Over the last few years, I’ve noticed there are five common differences between those that follow through with their financial plans and get results and those that don’t. So what are the key financial habits of wealth builders?

I want you to understand that you can push a pause button on your life whenever you want. You can then make some decisions and take decisive action before time gets away. Don’t just count the weeks and months away; realise that each day that goes by provides you with a precious opportunity to becoming a better version of yourself. Whatever that means for you.

So what are the five key financial habits that set the best ‘goal achievers’ apart from the rest?

1. They get started (now)

Just like an ocean liner launching into the sea, initial momentum is the hardest to build. But, once you get these objects moving, it’s easier to keep them going or adjust course or direction. Your money management is no different. Getting started is the single biggest, most important, and also most difficult of all the key financial habits.

Once you get started, it’s easier to change, adjust, and tweak your strategy to give you even better results. Setting up the perfect, seamless, integrated, and most effective money management strategy from the start can be really difficult (in some cases impossible). But, getting started with one or two key areas and building from there will make your life much easier.

If you don’t get started and hold off, waiting for the perfect time, strategy, or opportunity, it may never happen. Don’t make this mistake! Get started now. Today. Make it happen. Then adjust as you go. The other massive benefit of getting started is that once you get some ‘quick wins’ you’ll get a big motivational boost. This will also help you get things sorted in other areas.

2. They keep it simple

It’s easy to get caught up in the hype and be attracted to the sexiest (read: most complicated) money management strategies. But the more complicated your strategy is, the more difficult it will be to manage. Which means you’re more likely to lose interest.

The most common strategies are the most common for a reason – they work! Things like paying down mortgage or personal debt, setting a regular investment plan, contributing to super, or buying an investment property are generally considered ‘boring’. But they are also the most effective key financial habits you can practise.

You don’t need to overcomplicate your strategy. Having a solid plan and then being consistent and getting steady, stable results over time will pay big dividends. Your goal should be to set up a clear, simple, and easy to follow path from where you are now to the money and lifestyle outcomes you want.

Keep your strategy simple and it will be easier for you to understand and most importantly, easy to follow. This means you’ll also be more likely to stick to it. In turn, you’ll get the results you want. This is a simple and effective formula for success in any plan.

3. They nail their savings and spending

A solid savings and spending plan is the foundation for any other strategies you might put in place. So don’t put the cart before the horse.

Be clear on your everyday money management and have a plan in place for it. When you do you’ll have money going to the right places for your upcoming expenses. The boring ones like bills and rent, as well as the fun ones like travel and big ticket expenses.

You’ll also have a clear idea of what money is left over for you to do something smart with. You can then invest with confidence, knowing your money is working harder for you. Getting this right from the start will increase your chance of success and cause everything else to just ‘flow’.

This will help too: 7 traits that lead to bad investment decisions (and how to avoid them)

4. They have a solid system

I’m a systems guy. I feel that most things in life can be broken down into a process you can follow to get the outcomes you want. Your savings and spending is no different; although I do understand that especially when it comes to money it doesn’t always come naturally.

Ensuring you have a great plan or strategy is one of the most important key financial habits you can build. But a great plan alone won’t get you great results. You need a system that supports the strategy to make it work. One which makes it easy and will make it happen.

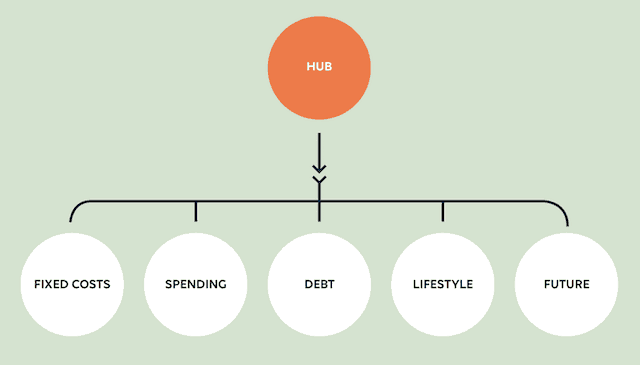

To give you some insight into what I mean, I’ve included a diagram of the banking system we use to help clients manage and automate their savings and spending. This is so it ends up in the right places at the right times.

Now how you manage your money is a personal thing, so I’m not saying this works for everyone. But, this system (or a system like it) can support a savings and spending plan and make everything just ‘happen’. When we set something like this up for someone, they know exactly where their money should be at any time, and by following this structure we can automate payments so it all flows without any input of time or energy (or stress).

Whether it’s a savings and banking strategy like the one above, or an investment plan, debt repayment, or a savings plan, automate these wherever possible to reduce your time input and free up your mental energy to focus on other things. The average adult makes over 30k decisions every single day, so you don’t need another thing to have to think about!

When your money management is complex or confusing it’s easy to get off track and end up throwing your hands in the air, putting real success with money into the ‘too hard basket’.

Add these: 10 killer budgeting strategies

5. They build in accountability

Personally, I’m a bit of a coaching junkie, and I work with a number of great people in different areas. I have a business coach, a multimedia coach, a mindfulness coach, a mentor, and other specialists like my accountant and bookkeeper.

One of the biggest benefits I get from working with these coaches is that I know they will keep me accountable to the goals I’ve set and the work I’m doing in these areas. I know that if I go to my business coaching session without having done the pre-work, I will be wasting my time and money by doing this. So I push forward.

This helps me stay on track and maintains my focus on the things I know I need to do to get the results I want. I know also that if I don’t, I’ll be having a conversation with someone about why I’m not following the strategy I’ve set and the impact of this on the targets I have set.

An adviser will help you do the same thing with your money. They will keep you accountable and push you forward when you need it, and get you back on track if you lose your focus. I’ve seen what a difference having someone to keep you accountable to your money goals can make, and I think the value of having an accountability buddy is hugely underrated.

The wrap

If you always have the ‘best intentions’, but haven’t actually ‘sorted out your money’ yet, it’s not too late. Being successful with money isn’t about having some secret formula, tools, or insights. It’s about doing the simple things right and doing them consistently over time. You need to act. Your strategy needs to be simple. You need a good system to make it easy to get what you want. And you often will get a lot out of having someone to help you get there. These are the key financial habits that build wealth sustainably over time.

Start small, build on your progress, and before you know it, your resolution will have become a revolution!

Ben Nash is a financial adviser and founder of Pivot Wealth, and the Author of the Amazon Best Selling Money Guide, Get Unstuck. This article was originally posted on the Pivot Blog.

Trending