Summer holidays are meant to be the most cheerful time of year, but 38.3 per cent of Australians argue over money with their loved ones.

I know it is probably stating the bleeding obvious, but I always reckon it’s interesting to see what everyone else is arguing about to judge whether Libby and I are any different.

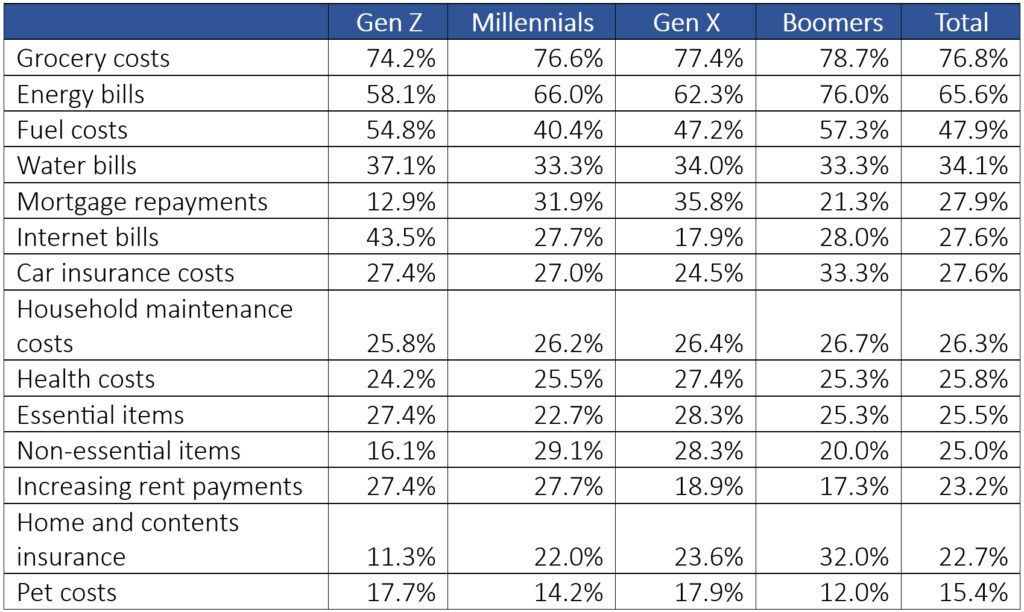

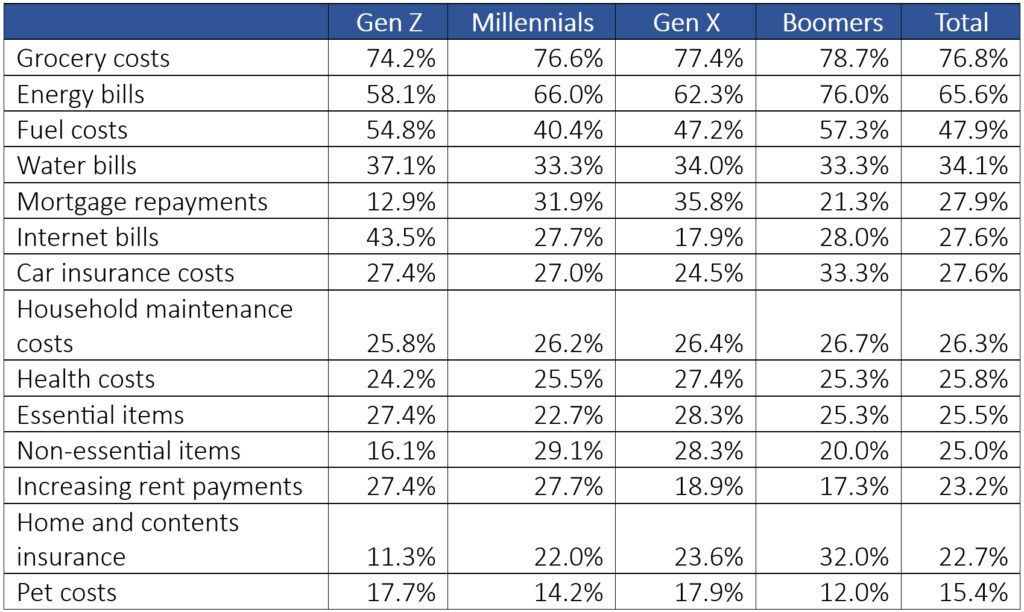

According to a Compare the Market survey of their customers, the bills causing the most arguments are groceries (76.8 per cent), energy bills (65.6 per cent) and fuel costs (47.9 per cent).

Meanwhile, just over a quarter are disgruntled about the cost of car insurance (27.6 per cent) and health (25.8 per cent).

Fuel and energy costs trigger the most arguments

It makes sense that people are arguing the most over energy and fuel costs because they’ve increased the enormously over the last year.

Australia’s big energy retailers have reported a dramatic increase in the number of households struggling to pay their electricity bills. One company revealed there are more people accessing hardship programs now than at the peak of the pandemic.

The research shows that for Boomers in particular, everyday expenses are causing them to argue over money. Whether it’s with providers, people who live with them or otherwise. This is surprising in a way as there’s a public perception that Boomers have it easier and are wealthier than their younger counterparts.

But not everyone who retires has retired comfortably. Pensioners, in particular, might be experiencing higher increases in the cost of living, which could be why older Australians are arguing over rising bills the most. The dollar isn’t stretching as far, so if people are dipping into their super or relying on government payments, it’s going to be hurting the household budget.

In retirement there is always a fear of running out of money because there isn’t the safety net of a regular wage landing in your bank account to help with unexpected bills.

What each generation argues about the most

Source: Compare the Market

A couple of tips from me to help you argue about money less and stop the household bills from bubbling over.

Compare your bills

From your energy bills to your healthcare costs and mortgage repayments – make sure you’re on the most competitive deal. Comparison websites like Compare the Market take all the hard work out of having to do your own research. If it’s been a while since you’ve switched providers, then you’re probably paying more than you need to. Spending a bit of time comparing your bills each month can save you a ton of money.

How to lower your energy bill

-

Ditch the dryer and instead use the sun or an indoor rack placed near a sunny window to dry clothes.

-

Close all the doors, windows, and blinds to trap the cool air inside when running the AC.

-

For cooling, set your air conditioner temperature between 24°C and 26°C. Each 1 degree of extra cooling or heating could increase your electricity usage between 5-10 per cent.

-

Open your windows and doors to create cross breezes and use fans to circulate and cool the air.

-

Make sure you are using energy efficient appliances.

-

Turn off switches if you’re not using appliances. Vampire power can add 10 per cent to your power bill.

Negotiate or switch to a lower interest rate

Mortgagees need to make sure they’re on a competitive low rate. If you find a rate that’s lower than the one you’re on, ask your current lender to match it. If they don’t at least offer you a discount, be prepared to walk. We’ve had someone recently refinance through Compare the Market who saved $623 on her monthly mortgage repayments. Suitable products and rates available to you can vary, but it’s worth checking to see how your rate stacks up.

Fuel up for less

You can save money every time you fill up your car by simply checking cheap fuel finder apps like the Simples app. But if you’re still feeling the price pain at the bowser, maybe try carpooling, public transport, walking or cycling. You could also try driving at off-peak times to avoid getting stuck churning through fuel in traffic. Maybe there’s a gym near your work and you could do a workout before work and stay ahead of the morning peak hour commute.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Financial infidelity: make sure your partner isn’t ripping you off

Trending

Sorry. No data so far.