Comments in the latest RBA Board minutes shows they don’t just want inflation to slow, they want it down at a faster rate.

Mark this Wednesday in your calendar. That’s the day the September quarter Consumer Price Index (CPI) will be released at 11.30am. That single figure will determine whether the Reserve Bank lifts interest rates or not at its next board meeting on Melbourne Cup Day.

The release of the Board minutes from the last RBA meeting indicate they have their finger on the trigger and they are more than ready to move.

The minutes said:

-

“The monthly CPI indicator suggested that progress in lowering services price inflation remained slow.”

-

“Some further tightening of policy may be required should inflation prove more persistent than expected.”

-

“The Board has a low tolerance for a slower return of inflation to target than currently expected.”

RBA want inflation to slow – fast

That last comment was a new one in the minutes and has markets on edge. It shows the RBA is not just wanting inflation to slow, they want it down at a faster rate.

They are concerned that rising property prices will make consumers feel rich and encourage them to go out and spend more, fuelling inflation.

The minutes noted rising home prices, “could support consumption by more than currently assumed” and, “the rise in housing prices could also be a signal that the current policy stance was not as restrictive as had been assumed”.

The RBA has for a while now been saying the inflation figure and the strength of the jobs market are its two main concerns. So Wednesday’s CPI is crucial because yesterday’s employment figures sent a mixed message.

There was a small increase in new jobs of 6,700 in September which was less than the 20-25,000 forecast by analysts. That figure, on its own, seemed to indicate that maybe the job market is softening.

But a surprise fall in the participation rate (proportion of the population in work) meant that the unemployment rate dipped from 3.7 per cent to 3.6 per cent… which by itself shows a strong job market.

Normally 37,000 new jobs need to be created each month to keep the unemployment rate steady on an unchanged participation rate.

What you need to know

Right now (pending Wednesday’s CPI data) the case to sit tight on rates remains pretty strong. The job market is showing signs of cooling and spending is down, so we may be spared another rate rise in November.

But we’re not out of the woods yet. The RBA won’t take the possibility of a rate rise off the table while inflation remains high.

There are also concerns about the rising cost of fuel, which not only impacts the cost of commuting but also the cost of delivering goods and essentials.

It’s really important that progress does not begin to backslide, but we don’t want to see the scales tip too much.

Any decision to raise interest rates should not be taken lightly, as major spending cuts and job losses could be very damaging to the economy.

Should you be worried?

Mortgagees are in a lot of pain with repayments increasing to 9.9 per cent of household disposable income in August. The RBA has reported that’s above the previous estimated historical peak.

Most households are treading water and should be able to keep their heads dry, but a big lift in unemployment could be catastrophic.

It’s not yet time to panic but it’s safest to prepare for all eventualities. Now is a good time to build up your rainy-day fund and search for savings in your everyday expenses. That’s the best defence against inflationary price hikes!

So what next?

If you’re coming off the fixed-rate cliff, it’s really important to shop around to avoid falling onto a rubbish rate.

Do some research, compare different loans, and see what you could be saving. Depending on your circumstances, the difference could save you thousands over the life of your loan.

Once you’re armed with some information, phone your lender and see if they can offer a discount. If the answer is ‘no’ be prepared to walk.

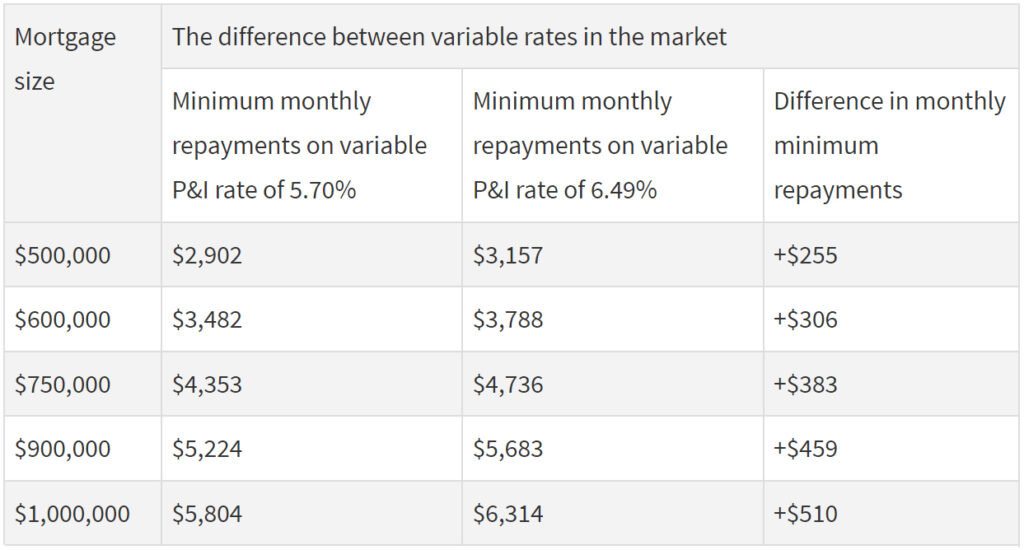

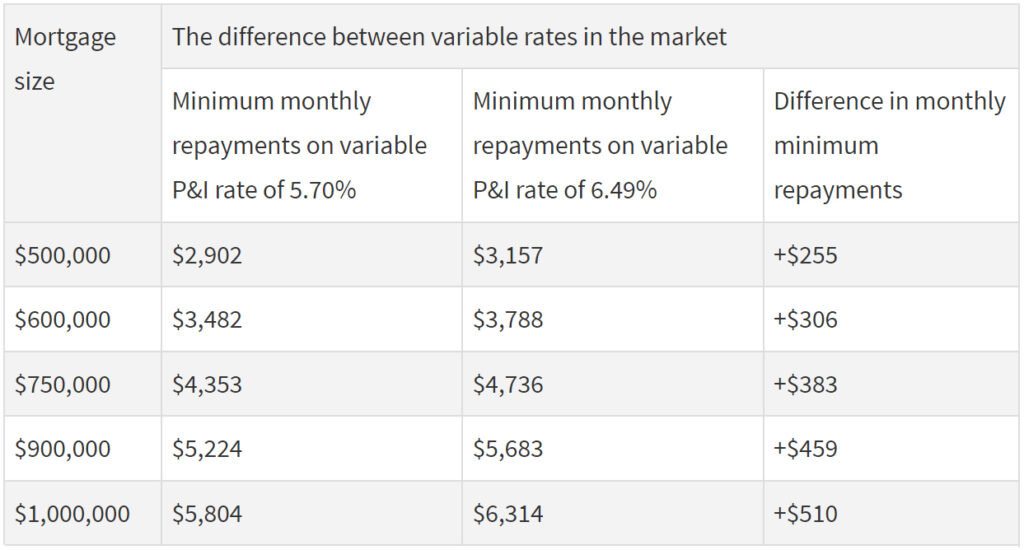

The story in numbers

Compare the Market analysis shows the difference between some advertised home loan rates was a whopping 0.79 per cent.

A person with an owner-occupier $750,000 loan could save $383 a month when they switch from a rate of 6.49 per cent to 5.70 per cent.

Source: Compare the Market. Monthly repayments do not include any reduction in the mortgage balance over time. These calculations assume: An owner-occupied variable interest rate of 5.69% compared to 6.344% pa; principal and interest (P&I) repayments; the loan term is 30 years; and there are no monthly fees.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.