Interest rates may be on hold after this week’s RBA board meeting but thousands of homeowners are still paying more for their home loan because they have fallen onto so-called “back-book” rates.

Back-book rates are where existing loyal customers are being charged a higher interest rate than new “front-book” customers.

That difference is as much as 2 per cent, which is the equivalent of eight RBA rate increases of 0.25 per cent.

The government needs to prioritise reforms that could help homeowners save money on their mortgages, as any further delays could end up costing people thousands.

In December, the government announced it would review the Australian Competition & Consumer Commission (ACCC) home loan price inquiry recommendations from its 2020 review of the mortgage process.

While it’s great to see the issue finally getting some attention, urgent action is needed to make up for slow progress over the past four years. There’s a significant difference between what new customers and old customers pay and right now not enough is being done to help those people onto better rates.

Rate hikes means we’re hurting

And the gap between advertised and back-book rates is hurting even more since most of the banks have passed on the RBA’s 13 rate hikes in full. One of the big banks has a net interest margin of 2.31 per cent… now that’s approaching the size of the 3 per cent serviceability buffer banks stress test you for, so that’s a huge discrepancy.

A Compare the Market survey of homeowners in September 2023 found that 18 per cent did not know their interest rate while approximately 45 per cent had been with the same lender for more than five years.

If the ACCC’s recommendations are mandated homeowners could benefit from:

- Speedier discharge times, with a maximum of 10 business days to complete the process.

- A streamlined process to refinance that isn’t as complicated or confusing as the current one.

- Continued monitoring of competition and prices in the home loan market.

A huge difference between front-book and back-book rates

Compare the Market analysis of some of the rates available from the big four banks showed the average difference between front-book and back-book rates is a massive 1.96 per cent.

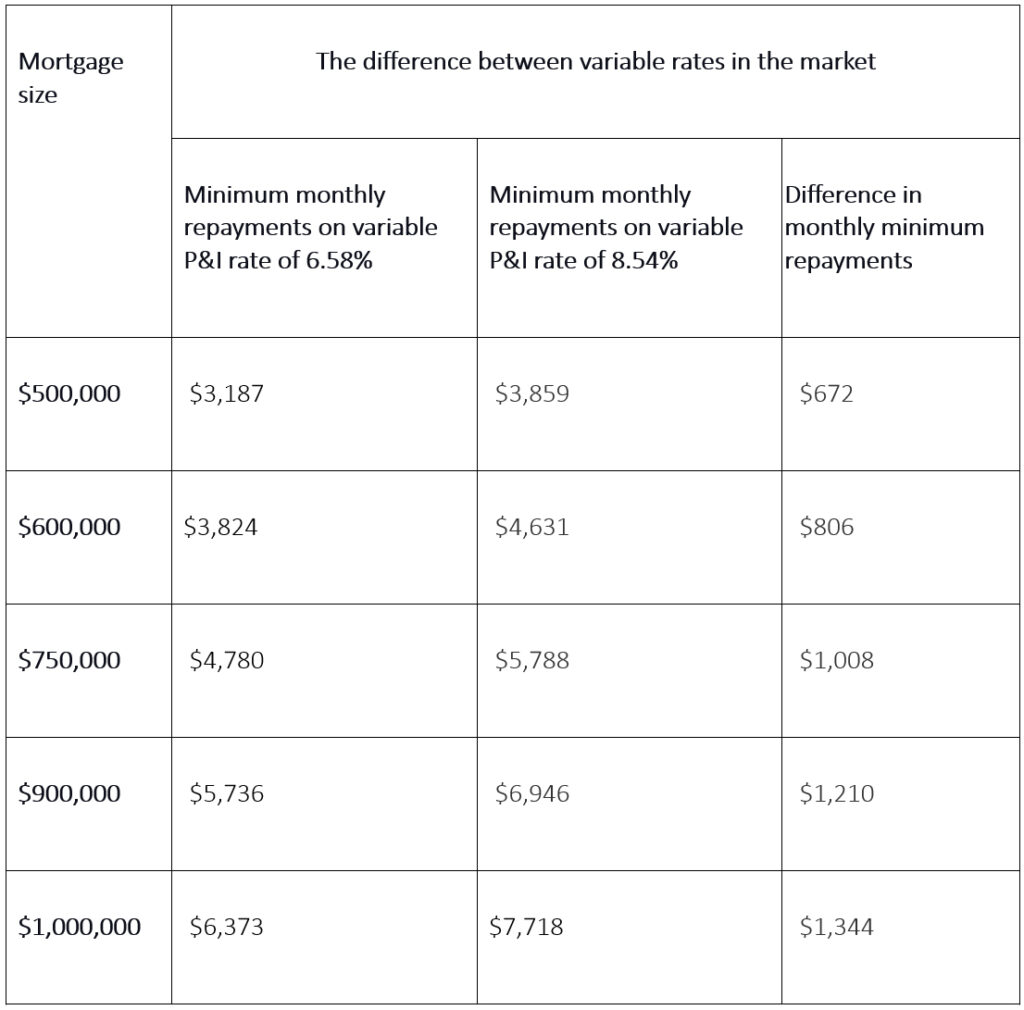

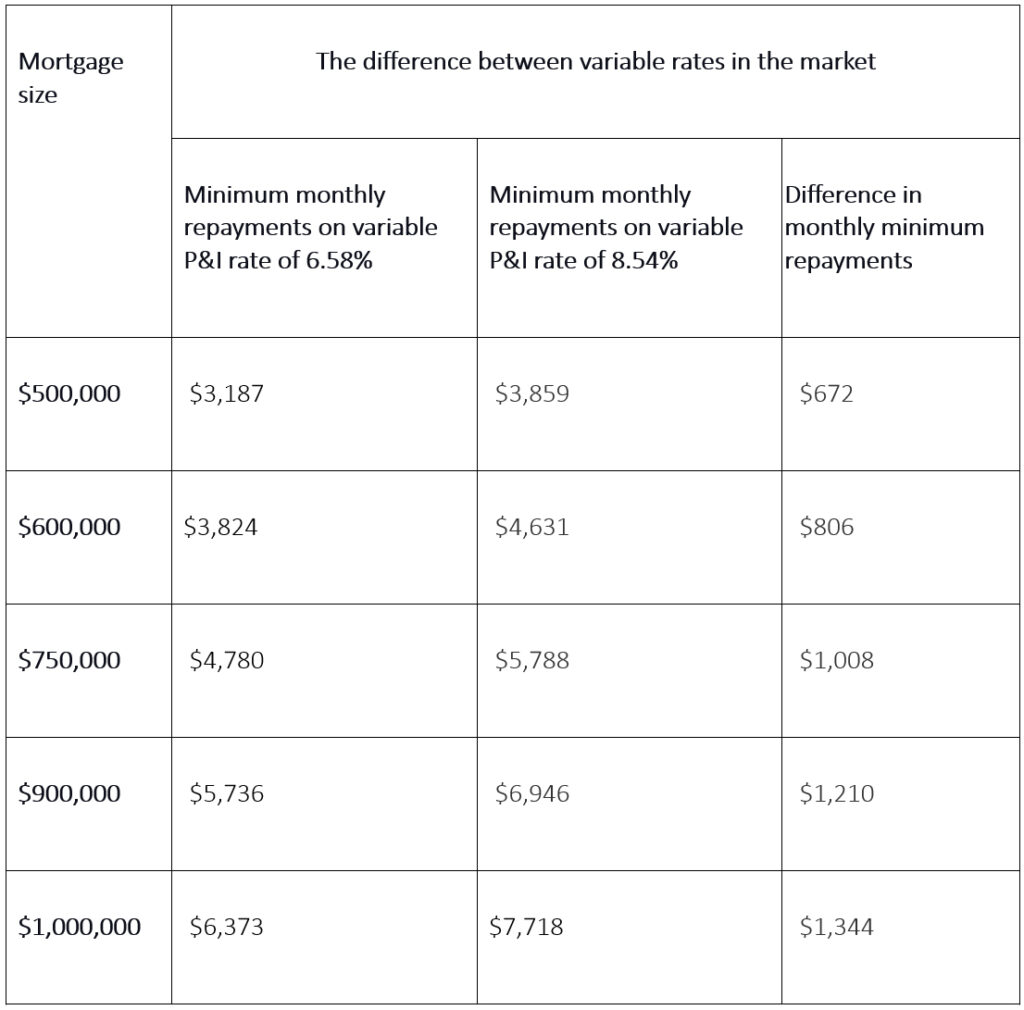

Therefore, a person with an owner-occupier $750,000 loan could be saving $1,008 a month when they switch from a rate of 8.54 per cent to 6.58 per cent.

Source: Compare the Market. Monthly repayments do not include any reduction in the mortgage balance over time. These calculations assume: An owner-occupied variable interest rate of 6.58% compared to 8.54% pa; principal and interest (P&I) repayments; the loan term is 30 years; and there are no monthly fees.

With the difference in rates potentially costing homeowners thousands, the government should be doing everything in its power to make refinancing easier.

What the government can do

The decision to switch and save ultimately lies with the borrower, but the government needs to make this process easier by mandating a standardised discharge form and putting a 10-day deadline on the process.

Right now, lenders are allowed to drag their feet to retain business, but these reforms could help drive competition in the home loan market.

Borrowers need to be sceptical about their current interest rate and use websites like Compare the Market to make sure it’s competitive.

I’d urge anyone who’s been with the same bank or lender for the past few years to be bit inquisitive, do some research, and see if they’re actually getting a good deal. If there’s a big difference between your rate, and the ones that are advertised, it’s probably time to walk.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending