Australian micro-investing accounts grew by 123% during the last year – the fastest rate of growth on record. Here’s everything you need to know to join the buzz and get started micro-investing.

What started out as a niche category under five years ago is really catching on. Micro-investing means you invest very small amounts of money over time into an investment portfolio. To get started, you don’t need to know a lot about investing, or even have a lot of money. It basically makes the sharemarket accessible to everyone.

A newly released report from Cache has shown that almost double the number of Australians hold micro-investing accounts (1.29 million) than ASX-listed ETFs (720,000 accounts). That’s over 11 per cent of the 6.6 million Australians who hold listed investments generally.

Caleb Gibbins, CEO of Cache, believes that the low barriers to entry are what’s driving the increased take-up of micro-investing products. “Most people have never invested before, often because they think it’s complex, difficult and scary. But they do save money, and they like the idea of getting an investment return,” he says. “Micro-investing products help people start small (below $500) and grow by regular deposits over time. These products can feel more like a savings product that produces an investment return, than an product to invest significant sums in one hit.”

Micro-investing apps and products

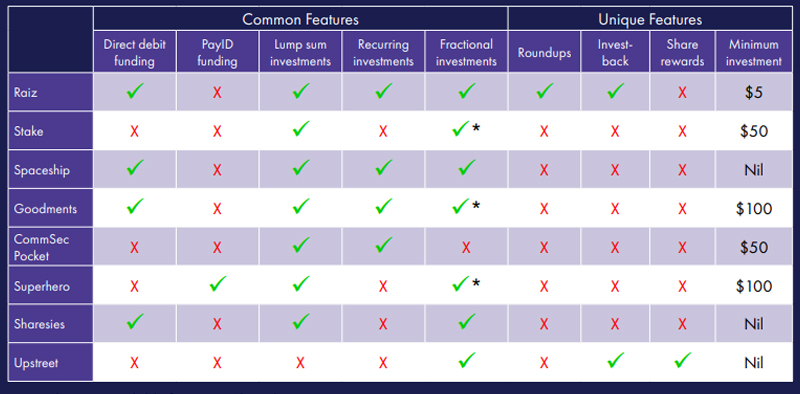

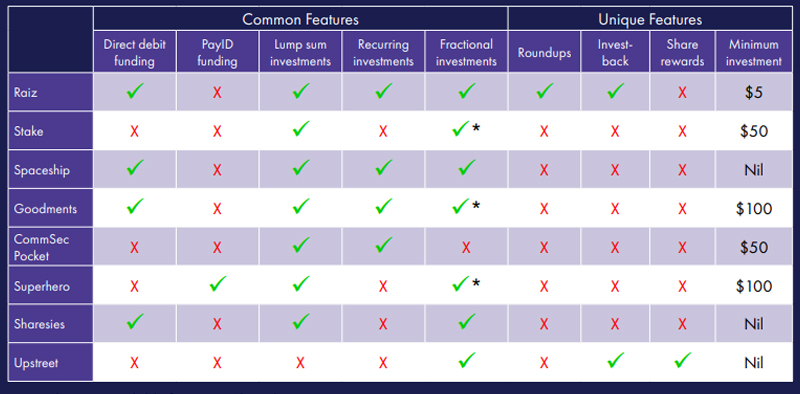

There are now eight micro-investing products in the market, with three introduced this year alone. Cache has put together a handy chart to showcase who is offering what and how.

Source: Cache Micro-Investing Report 2021 [Supplied]

Gibbins notes the difference between these user-friendly apps and traditional stockbroking paths. “New investors can struggle with the volume of information and options available through these platforms,” he says. “Cash-flows on small amounts are difficult, with brokerage sitting around $10 or more, minimum parcel sizes at $500, trades only open from 10am – 4pm, and the investor needing to pre-fund a dedicated brokerage bank account.”

By contrast, with a micro-investing app, it’s just a matter of selecting the one that best suits your needs, signing up and you’re good to go.

Jump in and get started micro-investing

Here’s a rundown on what the basic offering is from each app to help you choose what will work best for you.

Raiz

The first micro-investing app to enter the Australian market in 2016 (then known as Acorns) and the current market leader. Raiz is known for it’s user-friendly interface and low barriers to entry – you can get started for as little as $1.

A particularly attractive feature of Raiz is Round-Ups. It basically invests any ‘loose change’ by rounding up to the next dollar your everyday purchases from a linked spending account. You likely won’t notice these small amounts leaving your account, but they’ll add up over time.

In January Raiz introduced five risk-weighted investment options to customise their portfolios:

- Conservative

- Moderately conservative

- Moderate

- Moderately aggressive

- Aggressive

There’s also two custom portfolios:

- Emerald – made up of ‘socially responsible’ ETFs

- Sapphire – which steps up the aggressive option by including exposure to Bitcoin

Not only does this kind of customisation work with an individual’s investment risk tolerance, it also gives you more choice in what you’re investing in.

Spaceship

Spaceship has been around since 2018, and has more than 175,000 Australian investors. It’s particularly tailored to anyone getting started in micro-investing as there’s no minimum investment. Meaning you can start with just a spare $1. You can invest a lump sum, or set up a regular weekly, fortnightly or monthly to-up.

Spaceship offers three different portfolios, each made up of shares from different companies across Australia and countries like the US and China. You can’t customise the investment portfolio (common in low-entry micro-investment offerings). The three portfolios are:

- Origin Portfolio – a passive indexed fund made up of the top the top 100 Australian listed companies and top 100 international listed companies, based on market capitalisation.

- Universe Portfolio – a managed portfolio of what Spaceship deems “world-changing companies”, like Spotify, A2 milk, Adobe, Uber, Ramsay Health, Apple, and Tesla.

- Earth Portfolio – an actively selected ethical fund of 30 to 50 companies that Spaceship finds have a positive impact on people and the planet. Think of areas like poverty, climate change, and quality education.

Each of these portfolios also invests directly in the companies that make up its strategy rather than investing via ETFs.

Sharesies

Sharesies is the new kid on the block, offering another super low cost way to get started micro-investing. It started in New Zealand in 2017, aimed squarely at new investors with no experience in sharemarket investing.

It’s the first app on the Aussie market that lets you invest in multiple markets (ASX, NZX, NYSE, NASDAQ, CBOE) with no minimum investment amount. Literally one cent will get you started.

You’re charged a brokerage fee of 0.5 per cent for amounts up to $3000 and 0.1 per cent for amounts above $3000. So, when you place an order of $100, Sharesies deducts a $0.50 fee and the amount invested is $99.50. (Not sure how they charge on their one cent minimum investment…) They’ll also charge you currency exchange fees and ETF management fees.

Goodments

Aimed squarely at millennials getting started in micro-investing, Goodments invests solely in ethical companies that they consider are doing good in the world. The company was founded in 2017 by Emily Taylor and Tom Culver, who spotted a gap in the Aussie investment market. Then Douugh (ASX: DOU) bought them out in April this year.

You can invest in over 2,500 individual international shares and diversified ETFs that track indexes and focus on things like technology, climate and equality. You can actively choose areas you don’t want to support as well. Users then buy shares and track the financial and sustainability of their investments over time.

Minimum trade is $1, there are no brokerage or bank charges. However, you’ll pay an FX rate on deposits and a standard forex fee of 0.99% margin on any funds transferred between AUD and USD (note, your Goodments trading account is held in USD).

CommSec Pocket

The CBA’s micro-investment offering will appeal to anyone who likes knowing there’s a ‘big Aussie bank’ behind their transactions. Fifty bucks will get you started buying units in seven themed ETFs. The seven options are:

- Aussie Top 200 – this is the blue-chip conservative option that let’s you invest in 200 of Australia’s biggest companies.

- Aussie Dividends – earn an income along with your capital gains by investing in companies that are known for paying above-average dividends.

- Global 100 – exactly what it says on the tin: exposure to 100 of the world’s best-known blue-chip brands.

- Emerging Markets – 800+ companies in fast-growing economies like China, Taiwan, Korea and India.

- Health Wise – invest in medical innovation via 100 selected companies.

- Sustainability Leaders – invest with a clearer conscious in sustainable, ethical companies.

- Tech Savvy – join the cool kids by investing in the biggest tech innovators and non-financial companies on the NASDAQ.

The seven options make investing simple, as does the financial structure of the app. There are no account keeping fees, but you’ll pay a flat $2 for each trade up to $1000 or 0.20% of the trade value for trades over $1000. Similarly, an ETF management fee is also deducted from the ETF unit price (ie, not out of your pocket).

If you’re just getting started micro-investing, CommSec Pocket has an extra benefit, too. And that’s its huge range of in-built articles, tips and investor case studies that will quickly help you grow your investing knowledge and confidence.

Superhero

Superhero entered the Australian market in late 2020 with a bullet. You’ll need $100 to get started, which is higher than most offerings, but still an accessible entry into the sharemarket. Especially when Superhero offers the same level of trading as standard brokers, who generally have a starting value of $500 per trade.

Superhero also offers a more full-service brokerage compared to other micro-investing apps. In other words, you should have better control over your investments.

They’ll charge you $5 to trade ASX shares and ETFs and $0 brokerage to trade US shares. In addition, there’s a flat FX transfer fee of 0.5 per cent.

When it comes time to pay, it’s the only app that offers PayID funding. This brings an added level of security and flexibility to paying for your investments.

You can invest in individual Australian or US shares, or select from themed portfolios and ETFs:

- US Tech Giants

- Asia Technology Tigers

- Global Sustainability Leaders

- ASX 200

- Global Healthcare

- Battery Tech and Lithium

- Robotics and AI

While Superhero is a complex offering, it’s really easy to use. Above all, it’s a great option for anyone who hates all the investment jargon as they excel at plain-English explanations of complex concepts and offer clarity every step of the way.

Stake

Stake is one of the largest stock trading apps that provides users access to the United States share markets without needing a US trading account.

Through Stake you can trade 4,500 US stocks and ETFs listed on the NASDAQ and Dow exchanges with no commission. You can also buy fractional shares and they’ve even automated US tax form completion, which saves a ton of time.

There’s a $50 minimum investment and they’ll charge you an FX fee both for deposits and withdrawals of 70 basis points, or a minimum $2 for Australian/New Zealand customers.

Upstreet

Upstreet is brand new to Australia. It’s a unique offering in the micro-investing space that truly makes the sharemarket effortless.

You simply sign up and buy something from a participating brand. Then each purchase rewards you with tiny shares in that company, or a nominated company. In other words, customers build fractional share ownership with every eligible purchase without spending an additional cent. Making it the prize winner for ‘most effortless way to micro-invest’!

To use Upstreet, you connect the Visa, Mastercard, PayPal or bank account you use for shopping via open banking platform Basiq, which is considered a secure connection. After that, there’s plenty to spend your money on. For example, brands currently connected to the app include Bing Lee, Virgin Wines, eBay, booking.com, The Good Guys and Platypus. Happy micro-investing!

Trending

Sorry. No data so far.