Kids’ savings accounts are generally horrible when it comes to features and returns – but some are better than others.

As a father of four adult children and eight grandchildren, I’ve always been interested in kids’ savings accounts. Libby and I have always tried to instil good savings habits (with mixed success) into our kids and it starts with good financial behaviour.

What has annoyed us over the years is that kids’ bank accounts are usually horrible when it comes to features and returns. So it’s good to see RateCity.com.au has put over 50 kids’ savings accounts to the test to compare how they perform over time.

Traps catching young savers out

The rates available to young savers start at low as 0.1 per cent and climb as high as 3.5 per cent… that’s a massive range.

But RateCity’s analysis found the higher interest rates didn’t always deliver the biggest returns once all the fine print was factored in.

Some of the common traps catching young savers out were:

- Caps on overall balance

- Penalties if you withdraw money

- Minimum monthly deposits

- Age limits

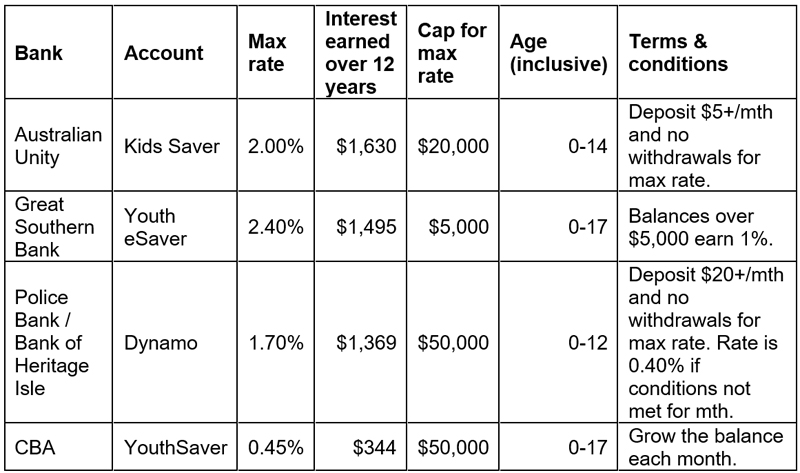

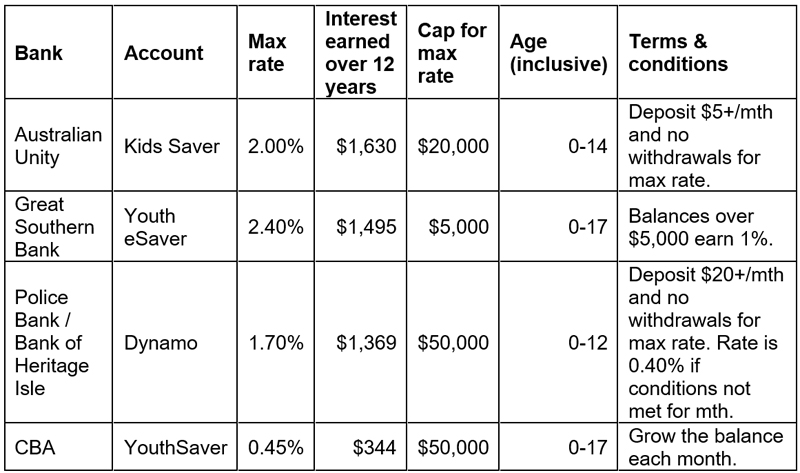

RateCity.com.au put kids’ savers to the test by calculating how much interest you’d earn if you opened an account for a child on their first birthday and deposited $20 a week until the day before their 13th birthday.

Once all the fine print was factored in, the account with the highest interest rate of 3.50 per cent earned barely any interest, because it was only available for kids aged eight and over and on balances of $1,000 or less.

Australian Unity had the third highest interest rate of 2 per cent, but earned the most interest – a total of $1,630. In this scenario the child would have a grand total of $14,150 in savings by their 13th birthday.

By contrast, CBA’s popular YouthSaver account earned just $344 interest over this time, with a total of $12,864 saved in the bank.

The highest earning kids’ savings accounts

Source: RateCity.com.au. Notes: Sorted by biggest return and based on depositing $20/week from age 1-12 (inclusive).

Tips to help you find the right kids’ savings account

- Plan how much you will deposit and withdraw: Start by thinking about how much you or your child are likely to deposit each month. Consider if you might need to make any withdrawals.

- Compare the top kids’ savings rates: Use a comparison site to look at what’s on offer.

- Read the fine print: Will your child be able to meet the terms and conditions? If not, try another account.

- Watch for the rate caps: Be aware that some accounts only pay the max interest rate up to a certain amount (for example $1K/$5K).

- Check if the app and website is easy to use: Read reviews online to help you know if the app/online banking is kid-friendly.

- Stay vigilant: Review your saving account every six months to make sure you’re getting a good rate.

Trending

Sorry. No data so far.