The average Aussie says they would need to earn a far higher salary than the average wage to feel rich. What’s behind this unattainable aspiration?

According to new research from comparison site Finder, the average Aussie says they would need to earn a far higher salary than the average wage to feel rich.

A survey of 1,013 respondents revealed one in four (25 per cent) Australians wouldn’t consider themselves affluent until they were earning at least $500,000.

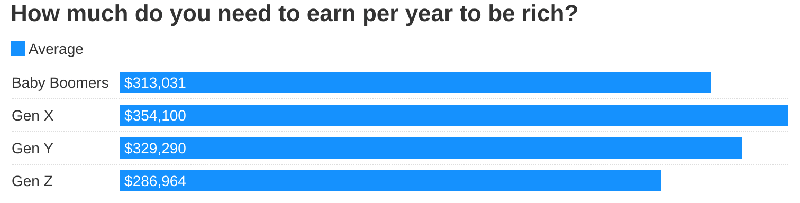

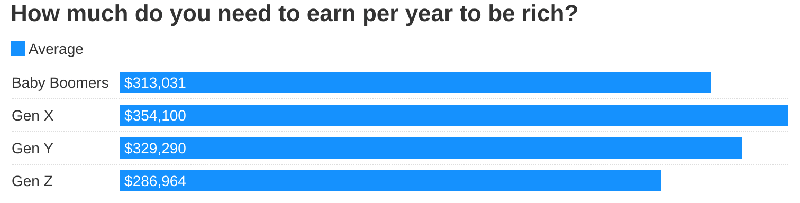

The average Australian said they would need to earn a salary of $326,900 per annum to feel rich – nearly seven times greater than the median personal income of $49,805.

The research also found that Gen X report needing the most money to feel rich ($354,100), while Gen Z need less ($286,964).

Source: Finder. Based on December 2021 Finder survey of 1,013 respondents.

Kate Browne, personal finance expert at Finder, said constantly longing for more money can be a dangerous game.

“A small percentage of high-income earners make average income statistics look impressive. But the reality is that the typical middle-class Australian is actually earning a $50,000 salary.

“If you are already fortunate enough to earn more than the median wage, it’s a good reminder that you are already ahead. It can be tempting to keep striving for more, but it’s also important to truly enjoy your work.”

Gender gap in what it takes to feel rich

Interestingly, women ($333,010) reported wanting slightly more than men ($318,952) to feel wealthy. This is despite women historically earning significantly less than men and certainly having far less tucked away for retirement.

According to the government’s Workplace Gender Equality Agency, the national gender pay gap is 13.4 per cent, with the average male taking home $93,818.40 a year compared to $79,040 for females.

As a result of earning a lower wage plus taking time out of the workforce to raise children, women’s super balances also lag significantly behind men’s on retirement. Which is particularly worrying when we consider that they also have a longer retirement to fund. On average, women live around four years longer than men ( Australian Bureau of Statistics figures show that life expectancy at birth was 80.9 years for males and 85.0 years for females in 2017-19).

Why don’t any of us feel rich?

A US study by Credit Karma found almost half (48%) of millennials spent beyond their means to keep up with their friends in 2019, up from 39% in 2018.

So, FOMO coupled with the comparison trap is most likely the reason behind why Aussies don’t feel rich. We might have ‘enough’, but we perceive that our friends – and others in society – have ‘more’. FOMO is that age-old ‘keeping up with the Joneses’ issue, wearing a new designer t-shirt.

We’re basically all caught in a loop aspiring to have as much as our friends, but our friends probably aren’t doing better than we are anyway.

Social media has a lot to answer for here. Just as filtering our faces is now expected, filtering our lifestyle is becoming acceptable, too. Just this week, 25-year-old South Korean influencer Song Ji Ah (also known as Freezia), who has over 5 million followers on YouTube, was outed by her followers for wearing fake designer brands.

It prompted her to issue a statement “sincerely apologising” to “everyone who was disappointed and hurt” by her faking out her followers. The bottom line was this: even a person who earns a living showing off how rich she is, is possibly not as rich as people think she is.

Steps to feel richer

If you really don’t feel like you’re earning enough, take steps to increase your salary. There are several ways to to do this: earn more money in your current job; take on additional part-time work; increase your passive income, including through investing in shares or property; or start your own side-business.

- Proven strategies to get the pay rise you deserve

- How to start a side hustle you can sustain

- How can absolute beginners get started investing?

- Climb the property ladder to new year success

- 10 passive income ideas to up your game in 2022

Of course, income doesn’t necessarily determine how ‘rich’ you are. Often the higher the income, the higher the spend. Instead, focus on building true wealth by increasing the gap between what you earn and what you save.

Browne agrees that there are many ways to build wealth outside of earning a competitive income.

“Working on habits like cutting back on spending where you can and saving a regular portion of what you earn is a great start.

“Aim to put at least 20% of your income every month into a savings account and let this grow. Having a savings goal to work towards – such as buying a house – will keep you motivated to keep going.

“Because interest rates are very low, you might also want to consider investing some of your money elsewhere for the future.”

Trending

Sorry. No data so far.