A large percentage of us are trapped in a debt cycle that is impacting our mental wellbeing. Now is the time to take steps towards a happier, healthier way of living.

Unfortunately, a many people are trapped in a debt cycle. With credit cards and personal finance products operating as a standard part of modern life, many of us don’t question the impact this vicious cycle has on our financial wellbeing.

In fact, having debts that you’re unable to manage well has been shown to have a devastating impact on mental health. Individuals with unmet loan payments suffer from depression more often than those without such problems. Unpaid financial obligations were also related to poorer subjective health assessments and health-related behaviour. Being unable to repay debt was also found to increase suicidal thoughts. So indebtedness can have serious and life-changing impact on people’s lives.

Seek help

If you are feeling overwhelmed due to debt (or anything in your life), please take advantage of the help that is out there. Don’t hesitate if you feel you are in danger – call emergency services on 000. If you are not in immediate danger, contact Lifeline on 13 11 14 for crisis support or contact the National Debt Line to talk to a financial counsellor.

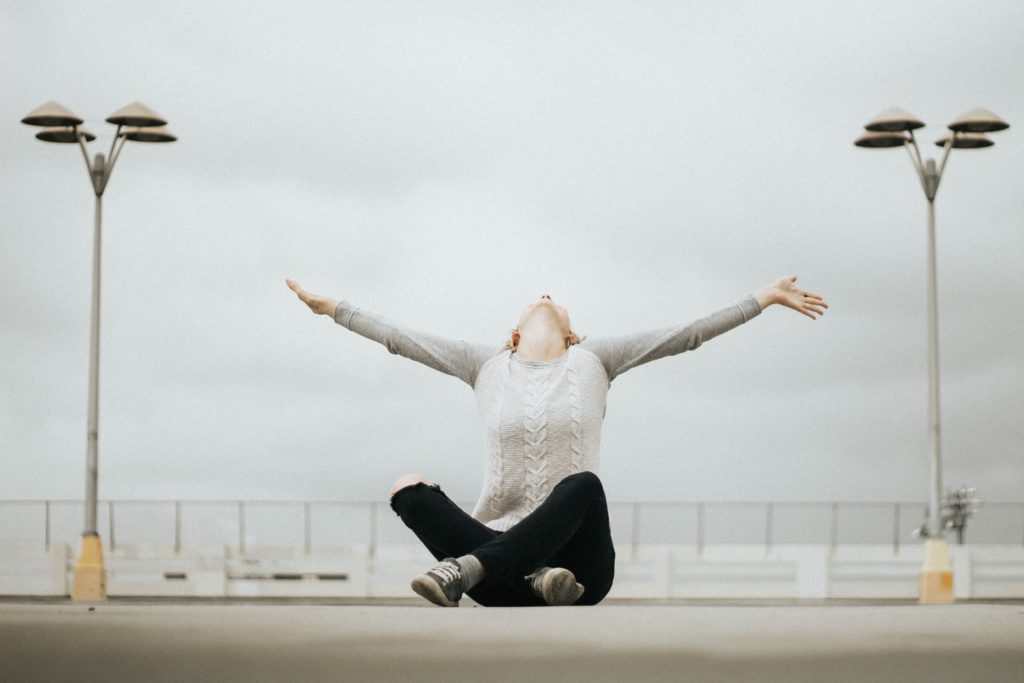

Otherwise, committing to make important changes can help you step out of the constant debt cycle and live a healthier life. Making active choices to break the debt cycle can have a positive impact on your mental health and general wellbeing. While debt can feel crushing and like there is no way out, taking steps to control your money can help you break out and gain financial freedom.

Recognise and accept

The first step is to acknowledge that being trapped in a debt cycle is limiting you and negatively impacting your financial and general wellbeing.

In fact, finances regularly top our list of worries. However, once you accept that you’re stuck, you’ll can make a decision to be empowered and inspired to do something about it.

The most important step? Making positive choices to point you in the right direction.

Understand how you’ve created your debt

Ultimately it comes down to one main thing: spending more than you have. Have you been buying things that you want rather than what you need? Are you relying on credit or loans to do so?

Living on credit allows you a certain type of lifestyle that you might not be able to afford otherwise. However, this also means that you’re constantly borrowing money and growing your debt.

Each month you’re becoming more reliant on this financial credit. It may seem like an essential for day-to-day life, but once you limit your spending to the bare necessities you’ll be able to dramatically decrease your credit usage and debt.

Commit 100% to making a change

Okay, so it might be tough at first, but you’ll need to commit yourself to breaking the cycle.

Stop using credit to pay for food and bills if possible, and cut out any ‘wants’ temporarily (or at least until you’ve paid off a large chunk).

Use cash for everything and if you go shopping, leave your credit cards at home.

Shop around to see if you can get better deals on groceries, service providers and any usual expenses.

Cut down on spending

Simply stop spending! After all, if you aren’t buying things then you at least aren’t increasing your debt.

Only buy the essentials. Start by writing down everything you spend your money on and question what expenses you need. What can you easily cut out?

By tracking this and monitoring the figures you’ll be able to cut back and make major savings. Once you stop adding to the debt then at least payments will stabilise and give you time to get into the habit of paying off more than the required amount each week.

Ask friends and family to help

To remove temptation completely try giving your credit card to a friend or family member so you don’t have easy access to it. Put ground rules in place. For example, if you ask to use your credit card then you’ll need to provide a good reason why you need it. By actually saying it out loud you might realise that you don’t really need whatever it is after all.

Of course, emergencies are an exception. And if you need a small amount of money quickly then you could always ask a good friend or a family member for a short-term loan (you have to pay off within a short-term agreed period).

This way you aren’t having to pay any more interest and you’ll be more motivated to make the repayment quicker.

If you’re accessing credit through an online lender, then you could try changing your password to something you won’t remember to create another obstacle. Or consider cutting up your credit card so you can’t increase the debt.

When you do manage to pay off your credit card then close your account completely. Live on cash for a year or so and then when you are ready only get a credit card with a small – and controllable – limit.

Use your savings to pay off the debt quicker

The best way to stop the debt cycle is to stop spending and get rid of your credit reliance. Then use any extra savings to pay off any debt you can.

See if you can earn a little extra money doing odd jobs locally or by selling anything from around the house you no longer need. It is a great opportunity to declutter!

Once you are free of debts, keep an eye on your spending to ensure you stay off the debt cycle. Make looking after your finances a regular part of your life and enjoy the feeling of freedom that finally being in control of your finances brings.

Trending

Sorry. No data so far.