The state of the US Government and American household debt is mindboggling.

In my newsletter last week I talked about how global credit rating agency Fitch had downgraded the US credit rating from Triple A to AA+ — only the second time ever that the US has been downgraded.

The reason was its huge level of Government debt and skyrocketing budget deficit. I gave some topline figures to show how bad America’s finances are.

This week a financial newsletter I follow in the US, The Kobeissi Letter, went into more detail on the state of the US Government and American household debt. It is mindboggling as to why this isn’t being tackled by US politicians.

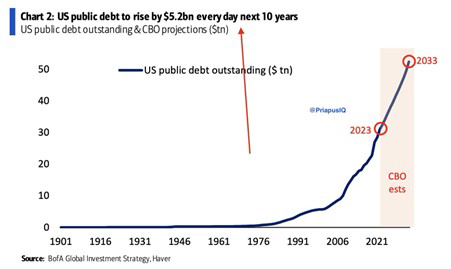

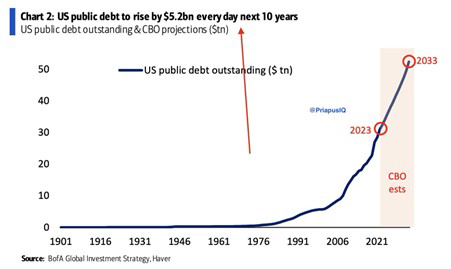

US debt rising $US5.2 billion per day

US debt is now on track to rise $US5.2 BILLION per DAY for the next 10 years.

By 2033, US debt is projected to hit a record $US50 trillion.

Over 20 per cent of government revenue will go toward interest expense ALONE.

Image: The Kobeissi Letter

So, that’s the debt situation. Naturally you solve debt by making budget surpluses to pay down debt. Pretty simple really. But it isn’t happening.

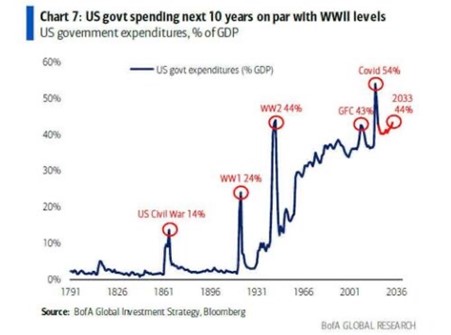

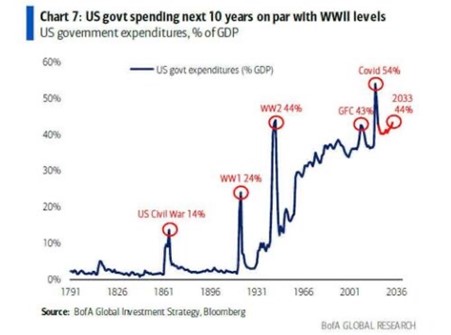

The US is now spending 44 per cent of GDP (the value of its economy) per year, the same levels as when it was on a war footing back during World War II.

In 2020, the US spent a record breaking 54 per cent of GDP in one year.

This is what Fitch meant by “fiscal deterioration” when they downgraded the US credit rating.

Current government spending is unsustainable. They are now spending a higher percentage of GDP than what was seen in the Global Financial Crisis in 2008.

Image: The Kobeissi Letter

US household debt a record $US17.1 trillion

But it’s not just the US Government with high levels of debt. US households now have:

- Record $US17.1 trillion in household debt

- Record $US12.0 trillion in mortgages

- Record $US1.6 trillion in car loans

- Record $US1.6 trillion in student loans

- Record $US1.0 trillion in credit card debt

Total mortgage debt is now more than double the 2006 peak.

Meanwhile, 36 per cent of Americans have more credit card debt than savings, while student loan payments are set to resume for the first time since 2020.

This is all while mortgage rates just hit 7.1 per cent and credit card debt rates hit a record 25 per cent.

Americans are “fighting” inflation with debt.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending