RBA Board meeting week and it was steady as she goes. A change in RBA Governor from Philip Lowe to Michele Bullock made no difference at all… and I suspect that was the point.

There was all sorts of talk in the lead up to the meeting about whether Michele would stamp her own unique brand on the Board meeting and the commentary surrounding the decision. Would she be more hawkish and aggressive or more moderate?

Yeah right… as if that was going to happen. Michele Bullock has been part of the RBA Board for years and understands the role of the Central Bank is to maintain continuity and confidence in the financial system. And that is exactly what she is doing.

Interest rates held steady

To the actual decision and, as expected, official interest rates were kept on hold for a fourth consecutive month at 4.1 per cent.

The Governor only made minor changes to the explanation attached to the decision, saying previous rate rises were “working to establish a more sustainable balance between supply and demand in the economy and will continue to do so.”

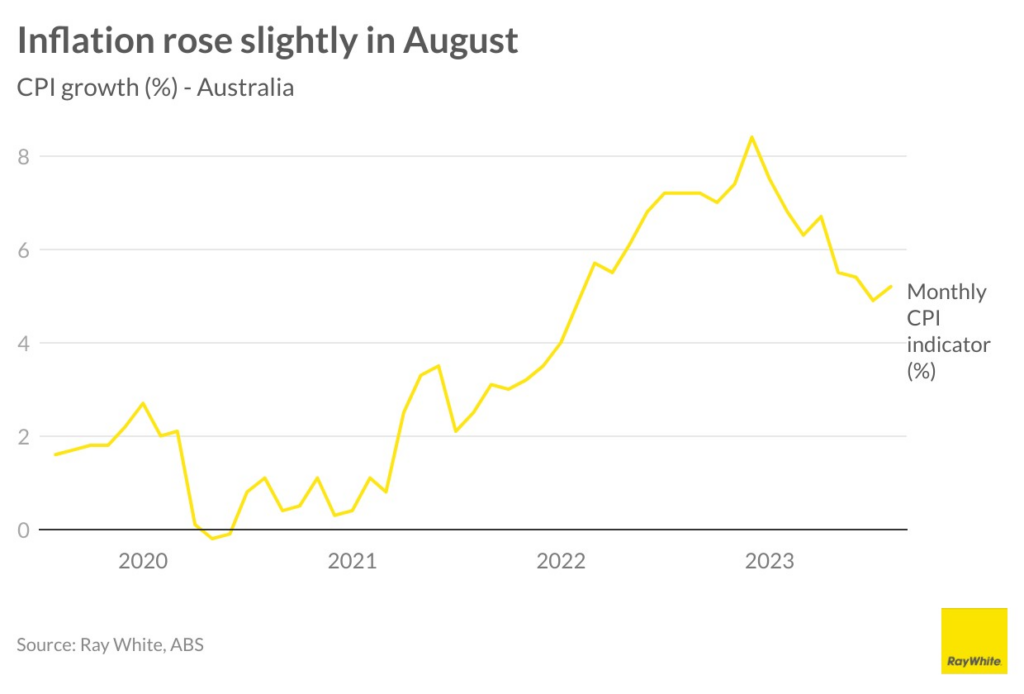

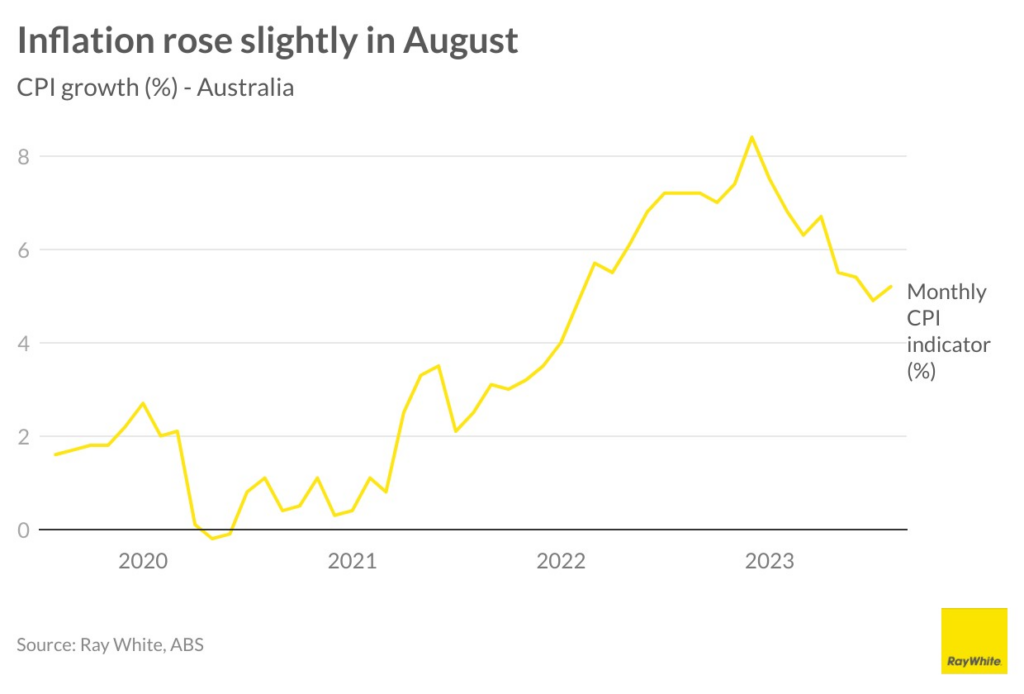

The RBA has noted that inflation has peaked, “but is still too high and will remain so for some time yet.” Goods price inflation continues to ease, but services price inflation is still trending higher. The RBA has also noted the recent rise in fuel prices and elevated rent inflation. It continues to reinforce that “returning inflation to target within a reasonable timeframe remains the Board’s priority.”

Inflation is currently tracking to the RBA forecasts which expects headline inflation to be back into the 2-3 per cent target range at the March-June quarter 2025.

The RBA has also highlighted that “growth in the Australian economy was a little stronger than expected over the first half of the year”. As well, “conditions in the labour market remains tight, although they have eased a little”.

September CPI figure is critical

The September quarter CPI figure due at the end of October is going to be absolutely critical in determining whether the RBA will lift interest rates on Melbourne Cup Day next month.

If it comes in on expectations and the trend continues down, then expect another pause and the likelihood that rates have peaked.

If it comes in higher than expectations, the RBA Board meeting on 7 November will likely raise rates another 0.25 per cent. Some analysts still see one more rate rise between now and next March.

But one thing is clear, there will be no rate cuts until the back end of next year. A few months ago some analysts were expecting rate cuts to come as soon as the March quarter next year as the economy slowed dramatically. That now looks very unlikely.

This looks to be the top (or close to) of the interest rate cycle and will be as tough as it gets. But it isn’t going to get any better anytime soon. What you see is what you get for the next year or so.

5 strategies to avoid mortgage stress

Drew Haupt, co-founder of WLTH, offers the following strategies for anyone feeling the pinch of higher interest rates.

1. Be realistic about what you can afford

Everyone wishes they could afford their dream home straight off the bat, but it’s not realistic for most Aussies.

Although it might be tempting to try your luck taking out a bigger loan, be critical with yourself about whether you can truly afford it.

2. Consider rentvesting

Rentvesting is where you buy and lease out an affordable investment property, then rent your ideal living property.

It’s a win-win situation, where the profit you make from your investment property funds both the rent in your dream home and existing loan repayments.

3. Set up an offset account

Depending on your home loan provider, if you have an offset account set up you can link the funds in the account to your home loan. The money in your account reduces the balance of your home loan, so you pay interest on a lower balance.

So the bonus of offset accounts is that they can also help reduce the interest paid on the loan.

4. Reduce unnecessary expenses

If you are struggling to meet your mortgage repayments, it’s probably a wise idea to assess where you can cut back your spending.

Unnecessary expenses can add up and impact your financial situation more than you think.

5. Look into split loans

If you don’t want to change home loan providers, but are struggling to make your loan repayments, you could consider restructuring your loan.

It may be worth speaking to your home loan provider about splitting your loan. That way part of your home loan balance is charged at a variable rate and the other amount charged at a fixed rate.

This option provides you with more flexibility with payments, based on what works best for your financial situation.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Economic update: Australia is kicking a few goals when it comes to inflation

Trending

Sorry. No data so far.