Here are two clear signs that things are looking pretty good for the Australian economy right now.

1. We’re coping with the interest rate increase impact on our home loans

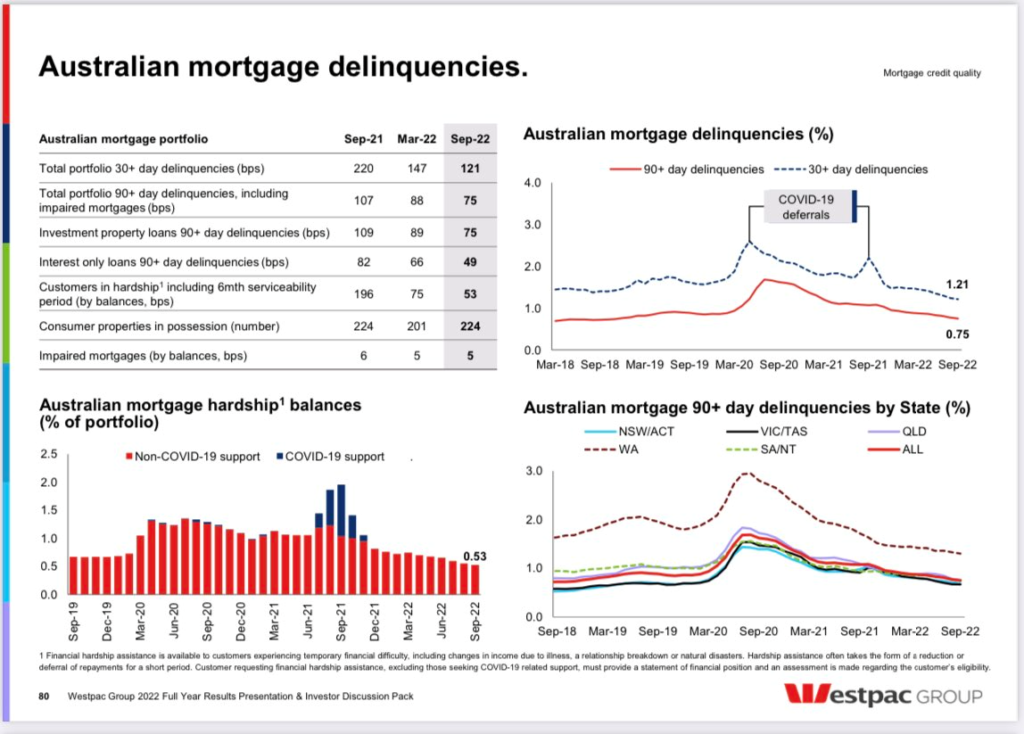

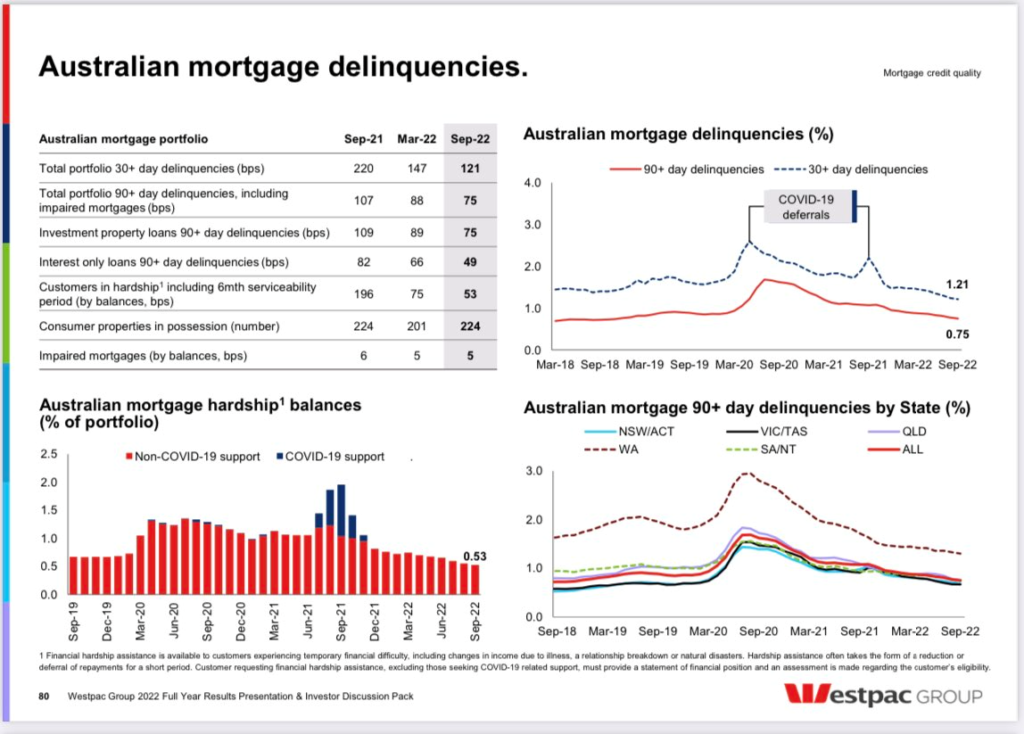

When Westpac declared their disappointing earning result this week – which hammered its share price – I was interested in the page summarising the state of the loan book and how borrowers are handling the rate increases.

Now I should warn you that the mortgage cliff of borrowers reverting out of fixed loans to variable loans hasn’t really started yet and things could change over the next six months when that happens… but so far borrowers seem to be well on top of their repayments and coping pretty well.

Despite all the hysterical headlines of “mortgage prisons”, the number of borrowers who are 30 or 90 days in arrears of their repayments is low and continues to fall. And that’s pretty consistent across the country – except in WA where delinquencies are by far the highest.

2. We’re paying down our credit cards

Remember that graph a little earlier of sharply rising credit card debt and falling savings in the US?

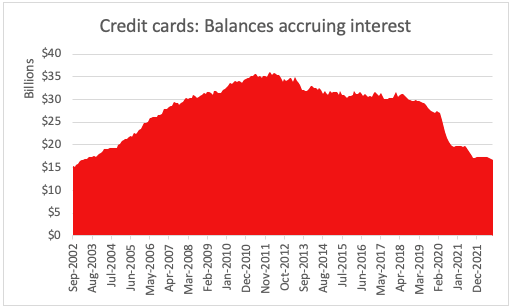

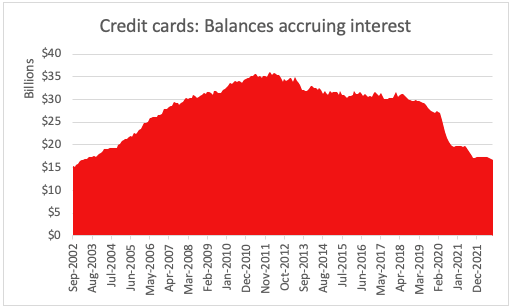

Here in Australia, credit card debt from Australian households attracting interest charges has fallen for the third month in a row, despite the RBA rate hikes.

Data released by the RBA for the month of September shows the total credit card bill for households dropped by $144.2 million to $16.80 billion, which is the lowest level since March 2003 almost 20 years ago.

The number of actual credit card accounts also dropped slightly and has been dropping for the last 15 months. It appears not only are Australians getting savvier about their cards, they also seem to be getting rid of them.

Tips to pay down your credit card

1. Rework your budget

Look at your spending habits to work out where you can make easy cuts to save money.

Those savings can then be used to reduce your debt quicker. Once the card is paid off, you’ll be able to put the money you were paying your credit card down with towards supercharging your savings.

2. Repay more than the minimum

If you only make the minimum repayment each month, you’ll get nowhere.

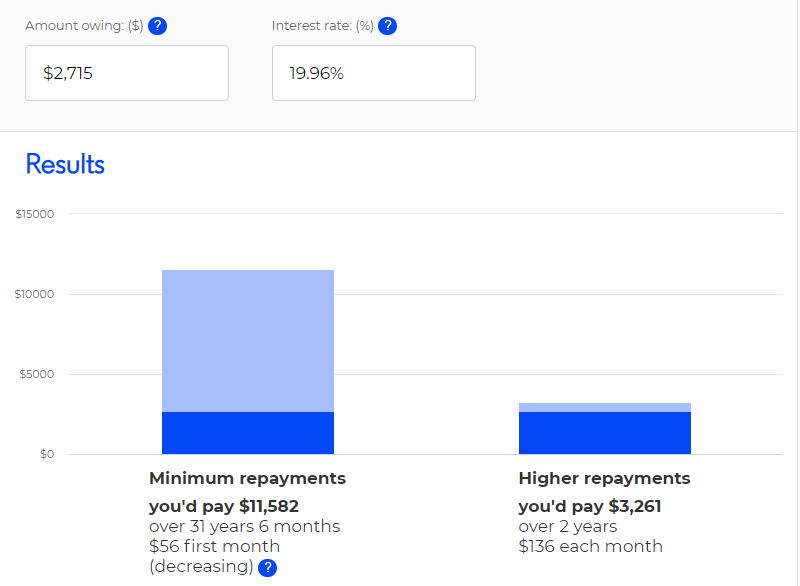

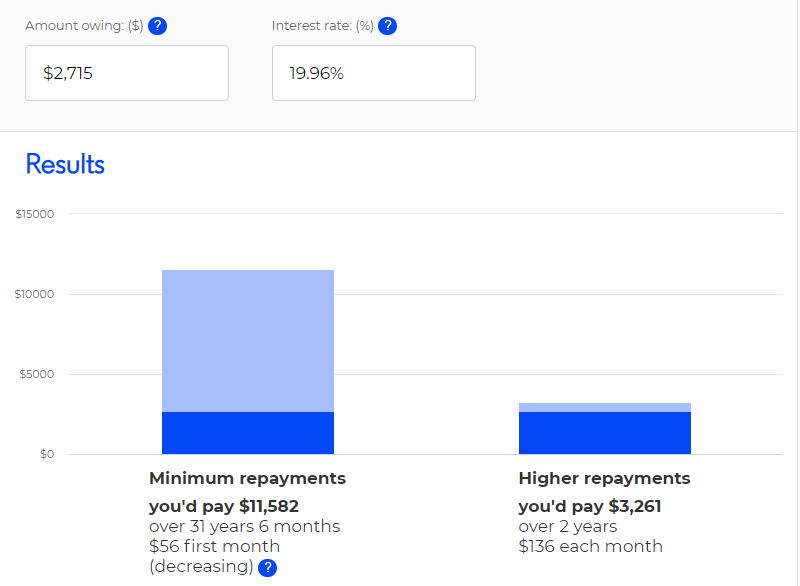

I’m serious… it would take you over 30 years to pay off the average Australian credit card debt of $2,715 making minimum repayments.

Source: moneysmart.gov.au credit card calculator

Pay as much as you can above the minimum every month to manage your credit card better and ditch your debt as quickly as possible. In the above scenario, paying an extra $80 a month means you’d pay the balance off in two years and save yourself a huge $8,321 in interest. Find that extra $80 a month or more, no matter what.

3. Arrange a balance transfer

Many banks offer you an interest free deal if you take out a new credit card with them and transfer the balance of your existing credit card to the new one.

This can be a highly effective way to get some breathing space and make a real dent on your debt.

Just do one thing for me.

When that new card arrives, cut it up. Whatever you do, don’t spend a cent on it.

Any new purchases on the card will incur interest at the usual exorbitant rate, but your existing balance won’t. So, if you avoid using the card, you can pay off what you owe without any extra charges.

4. Get a loan

It might sound counterintuitive, but if you have multiple credit card debts incurring interest, consolidating them by taking out a lower interest rate personal loan can save you money.

Plus, you don’t get the temptation of extra credit purchases.

Again, just make sure to cut those cards up once they are paid off.

Trending

Sorry. No data so far.