Avoid the sting of credit cards at Christmas with these tips for staying on track. Tip #1: get the lowest-possible rate card you can.

It happens every Christmas. We go on a Christmas shopping splurge and feel great… until the credit card bill arrives in January. Outstanding balances can provide a horrible financial sting.

New research from RateCity shows eight out of 10 credit card users with outstanding balances don’t even know what interest rate they are paying.

The average credit card rate is currently and extortionate 17.23 per cent. But did you know rates range from 7.49 per cent up to a whopping 23.99 per cent? That is a significant difference which can have a massive impact on the amount of interest you’ll pay.

Of the people paying interest, one quarter have debts of less than $1,000. However, 10 per cent said they had a credit card debt of $20,000 or higher.

RateCity.com.au analysis found that accounts with debts of $20,000, on the average rate, paid a monthly interest bill of $283. However, on the lowest rate card, this would be $123 per month – reducing the interest paid by more than half.

Source: RateCity.com.au, RBA personal lending rates for September 2021, released 5 November 2021, data is in original terms.

Australians had been paying down debt and cutting up credit cards in droves during COVID (mainly switching to Buy Now, Pay Later), however, there are still people stuck on a debt treadmill.

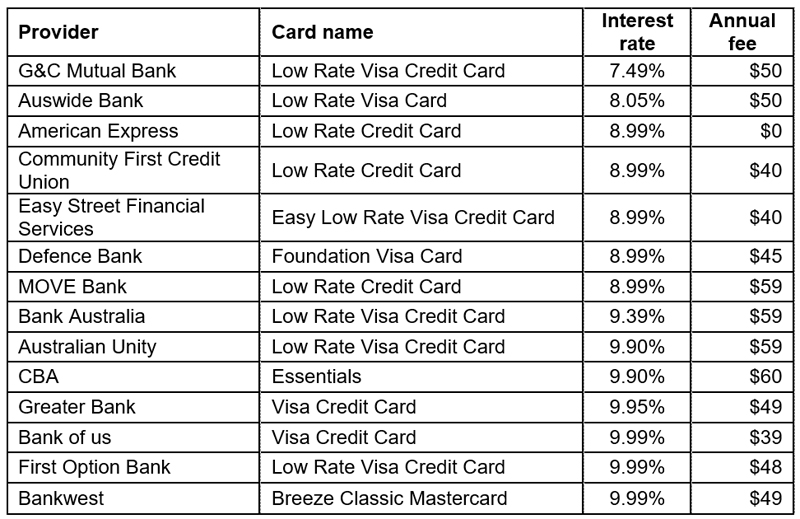

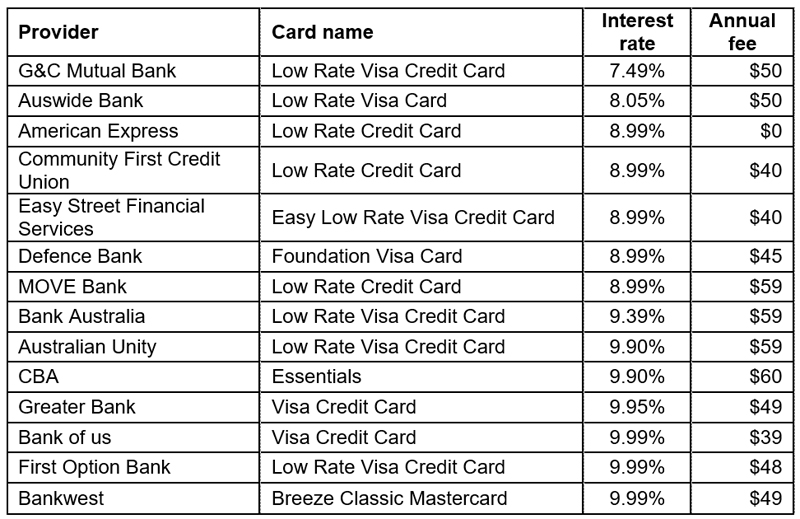

Credit cards with interest rates under 10% and no or low annual fees

Source: RateCity.com.au.

Credit card debt is one of the worst kinds of debt. Avoid it as much as you can, and if you can’t avoid it, manage it well.

RateCity’s top 5 tips for using credit cards at Christmas

1. Check your rate: There are 17 credit cards with interest rates under 10 per cent. If you aren’t clearing your debt each month, you could save a lot of money switching to a lower-rate card. Three of the big four banks also offer 0 per cent credit cards, although monthly fees may apply.

2. Pay more than the monthly minimum: For most cards, that’s around 2 per cent of the balance you owe. At that rate it could take decades to repay your balance. Always pay as much as you can each month to clear your debt as quickly as possible.

3. Check your interest free days: Most cards give you some breathing room to pay off a purchase, typically up to 55 days before interest kicks in. But you can lose your interest free days if you haven’t repaid last month’s bill. Check your card’s T&Cs and stay on top of your repayments.

4. Weigh up the rewards: While a free flight, or even a free bottle of wine, might sound nice now, know that credit cards offering perks often come with higher-than-average interest rates and fees. Look for the lowest possible interest rate card.

5. Set a budget: If you use your credit card to plug the shortfall until pay day, then set up a budget. Write everything down that you spend in a month – you might be shocked to discover just how much you spend, as well as ways to cut back.

Trending

Sorry. No data so far.