I did warn over the last few weeks that many of the sharemarket experts were stashing away cash to take advantage of another sharp correction down. It came with a bang this week… the biggest one day percentage drop on Wall St since 2020.

Why? Inflation. It’s driving global financial markets because inflation determines interest rates.

The headline US Consumer Price Index (CPI) unexpectedly rose by 0.1 per cent in August, defying market expectations for an easing in price pressures (survey: -0.1 per cent). While petrol prices fell by 10.6 per cent in August, prices for most goods and services rose – food (up 0.8 per cent), electricity (up 1.5 per cent), natural gas (up 3.5 per cent), new vehicles (up 0.8 per cent), shelter/housing (up 0.7 per cent), transportation services (up 0.5 per cent) and medical care services (up 0.8 per cent).

Over the year, US CPI was up 8.3 per cent in August, down from 8.5 per cent in July and 9.1 per cent in June, which was the highest level since November 1981. Over the year to August, prices of rent (up 6.7 per cent, highest since 1986), food (up 11.4 per cent over the year, highest since 1979) and electricity (up 15.8 per cent, highest since 1981) all climbed sharply.

The reason sharemarkets dropped so much was on the expectation that the US Central Bank, the Federal Reserve, would have to put interest rates up higher to dampen inflation.

Since the big drop earlier in the week, markets have tried to struggle back into the black, but with no real conviction.

The massive cost of panicking in a sharemarket crash

I know sharemarket crashes are stressful, but history tells us that those that keep their nerve come out winners. SuperRatings proved the point.

They looked at the impact of switching out of a balanced or growth investment option in your superannuation fund and into the cash option at the start of the pandemic, when markets started crashing.

Significantly worse off if you switch

The study found that those with a balance of $100,000 in January 2020 who switched to cash at the end of March would now be around $22-27,000 worse off than if they had not switched and just stayed in the growth or balanced options. Because they missed out on the subsequent strong rebound in markets since then.

Source: SuperRatings

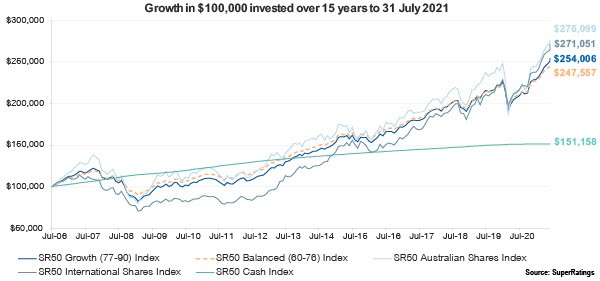

This effect of switching into cash as a response to market turmoil is also seen when looking at returns over the past 15 years. In this period, a typical balanced Super option has risen substantially, with a balance of $100,000 in July 2006 accumulating to $247,557, more than doubling in size.

Those members investing in a growth option have experienced an even stronger result, with a $100,000 balance growing to $254,006.

Though share focused options involve greater risks, they have delivered the highest returns of all. The median Australian shares option grew to $276,099 and the median international shares option grew to $271,051.

Over the same period, a $100,000 balance invested in cash would only be worth $151,158 today.

Keep calm and carry on

It’s a great lesson in how investing over the long term smooths out any short term crashes.

The cost of reacting to a sharemarket crash by selling up or changing your strategy can be massive. So the moral of this investment story is to hold your nerve and let your money work for you over the long term.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.