For years I’ve been following Louis Christopher from SQM Research, who I reckon is one of our very best property analysts. Long-time readers will know I often quote him here and share his research.

But this time every year he issues what I think is the best property forecast for the year. It’s called Christopher’s Housing Boom and Bust Report for the next calendar year and has proven to be incredibly accurate over the years.

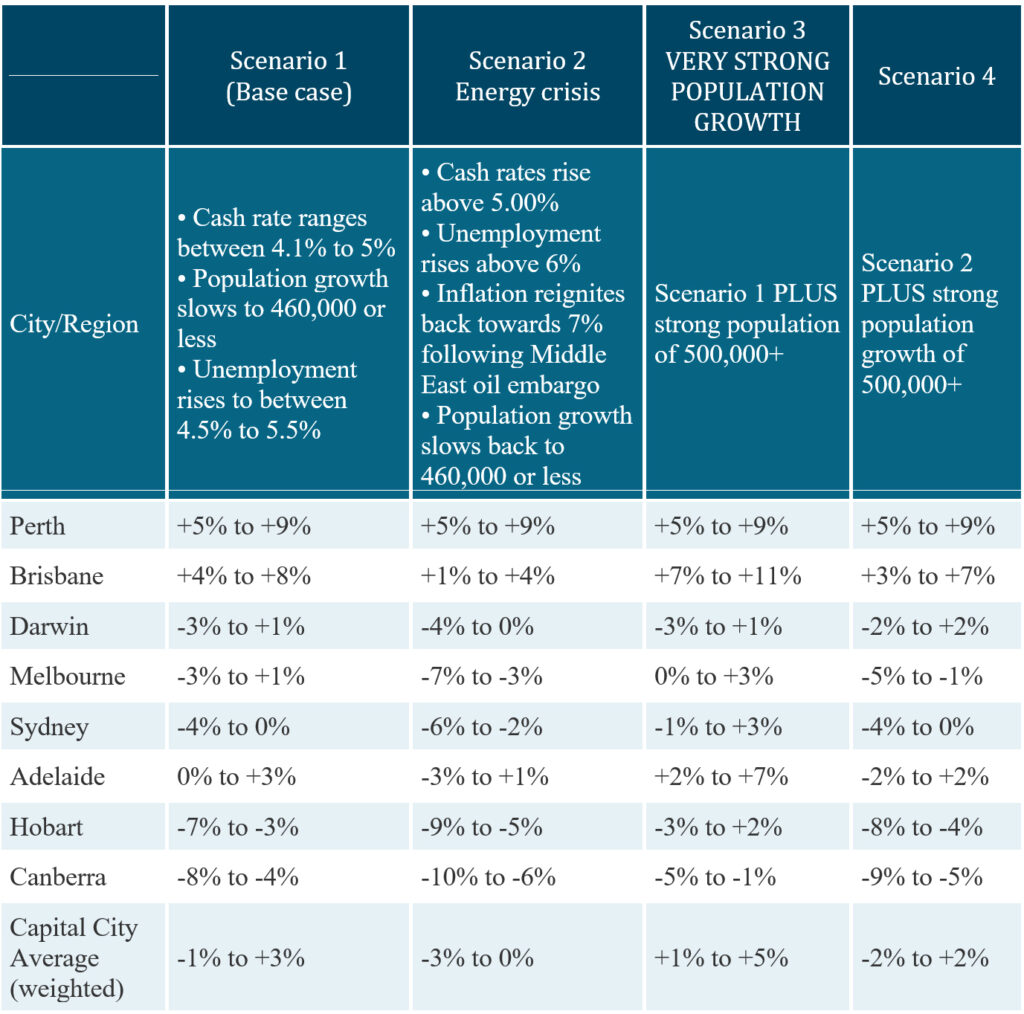

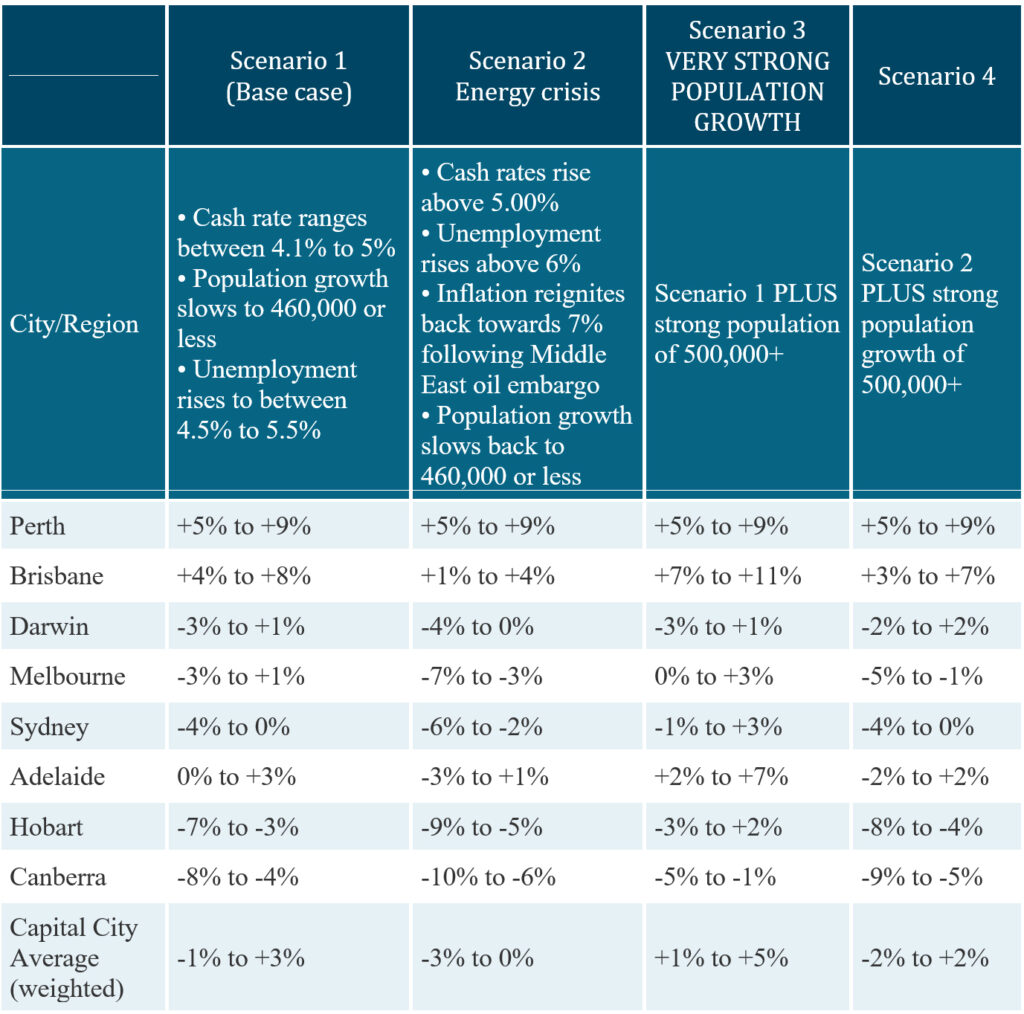

The 2024 Housing Boom and Bust Report was issued this week and it’s forecasting that Sydney and Melbourne property prices, which have been the star property markets over recent years, will fall next year. Only moderately, but they will fall from their record high levels as interest rates bite.

The base case forecast is for average national dwelling prices to change between a fall of 1 per cent to a 3 per cent rise. Perth and Brisbane are the only cities expected to record price rises, with each respective market driven by the tailwind of a recovering Chinese economy, and the resulting strong demand for base commodities such as iron ore.

In Perth in particular, when the mining industry is booming so is the property market.

But for much of the rest of Australia, the sharp deterioration of housing affordability – driven by ongoing interest rate rises which are now (in SQM’s opinion) at restrictive levels, plus an anticipated slower economy – will see a moderate correction in dwelling prices take place in Sydney, Melbourne, Canberra and Hobart. Adelaide and Darwin are anticipated to remain steady or record a minor rise/correction.

Source: Christopher’s Housing Boom and Bust Report 2024 , SQM Research

The rise in interest rates over 2022 and 2023, and possibly into 2024, will start to bite both homeowners and would-be home buyers alike. SQM Research expects a rise in distressed selling activity over next year and only the most cashed up willing to enter the market.

Sydney’s housing market is expected to record a moderate fall in dwelling prices of 4 per cent to 0 per cent. It is expected Sydney’s middle to outer rings for freestanding houses will record a greater correction. Sydney units are expected to outperform, and Sydney’s inner ring is still expected to record price rises as top-end property remains in demand from foreign investors.

2023 has recorded a significant deterioration in housing affordability for Sydney. Typical mortgage repayment to household income ratios have reached generational new highs and, based on the current Sydney median dwelling price ($1.1 million), have put housing out of reach for the majority of Sydney working adults.

Melbourne is also forecasted to enter into a modest correction with prices tipped to fall by up to 3 per cent. Like Sydney, Melbourne’s top end of the market is still expected to record price rises and units are also expected to outperform.

Canberra is forecasted to record the largest falls out of all cities with price falls anticipated of between 4 to 8 per cent. This is due to a combination of slower anticipated federal government spending plus an expected strong rise in dwelling completions (one of the very few cities recording accelerated supply of new homes built).

Louis’ forecasts are based on two important assumptions:

-

The rate of net short term and longer-term migration is expected to peak next year and then ease, so total population growth for 2024 falls back to around 460,000 people.

-

The rate of inflation is expected to continue to ease to back to between 3 to 4 per cent by the end of 2024.

But if Australia’s migration rates don’t slow as anticipated, this would likely mean SQM’s base case forecasts of a mild correction would not materialise. On the other hand, housing price falls could be greater if inflation were to accelerate to the point which forced the Reserve Bank to lift the cash rate beyond 5 per cent.

SQM has built out a scenario based on a second energy crisis, driven by current events in the Middle East. Such a scenario would force the RBA to lift interest rates more aggressively during 2024 and very likely trigger a sharp recession for Australia.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

A property for under $500,000 or a rental under $500 a week? Yes, they do exist

Trending

Sorry. No data so far.