A raft of changes are coming into effect from 1 July – here’s what the new policies will mean to your hip pocket.

The start of a new financial year brings an enormous number of changes… everything from superannuation and childcare to pay rises and paid parental leave.

RateCity.com.au has compiled a list of major changes that could see a material impact to your bank account.

Key changes include:

- Increase to the childcare rebate (from 10 July).

- Release of 50,000 new places in the Home Guarantee Scheme with wider eligibility conditions.

- Increase to electricity prices up to 25 per cent.

- Increase to the Super Guarantee from 10.5 per cent to 11 per cent.

- Increase the Age Pension Age to 67.

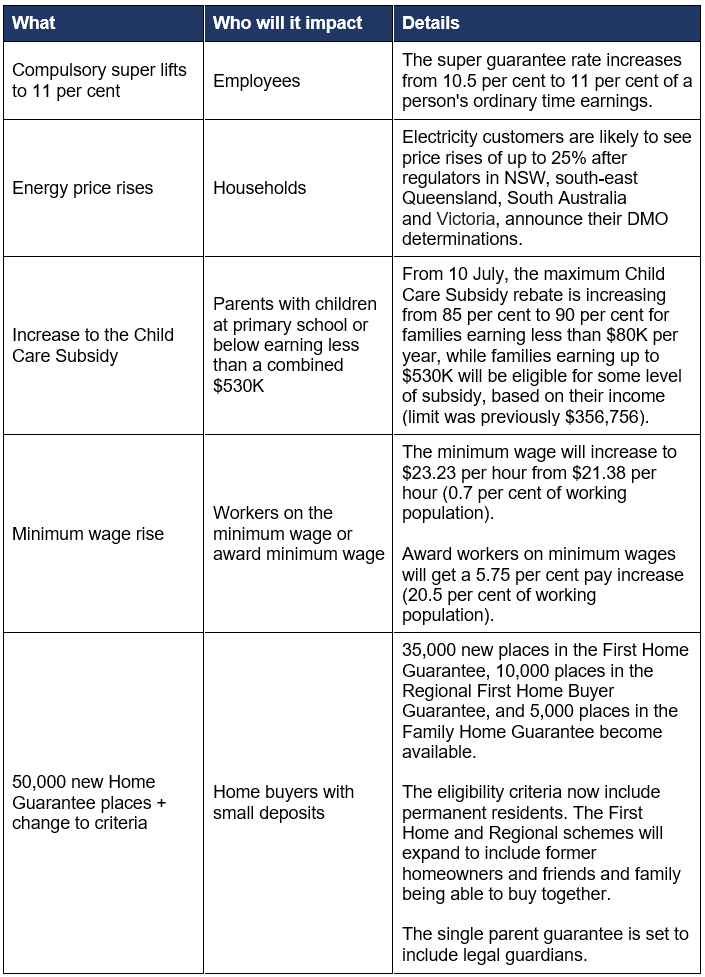

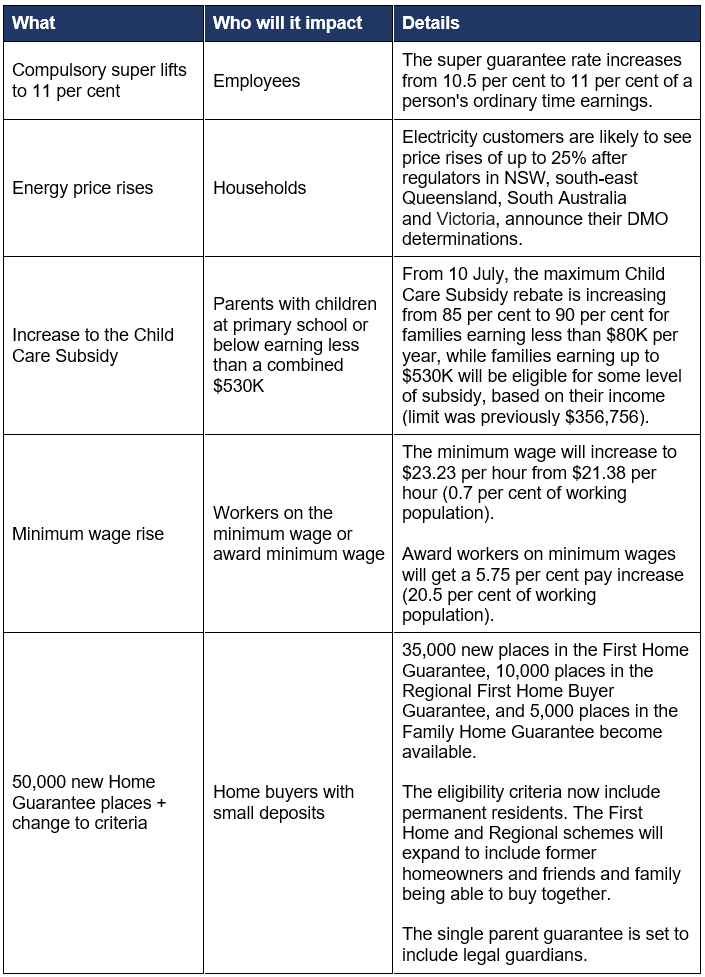

National changes that could affect your hip pocket 1 July 2023

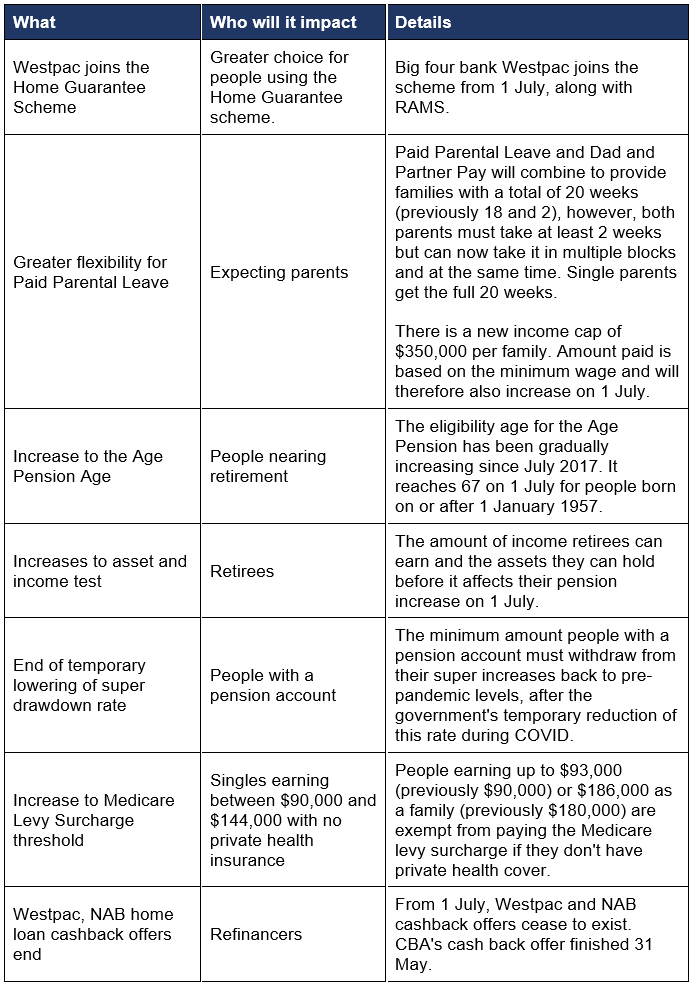

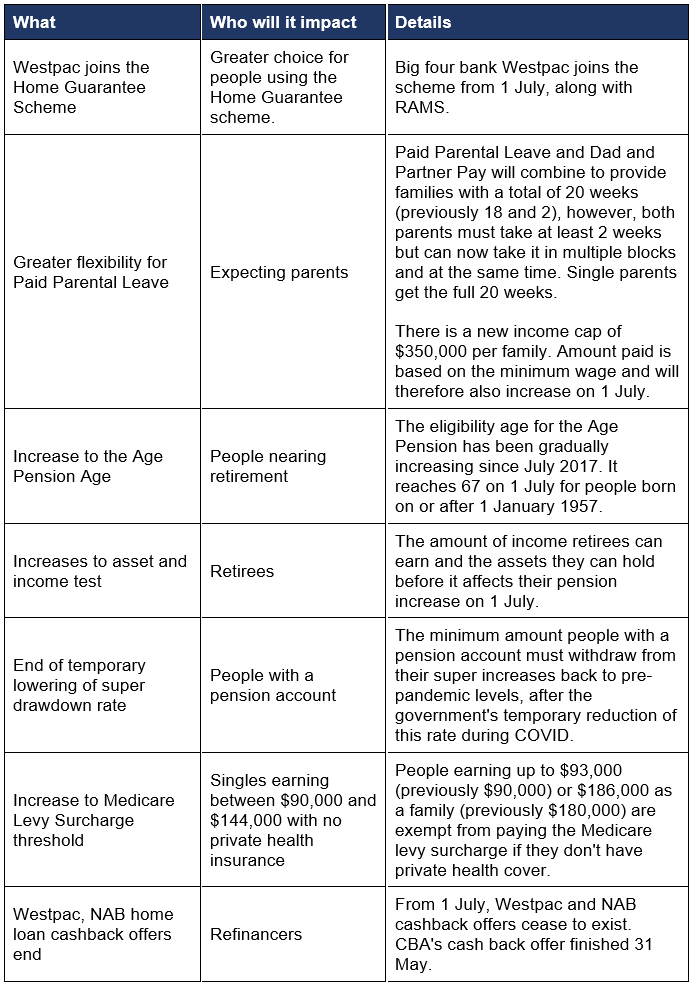

But wait, there’s more…

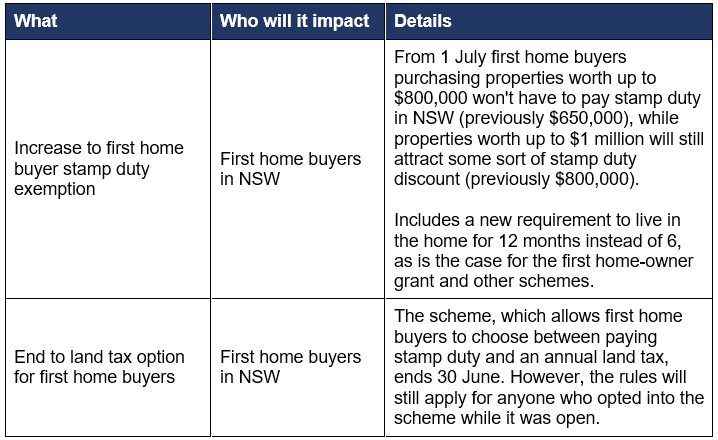

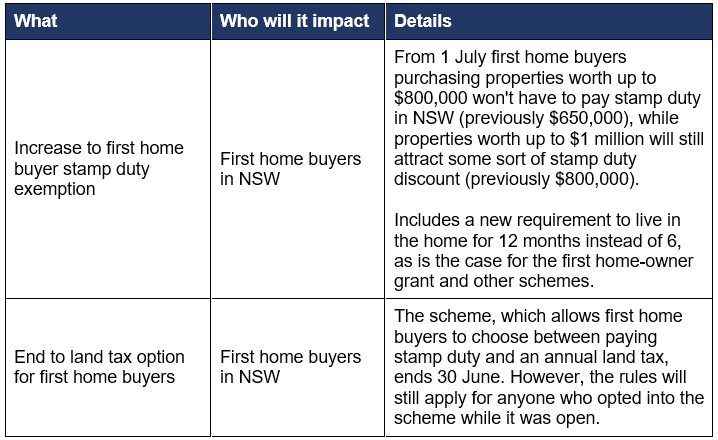

NSW changes from 1 July 2023

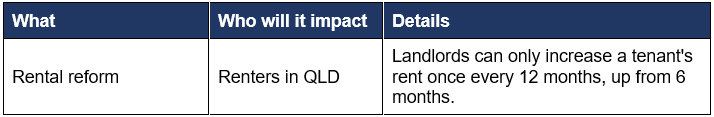

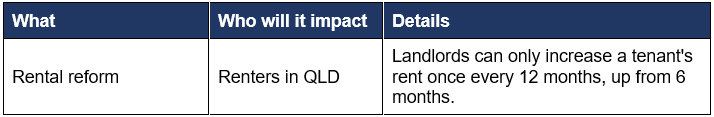

Queensland changes from 1 July 2023

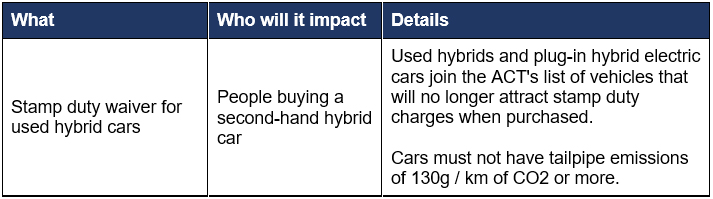

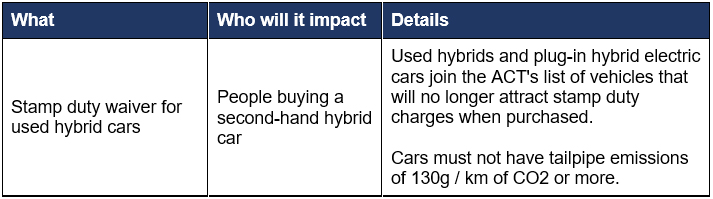

ACT changes from 1 July 2023

How to make the most of any extra cash

If you do find yourself sitting on a little windfall after the 1 July changes, don’t waste it. Use your extra cash to:

1. Pay down your debts

Trying to get ahead while you still hold debt is like pouring water into a bucket with a hole in it. Plug the bucket first by getting rid of any excess debt you’re carrying.

Some debt reduction methods to try:

- 4 steps to break out of the credit card rut

- Everything you need to know about debt consolidation

- 5 tips to get on top of your debt – and stay there

2. Invest in your education

Any qualification that will put you on a path to earning more money is a good investment in your future. You should also consider putting money towards improving your financial or property know-how as well. This might be in the form of buying books, attending seminars, workshops, a TAFE or industry qualification or even a university degree.

3. Invest in the sharemarket

Every little bit you can put towards building your portfolio counts. Setting up a regular direct debit (for example, the extra you’ll receive each month via the 1 July changes to the child care subsidy) into an ETF account is a good place to start.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.