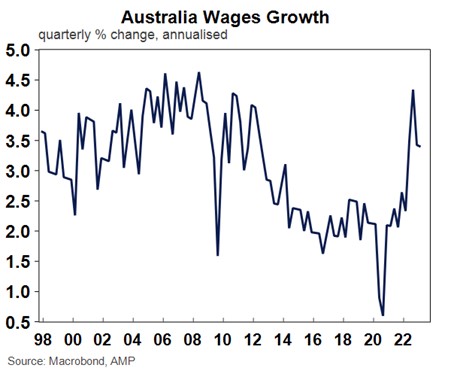

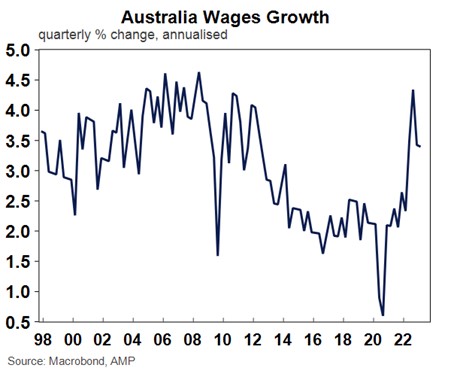

Wages are rising but not at the same pace as inflation, which means the purchasing power of your money is going backwards. In fact, “real wages” growth has never been worse. You’re getting paid more cash, but your cash is buying less.

While wage rises are stronger than normal, it is completely understandable if you’re baffled about where that money is going. The answer is inflation.

Wages are rising but not at the same pace as inflation, which means the purchasing power of your money is going backwards. In fact, “real” wages growth has never been worse. You’re getting paid more cash, but your cash is buying less.

That’s the financial evil of inflation. It erodes the value of your money and that’s why the RBA is aggressively fighting it. Bring down inflation and your money goes further.

Consumers are understandably pessimistic

The financial stress of inflation and eroding value of cash is making us all grumpy. Westpac’s Consumer Sentiment Index dived 7.9 per cent to 79 points in May, reflecting “deep pessimism after surprise rate hike and mildly disappointing Budget,” according to the survey results.

“The Index has fallen back to just above the dismal levels seen back in March, which recorded the lowest monthly read since the COVID outbreak in 2020 and, before that, since the deep recession of the early 1990s,” says Westpac chief economist Bill Evans.

Nearly 70 per cent of respondents expect a further rise in variable mortgage rates over the next 12 months, with just over 40 per cent expecting them to rise by a whopping one per cent or more.

That’s pretty ugly, but I was really interested in some of the breakdowns of the consumer sentiment survey.

First of all, Aussies in regional areas are gloomier than those in the city. As well as negative real wages, we can probably put that down to falling agricultural prices, following that big spike after the start of the Russia-Ukraine war, and regional property prices softening after the big COVID spike.

There’s an old saying that if the value of your property is going up then you feel wealthier, even if you don’t have extra cash.

And that theory is certainly reflected here. The sentiment of homeowners is rising again as property prices rebound.

By contrast homeowners facing higher mortgage repayments are hurting, as are renters from a tight rental market and spiking rents.

Sort of makes sense, doesn’t it? And it reminds us that economic data simply reflects the actions and feelings of actual people who make up that economy.

How to set yourself up for a pay rise

To help combat the impact of negative real wages, now is the time to ask for a pay rise. Easier said than done, right? But with the right approach, you should feel confident.

Firstly, go to online recruitment websites like seek.com.au to see what the going rate is for your position. If there’s a disparity then it’s worth approaching the boss.

You need real, practical examples that you can fire off that demonstrate your great performance, or your readiness to accept greater responsibility.

List a bunch of recent case studies that you can use as examples of where you’ve gone above and beyond expectations, or where you’ve performed exceptionally well. But also start thinking about ways you could improve and evolve the business, both within your area and overall.

It doesn’t have to be revolutionary. Even if it’s a simple change to an internal process that streamlines work a bit. Little things can have big impacts, but they also demonstrate your ability to think laterally and critically.

The goal is to have your boss thinking that you’d be a good person not to lose, to keep developing and hopefully pay more.

Here are three steps to help get your next pay discussion right.

1. Book it in

This absolutely must be a formal meeting. No off-the-cuff comments looking for an opening or tagging the topic on to the end of another meeting.

Ask for a time to sit down with the decision makers and get yourself prepared.

2. Pump up your tyres

Most people are terrible at taking credit and talking themselves up. But if there is a time and place to be a tall poppy, it is here.

Walk the pay masters through how your role has changed since your last salary review and highlight any achievements and innovations you’ve brought on board.

But, more than that, talk about why you’re there, what you want to achieve and how you see your role and responsibilities developing. Managers love this stuff.

3. Get a result

This is where a lot of people fall down. You can’t leave that meeting without an agreement on the next steps.

What else do you need to do to hit that next pay bracket? When will the next review take place? What date will they come back with an offer? When will the pay rise kick in?

If you leave the next steps hanging, or meekly back away from your once-firm position, you will have shown your cards and could be left in limbo. So, make sure to get a result.

If this all sounds a bit serious, it is. But it can be an easy conversation when approached in a level-headed and well thought out way.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.