they’ve seen was at the end of 2018 when there was a significant drawback in investor activity. The highest was in September 2021 with over 4 bidders per auction, which was the absolute peak of the pandemic driven boom.

Average active bidders

Average active bidders have come down from the peak. In April, the average was 2.9. It was still above the long term average, but has clearly come down from the September peak. It is also lower than what was experienced in April 2021, but a lot higher than April 2019 and April 2020.

As to how this number fares over the next few months will depend on how far interest rates go up; however the winter slowdown is also a consideration.

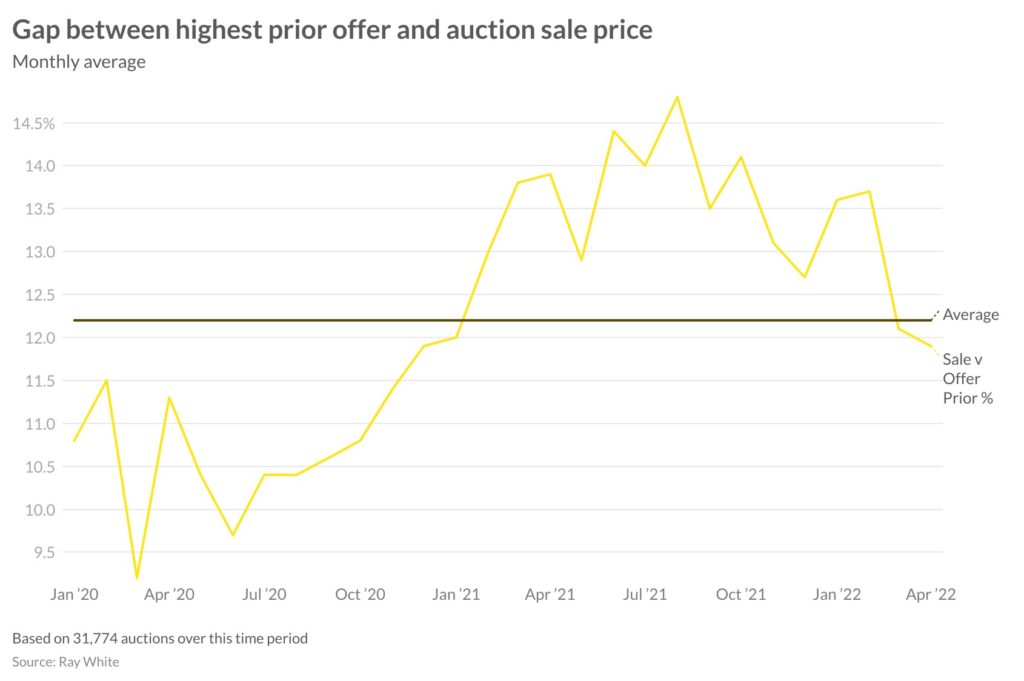

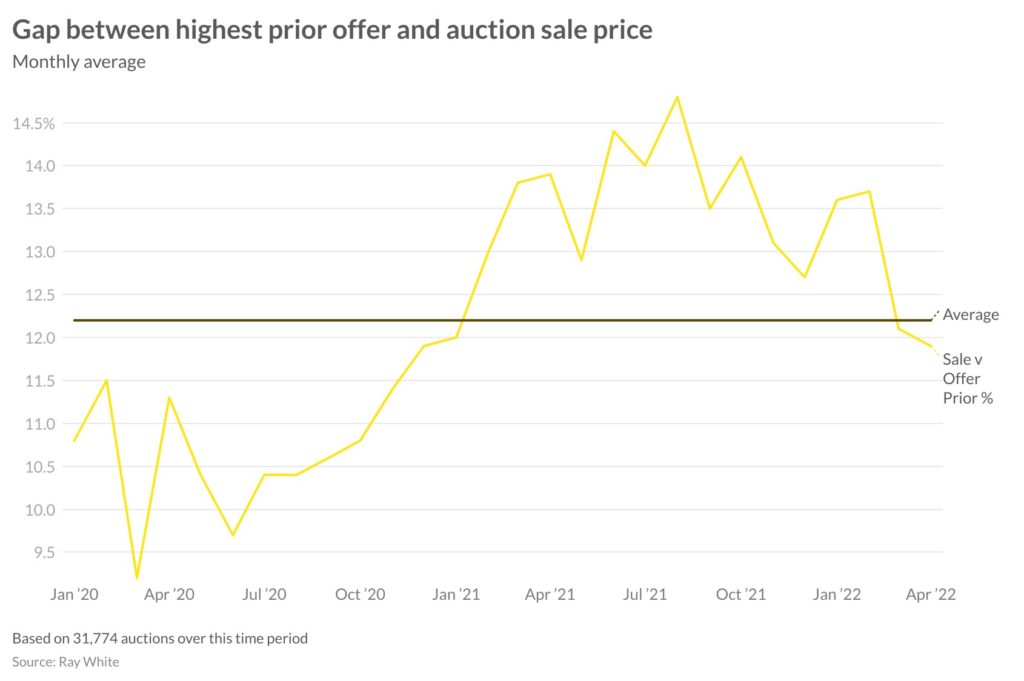

Gap between highest prior offer and final sales price

Another auction measure is the gap between the highest prior offer and final sale price, which Ray White have been tracking since the start of 2020. On average, Ray White auctions yield a 12.5 per cent gap above the highest prior offer. Not surprisingly, the very high number of active bidders led to a much higher gap, hitting a high of 14.8 per cent in August 2021. In April, the gap dipped slightly below average to 11.9 per cent.

Right now, the Ray White auction data, particularly average active bidding, suggests that demand conditions are looking better than they were prior to the pandemic, but not as good as they were last year.

Although we don’t have as long a time series for the gap between highest prior offer and auction sale price, the data is showing that demand is cooling from last year. However, it’s still a lot better than what it was just prior to the pandemic and within the first nine months following the first lockdown.

Trending

Sorry. No data so far.