A tumultuous week for finance nerds like me who for years have excitedly marked the first Tuesday of the month in our calendars as “Reserve Bank Board Meeting Day”.

This week was the last RBA board meeting on the first Tuesday of the month… the next one will be Tuesday March 19 as the RBA moves to eight meetings a year.

Plus last Tuesday was the first press conference from an RBA Governor after the release of the RBA rate decision.

It’s a lot to take in 😊.

Clear and approachable

Seriously though, RBA Governor Michele Bullock was terrific at the press conference. Previous governors have been, shall we say, very academic and “nerdy”. Bullock, on the other hand, was forthright, very clear in her messaging and approachable. I must admit I’ve never heard an RBA Governor commenting on the inflationary impact of Taylor Swift.

The press conference is a great initiative (although the US Fed chairman has been doing it for years) and Bullock handled it well.

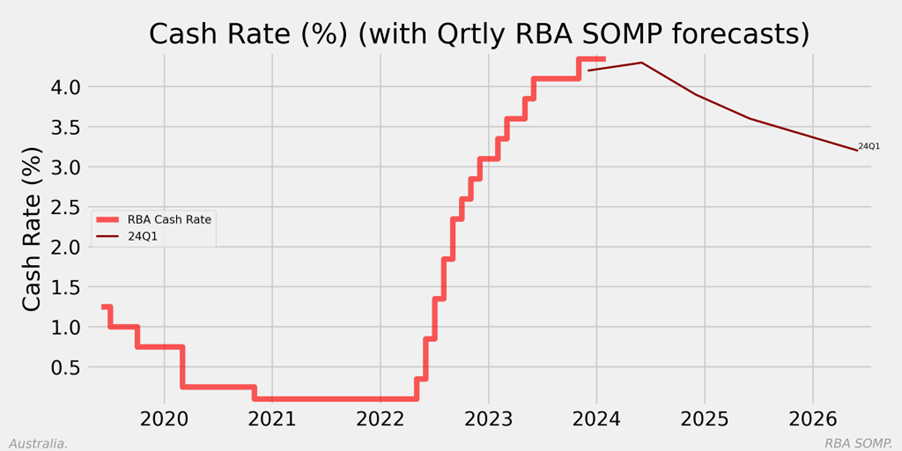

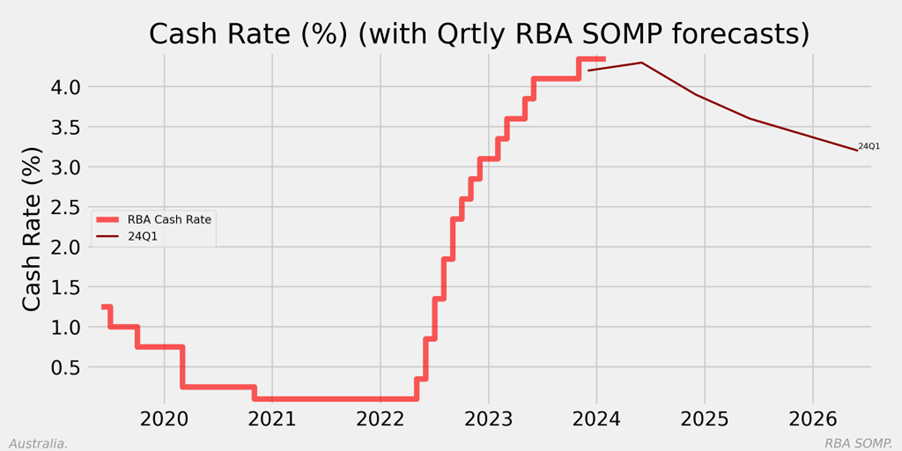

Keeping interest rates on hold at 4.35 per cent was widely expected, but there were some interesting changes in the attached Statement on Monetary Policy which updates the RBA’s economic forecasts.

Interest rates to hold until end-June

It has based their new forecasts on the assumption that official interest rates will stay the same until the end of June and fall to 3.9 per cent by the end of the year.

So, the RBA is forecasting a 0.4 per cent cut in rates over the second half of the year.

Source: RBA

When it comes to inflation the RBA is now assuming a fall in the annual CPI to 3.3 per cent by June, but then it reckons it will take another 18 months to dip down to the 2-3 per cent target range. That to me seems a long time for it to dip another 0.3 per cent.

Slowdown sharper than expected

Based on that assumption the RBA now expects the economic slowdown to be sharper than it expected. It is now forecasting economic growth in the June quarter to be 1.13 per cent a year… slower than the 1.8 per cent it previously expected.

The economic growth forecast for the end of the year was also lowered to 1.8 per cent, while the forecast for late 2025 and June 2026 were kept the same at 2.4 per cent.

The RBA now expects unemployment to rise from the current 3.9 per cent to 4.4 per cent by June 2025.

Australia’s financial therapist

But remember it’s not just economic data and forecasts that the RBA needs to be good at. It also needs to be the country’s financial therapist. They try and get into our minds to influence our behaviour because that, in turn, affects the economic data.

That’s why the RBA constantly “threatens” us with the possibility of higher interest rates. That way we don’t start thinking this is the peak of the interest rate cycle and go out shopping to celebrate, which will, in turn, feed into inflation.

That’s why even this week we get told higher interest rates “cannot be ruled out”. It’s why in the Bullock press conference she said the economy and rates “are finely balanced”.

The fear of rising interest rates keeps our behaviour in check.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.