Consumer sentiment is at near record lows and most customers are heading for the bunker. Not our farmers, though, who apparently have never had it so good.

It seems most of us are very glum at the moment. That’s according to the latest Westpac-Melbourne Institute Consumer Sentiment Index which fell another 0.4 per cent to 81 points in August.

Our sentiment (the way we’re feeling) it at near record lows… if the Consumer Sentiment Index is below 100 we’re gloomy, above that level we’re positive. We’re at 81.

That gloominess means any business dependent on consumer spending, particularly discretionary spending (non-essential) better be wary because their customers look to be going into the bunker.

It is easy to see why: Rising interest rates; the fixed rate mortgage cliff; high inflation; and big business starting to lay off staff.

The silver lining is that this downbeat consumer is exactly what the Reserve Bank has been wanting. Consumers going into the bunker means they don’t spend as much which, hopefully, then deflates inflation.

News for farmers is good

The news for Australia’s farmers is considerably better, however. According to Ray White Group chief economist, Nerida Conisbee, we’ve never had such good farming conditions as we did in 2022. While particularly good Australian weather conditions were the major driver, so too were poorer conditions elsewhere around the world.

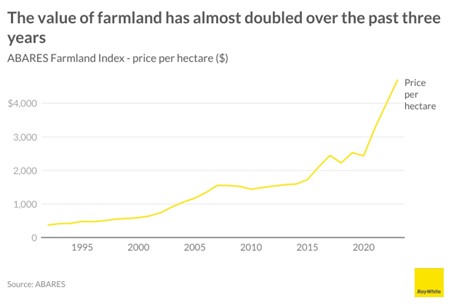

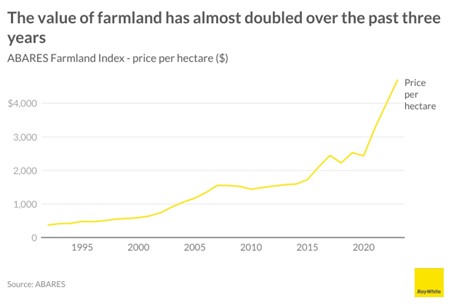

We were producing a lot, while others were producing far less. As we came out of the pandemic, people began spending more. The Ukraine conflict further complicated wheat markets. These factors resulted in total agricultural production exceeding $90 million and land values almost doubling in the past three years. Unfortunately, the outlook is more uncertain.

Wheat growing strong

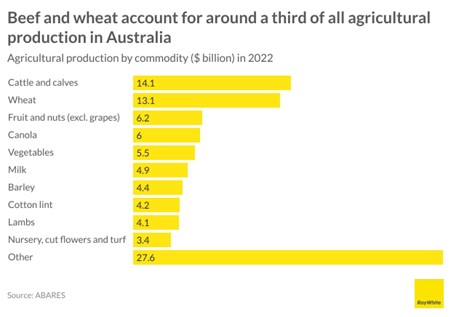

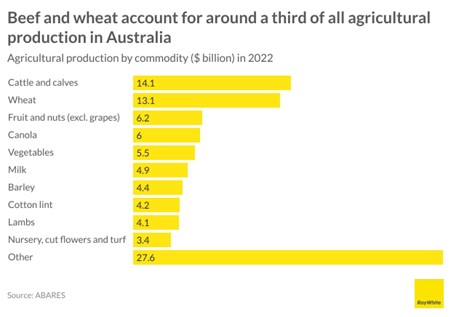

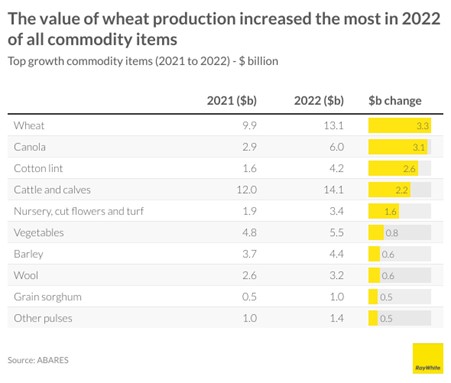

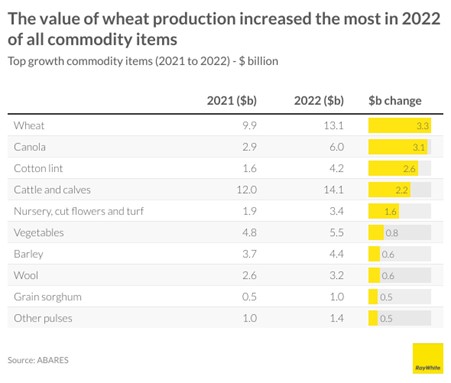

Australia’s two main agricultural products are wheat and beef, and these accounted for a third of all production by value last year. Wool, historically important for Australia, now doesn’t even make it into the top 10 commodities by value. Nursery cut flowers and turf became a higher value commodity, with $3.4 billion of production in 2022, compared to $3.2 billion for wool.

However, the top performer for growth in 2022 was wheat. The total value of wheat production increased by $3.3 billion in 2022, hitting an all-time high of $13.1 billion. Canola and cotton lint also saw large increases, more than doubling. This strong performance in wheat had a strong flow-on impact to farming communities and farm values. It also resulted in record house price rises in many wheat farming regions.

However, outlook set to wither in 2023

While last year was a record year, according to Nerida’s report, this upcoming year is set to be far less stellar. The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) has forecast that the value of agricultural production will fall by 14 per cent next year. Dryer conditions across Australia are the main driver, however better production overseas is expected to impact values.

Although wheat production is set to fall in Australia as weather conditions deteriorate, wheat prices are expected to rise. Putin has abandoned the Ukrainian wheat deal which ensures safe passage of wheat from that country. A subsequent drone attack on a wheat storage silo in a Ukrainian port city led to global wheat prices rising to their highest level since February.

Rice prices are also expected to rise rapidly with the Indian government banning all exports of non-basmati rice to deal with domestic shortages. India produces around a quarter of all rice in the world and is the world’s biggest exporter. This announcement is expected to result in the biggest global rice shortage in 20 years.

While it is now our highest value commodity item, cattle prices have halved from where they were in February 2022. Meat and Livestock Australia forecast that prices will continue to fall marginally over the rest of the year. More positively for the total value of beef, the national herd continues to grow and is set to be at its highest level in more than a decade.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Retail sales have slowed, but we’re not out of the woods yet

Trending

Sorry. No data so far.