Interest rates are a blunt instrument, but governments have more options to help fight inflation. They’re just not using them.

The Reserve Bank boss, Michele Bullock, recently said interest rates were a “blunt instrument” when it came to fighting inflation. In other words, the impact of interest rate rises can be a bit of a sledgehammer in dampening the economy to keep inflation down. But it’s the only instrument the RBA has at its disposal.

The other inflation-fighting instruments are held by governments in terms of fiscal policy.

Governments can cut spending to dampen the economy but they don’t want to make those hard decisions. They want to be seen as the good guys and are very happy to paint the RBA as the bad guys.

I’ve made this point many times. Federal Treasurer Jim Chalmers can’t promise everyone a big pay rise and then grumble about high inflation and the need to bring it down through higher interest rates. Those wage rises feed into inflation which then causes rates to rise.

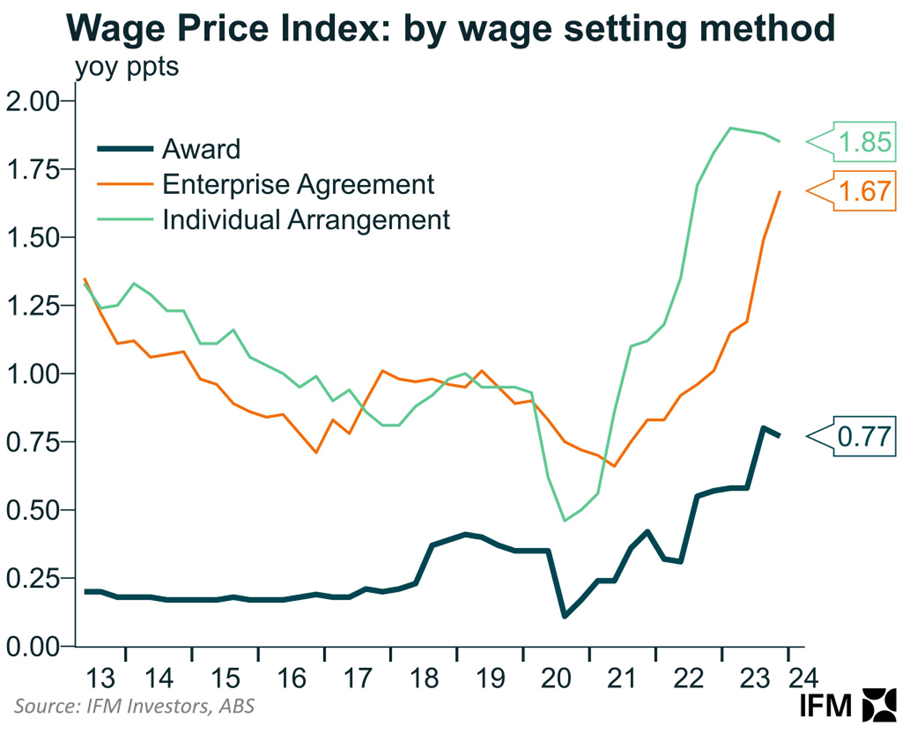

Public service pay rises are driving the data

This week’s wages data is a classic example. Wages rose by 0.9 per cent in the December quarter and 4.2 per cent for the year – above expectations and above the September quarter figure of 4.1 per cent.

What’s driving the increased wage growth is government pay rises to public servants, which are outweighing pay rises in business. In the December quarter public service wages rose 1.3 per cent while wages in business were up 0.9 per cent.

The key driver of growth in the public sector was new enterprise agreements for essential workers linked to NSW and Queensland state wage policy outcomes. The NSW government provided wage increases of 4.5 per cent and the Queensland government 4 per cent.

Eligible jobs in Queensland also received top-up payments from a “Cost of Living Adjustment” in addition to the wage increase. NSW teachers also saw historic pay increases in the December quarter of between 8 and 12 per cent. As a result, public sector wages in Queensland rose by 5.4 per cent (the strongest of all the states and territories) while NSW public sector wages rose by 4.9 per cent – up from 3.2 per cent in the September quarter.

It becomes a vicious cycle

I know we all love a pay rise, but it is a delicate balance for the economy as it feeds into inflation and then the RBA thinking on whether another rate rise is needed.

But my point is governments need to do some of the heavy lifting to fight inflation and not simply leave the hard decisions to the Reserve Bank.

However, it’s a real economic chicken and egg dilemma. Wages are up, but so is inflation and inflation destroys the purchasing power of wages.

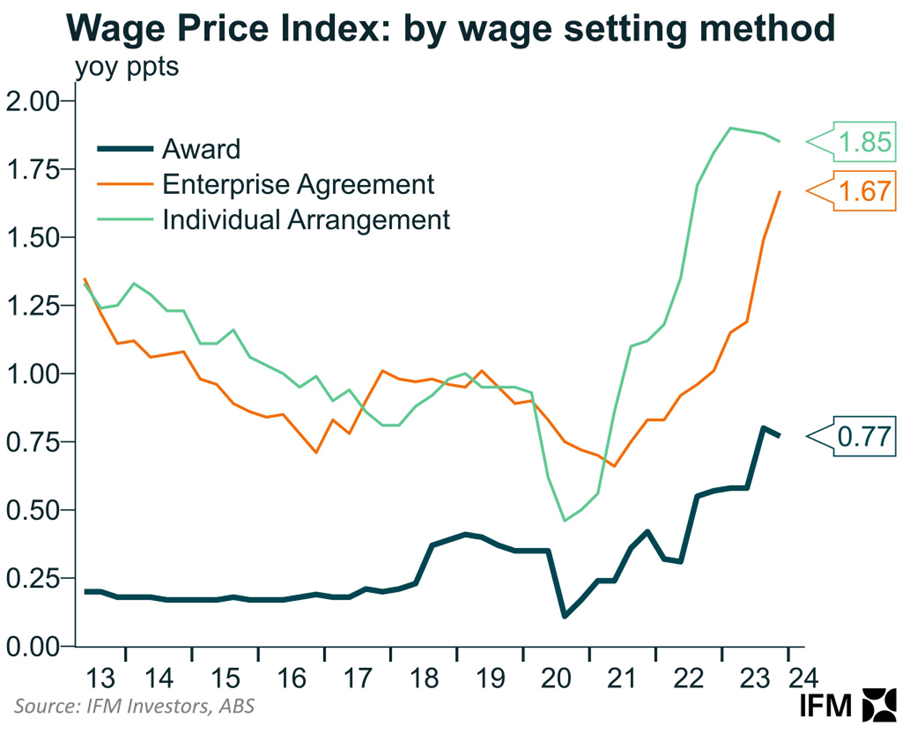

Look at this chart which shows “real wages” (which are wage rises less the inflation rate):

Wage rises in terms of the value of what they purchase have been falling. In other words, the dollars in your pay packet are buying less because prices for the goods and service you buy are rising at a higher rate.

The problem is that wage rises given to keep pace with inflation are themselves feeding into inflation and eroding your purchasing power even more. It is a vicious cycle.

Again, that’s why governments need to use other measures to fight inflation and break the cycle.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.