The stage three tax cuts continue to be a talking point for next week’s first Labour Budget. But should they be?

Federal Treasurer, Jim Chalmers, brings down his first Labor Budget next Tuesday. He has certainly been preparing us with dire forecasts of a global recession and tough economic times ahead due to high inflation (which will be exacerbated by the current floods hitting crops).

The big talking point is whether he will ditch the planned stage three tax cuts. These will scrap the 37 per cent marginal tax bracket and lower the 32.5 per cent marginal tax rate to 30 per cent.

Remember these cuts don’t start until July 2024, so they are a way off and really no firm decision needs to be made on them for another year.

The recent UK tax cuts were a disaster

The UK economy was sent to the financial brink last month when the new (now former) PM introduced immediate tax cuts.

That was such a stupid idea and no wonder the British pound collapsed. You don’t fight inflation by putting more money into the economy through tax cuts. It forces the Bank of England to lift interest rates to get that money back out of the economy. And recession follows.

The UK quickly reversed the decision.

But Australia’s stage three tax cuts are different because they are still 18 months away from taking effect. By then inflation is hopefully under control and the RBA is cutting rates to stimulate the economy, which could be done in tandem with the tax cuts.

Australia’s highest marginal tax rate is high indeed

Australia Institute analysis shows 600,000 high-income earners making more than $200,000 will receive a tax break of $9075 per year under stage three tax cuts, which are estimated to cost the budget $243 billion in lost revenue over a decade.

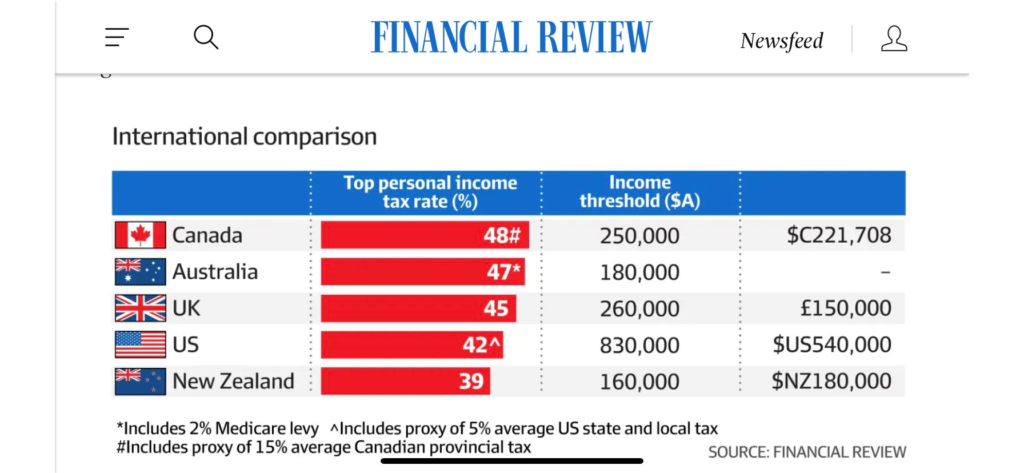

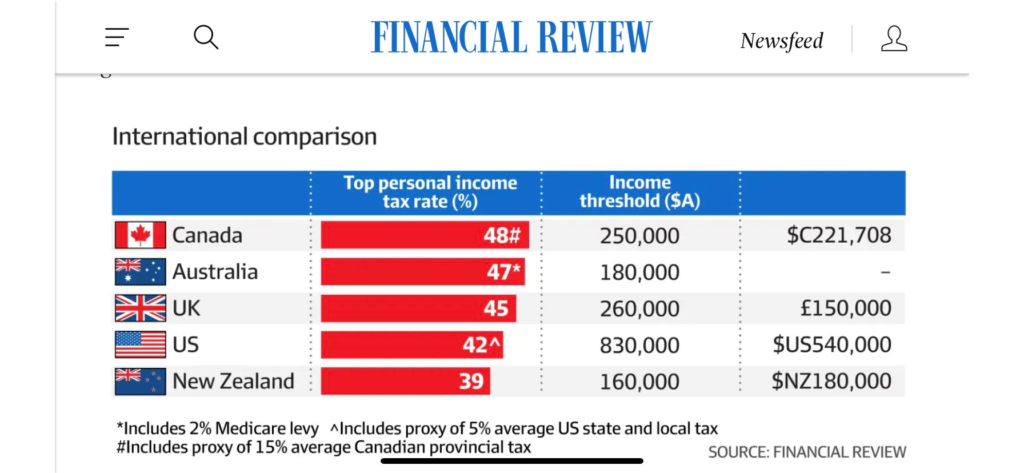

This table in the Australian Financial Review shows just how high our highest marginal tax rate is… and how low the income threshold is to get there.

Australia’s top tax rate highest in the world. Source: Australian Financial Review

Overall Australia is a fairly low-taxing country by international standards, but taxes on personal income is comparatively large.

When adjusted for currency and in Australian dollar terms, our highest tax rate kicks in substantially earlier than in Canada ($250,000), the UK ($260,000) and US ($830,000). In New Zealand, the maximum tax rate starts at $160,000 in Australian dollar-terms, but it’s only 39 per cent – Australia’s is 8 percentage points higher at 47 per cent.

OECD data reveals just how much we pay

An international comparison Organisation for Economic Co-operation and Development (OECD) also showed that only Denmark raises more revenue from the personal income tax base than any of the 30 wealthier economies.

The organisation found that relative to the OECD average, the tax structure in Australia is characterised by:

- Substantially higher revenues from taxes on personal income, profits & gains, and higher revenues from taxes on

corporate income & gains; payroll taxes; property taxes; and goods & services taxes (excluding VAT/GST). - A lower proportion of revenues from goods and services tax.

- No revenues from social security contributions.

Trending

Sorry. No data so far.